Attention Shifting Away From Memecoins to Bitcoin, Ethereum, Solana and Cardano: Santiment

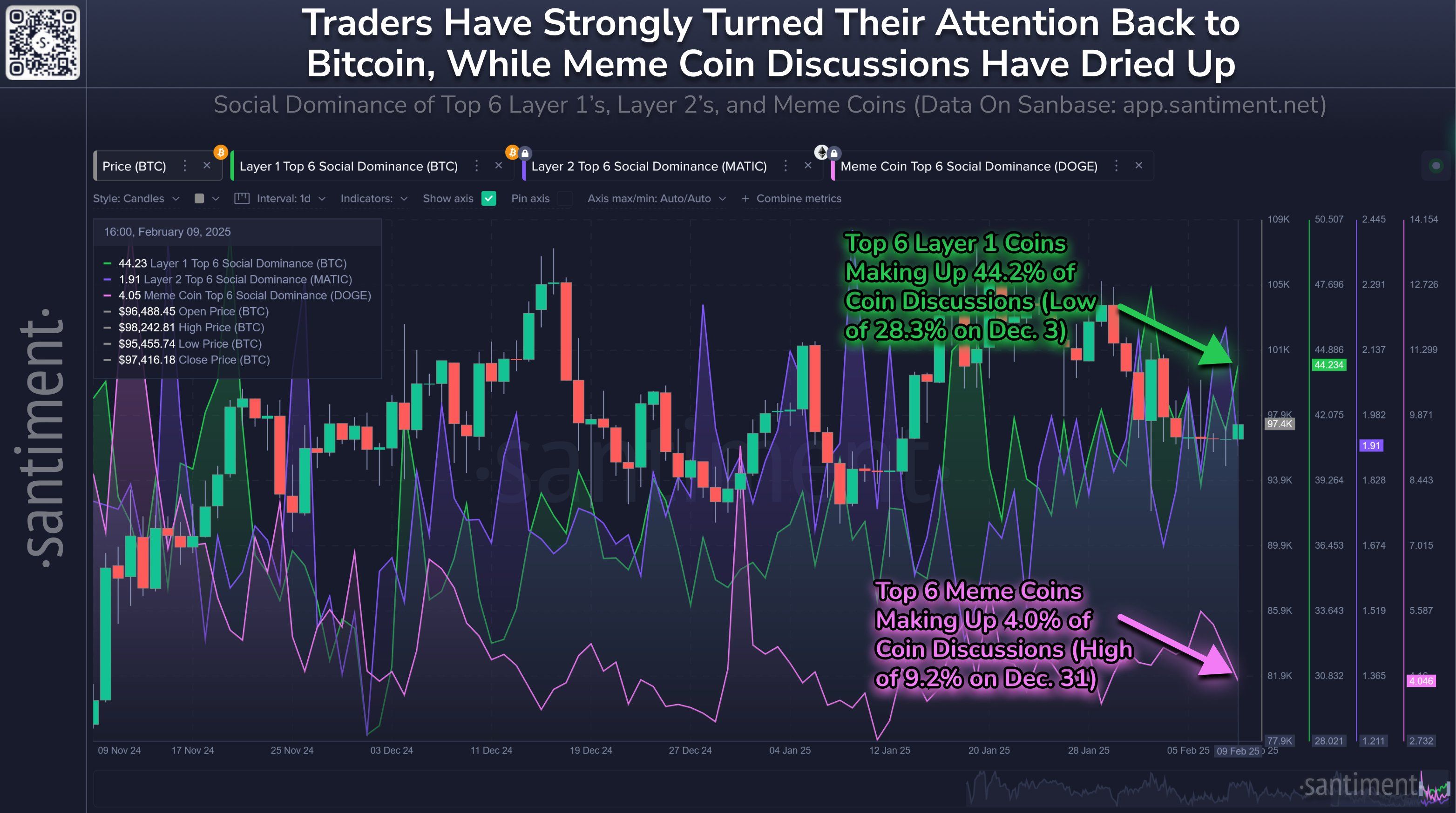

Attention in the crypto sector is shifting away from memecoins and moving towards large-cap layer-1 projects, according to the digital asset analytics firm Santiment.

Santiment notes traders are more focused on Bitcoin ( BTC ), Ethereum ( ETH ), Solana ( SOL ), Toncoin ( TON ) and Cardano ( ADA ), which the firm says suggests a healthier crypto market dynamic.

“A shift in trader attention from meme coins to Bitcoin and layer-1 assets is generally a sign of a more stable and sustainable market environment. Memecoins tend to attract speculative enthusiasm, often driven by hype, viral trends, and a gambling mindset rather than fundamental value. When these assets dominate discussions, it typically signals a phase of excess greed, where traders chase rapid, short-term gains without considering long-term viability.”

Source: Santiment/X

Source: Santiment/X

Santiment says a focus on Bitcoin and other layer-1 projects suggests a “more mature and informed approach” from the crypto community.

“Historically, memecoin frenzies precede market corrections, as speculative excesses often lead to sharp reversals when hype fades. When traders pivot back to assets with strong utility and established market positions, it suggests a healthier market cycle. This shift encourages a more balanced ecosystem, reducing the risk of unsustainable price surges and crashes fueled purely by speculative mania.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!