The Bank of England (BoE) must proceed cautiously with cutting interest rates as inflation remains a persistent concern, insists Chief Economist Huw Pill. His remarks come a week after the central bank lowered the rates to 4.5%, while also forecasting a much lesser economic growth rate in the fiscal year 2025.

Speaking to Reuters on Wednesday, Pill acknowledged that inflation is gradually declining toward the BoE’s 2% target, but warned that price pressures could be a hindrance in achieving it. He said that taking an aggressive rate-cutting approach will add to Britain’s already sluggish economic growth.

“We are able to remove some of the restriction we imposed because of the successful, but not yet complete, process of disinflation,” Pill reckoned.

Inflation remains above target

According to data from Trading Economics, the UK’s annual inflation rate unexpectedly dipped to 2.5% in Dec. The central bank now expects inflation to rise to 3.7% later this year – before gradually dropping to the 2% goal by late 2027.

Last week, the BoE maintained its “gradual” approach to rate cuts. Some policymakers are pushing to add the word “cautious” due to concerns about weak productivity fueling inflation. Others on the Monetary Policy Committee (MPC) preferred the term “careful,” which was ultimately included in the bank’s guidance on borrowing costs.

Economist Pill took his forever position that easing policy should be approached cautiously. Previously he voted against the BoE’s first rate cut last August.

“I would expect we’re going to cut Bank Rate further. But the pace at which you can do it is less,” he said. “And I think that’s what’s being indicated by the words ‘cautious and gradual’, as opposed to ‘gradual and careful’.“

Seven members of the MPC supported last week’s quarter-point rate cut, but two dissented, arguing for a larger half-point reduction to address weak demand. They attributed the stagnation in output for much of 2024 to a slump in consumer and business activity.

UK economy sees modest growth amid weak forecasts

Last week, the BoE slashed its 2025 growth forecast in half to 0.75%, putting more pressure on Chancellor of the Exchequer Rachel Reeves.

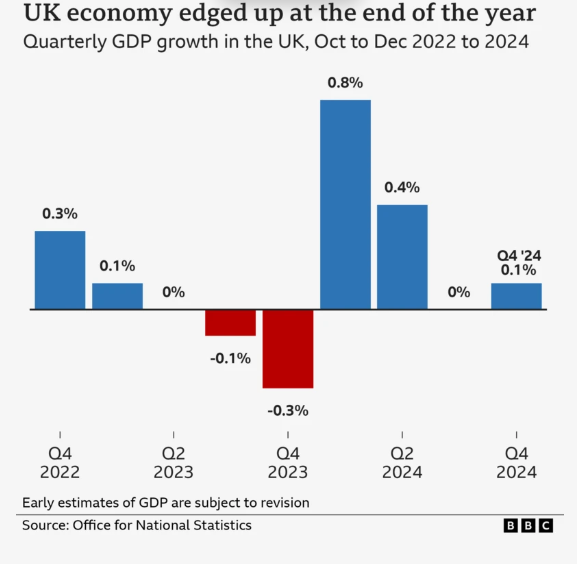

Reports from the BBC earlier today show that the UK economy may have recorded slight growth in the final three months of 2024. But analysts warn that the outlook remains bleak, especially with new business taxes set to take effect in April.

Data from Capital Economics showed that business investment dropped by 3.2% between October and December. This coincided with a decline in employment and flat consumer spending. The only sources of growth came from increased government spending and public-sector consumption.

“In short, October’s Budget decisions contributed to rising public sector activity [but] contributed to falling private sector activity,” said Paul Dales, chief UK economist at Capital Economics.

Still, monthly data released yesterday showed that the UK economy expanded by 0.4% in December, outperforming weak figures from earlier in the quarter.

Rachel Reeves responded to the economic data with a pledge to revamp Britain’s economic landscape.

“For too long, politicians have accepted an economy that has failed working people. I won’t,” Reeves said.

Citing 14 years of stagnant living standards, she vowed to accelerate reforms under the government’s “Plan for Change,” promising to boost infrastructure spending and remove barriers for businesses seeking growth.

“We are taking on the blockers to get Britain building again, investing in our roads, rail and energy infrastructure, and removing the barriers that get in the way of businesses who want to expand,” she concluded.

Cryptopolitan Academy: Are You Making These Web3 Resume Mistakes? - Find Out Here