-

Bitcoin’s (BTC) recent market signals indicate a robust potential for a short-term rally, driven by positive net taker volume and stabilizing prices.

-

Market analysis shows that reduced liquidation events are fostering a favorable environment for BTC, as it hints at increasing buyer confidence.

-

According to a recent report from COINOTAG, “The shift in market dynamics, coupled with stable funding rates, might pave the way for BTC to reach significant price milestones.”

Bitcoin’s market dynamics are shifting towards a potential short-term rally as buyer confidence increases, and liquidation events decline.

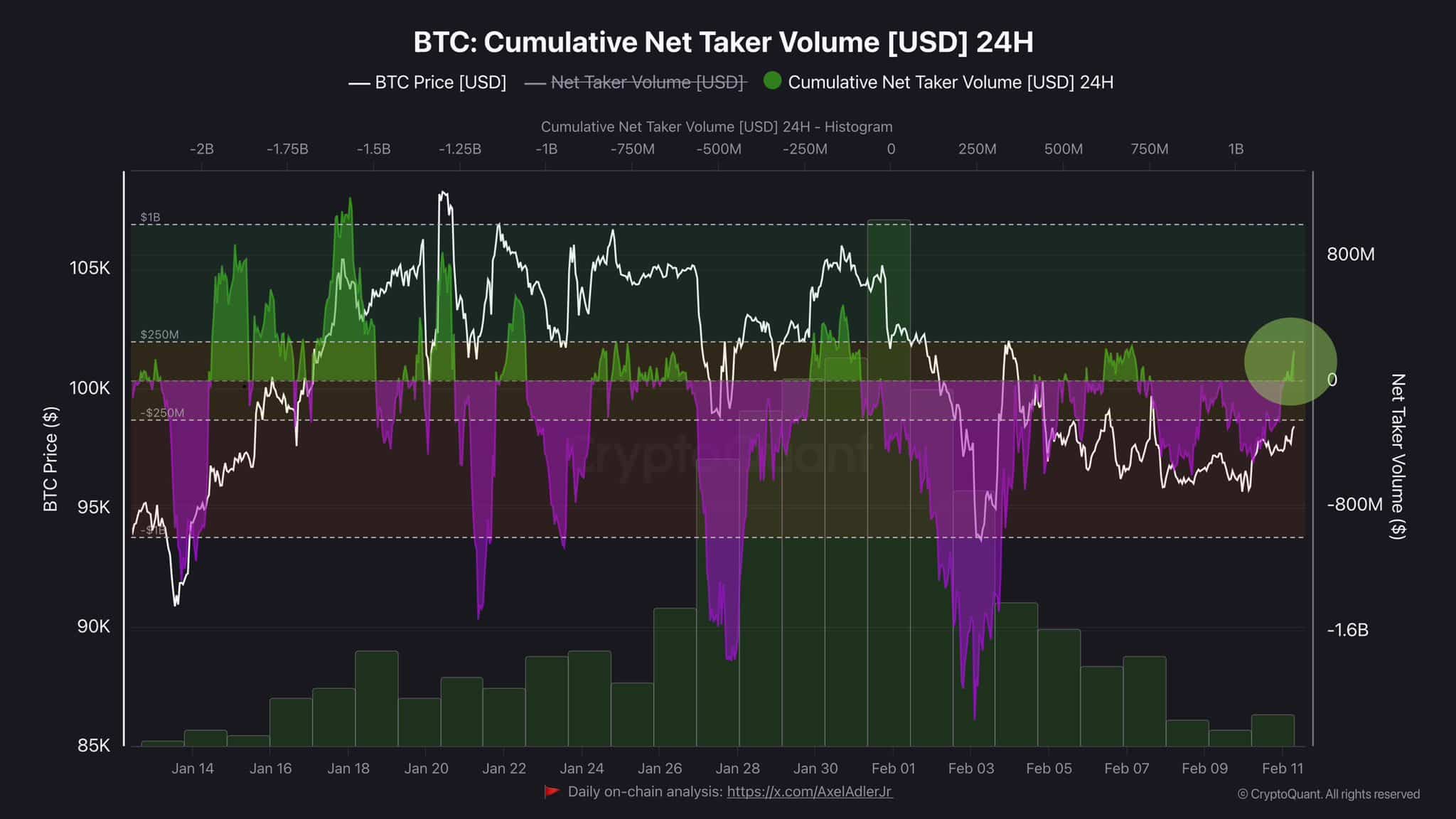

Positive Shift in Bitcoin’s Net Taker Volume Signals Market Strength

The recent upturn in Bitcoin’s cumulative net taker volume has garnered attention, transitioning from negative to positive levels for the first time in months. As of the latest analysis, the net taker volume stands at approximately $189 million, suggesting a strong inclination toward buying over selling.

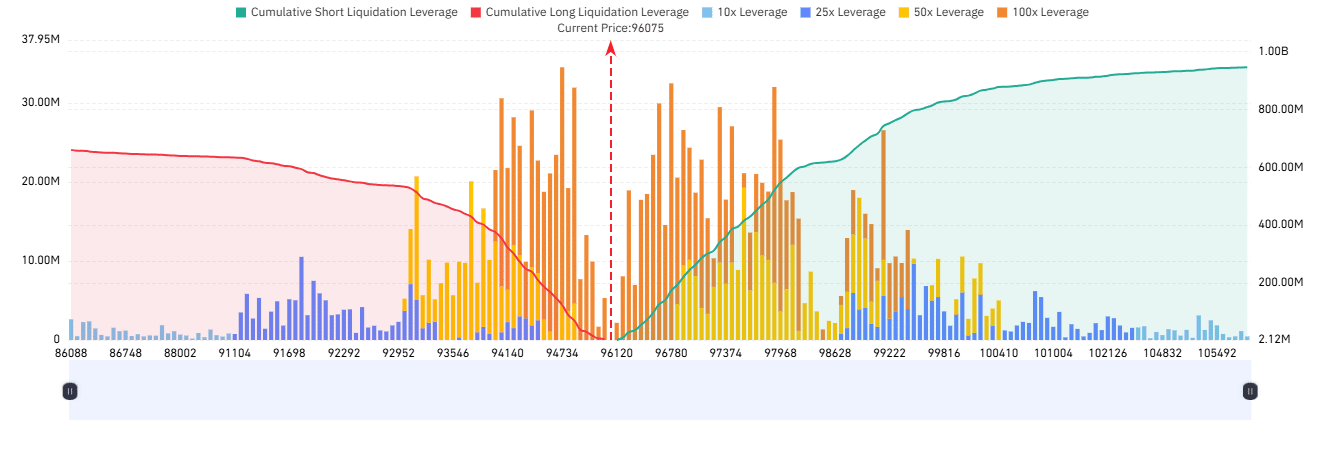

Market Dynamics Favoring BTC as Liquidation Events Decline

BTC’s market environment shows signs of recovery, as the number of liquidation events has decreased significantly. This development is particularly notable among high-leverage positions, which historically have been associated with increased volatility. The recent liquidation data illustrates a formidable reduction in forced selling, indicating that market participants might be more strategically positioned.

Source: CryptoQuant

The Calm Before a Potential Price Surge?

Recent data indicates that the BTC/USDT market has experienced a stabilization phase, further supported by the downward trend in liquidation events. This could suggest that a price surge may be imminent, as traders are increasingly opting for less risky leverage positions.

Source: Coinglass

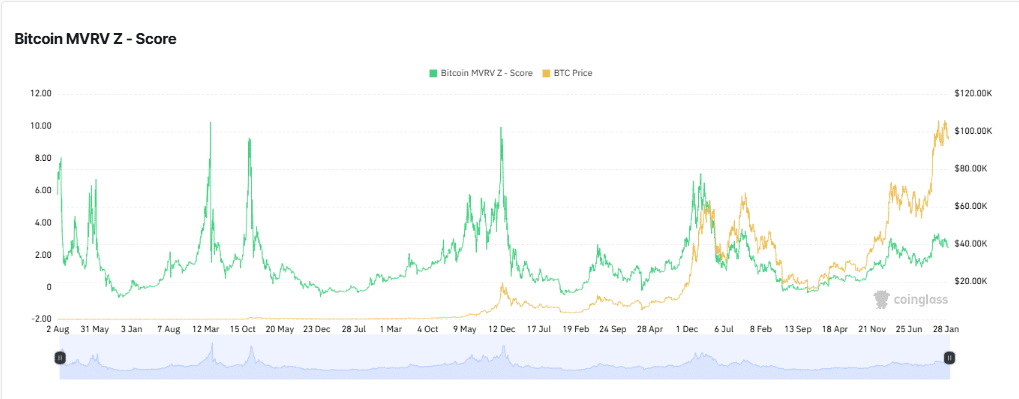

Strengthening Investor Sentiment Reinforces Market Optimism

The latest metrics reveal that the MVRV Z-Score, which assesses Bitcoin’s valuation relative to its fair market value, has seen an upward trajectory. This upward movement, coupled with a shift away from undervalued territory, signals a bullish sentiment that may further ignite buying interest.

Source: Coinglass

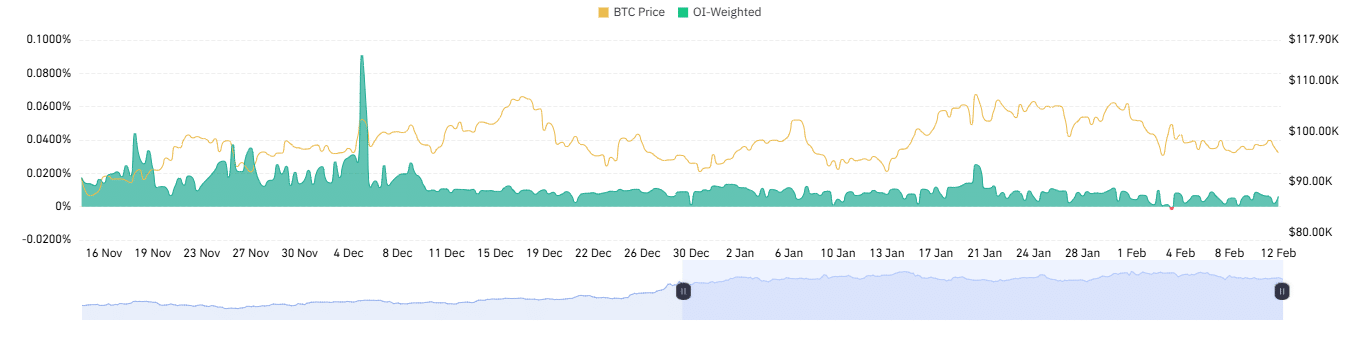

Expectations Rise: Will Bitcoin Reach New Highs?

Current analysis shows that the Funding Rates in the Futures market have stabilized and exhibited positivity, indicating that long positions are prevailing. This sustained positive sentiment is significant as it hints at traders’ willingness to maintain bullish bets on Bitcoin’s price trajectory.

Source: Coinglass

Conclusion

In summary, various indicators, including positive net taker volume, declining liquidations, and favorable funding rates, collectively support the notion of a possible rally in Bitcoin’s price. As market sentiment strengthens, Bitcoin is positioning itself to potentially breach key psychological price levels, possibly eyeing the $100,000 mark in the near future.