QCP Asia: Fluctuations appear in the Ethereum options market, Pectra's upgrade becomes a key driving factor

According to a report by PANews on February 18, QCP Asia analysis shows that the term structure of the options market has undergone significant changes as it approaches expiration in March, especially in the ETH options market. This reflects traders' positioning ahead of Ethereum's Pectra upgrade. The upgrade is currently being tested and is expected to go live in early April.

Looking back at past upgrades, September 2022's The Merge followed a typical "buy the rumor, sell the fact" pattern. ETH rose more than 100% from its low point in June but corrected after the event took place. In contrast, April 2023's Shanghai Upgrade (which allows for staking withdrawals) faced pessimistic sentiment due to fears of oversupply. However, when selling pressure failed to materialize, ETH subsequently rose by 30%.

Currently, traders may be preparing for another volatility event with implied volatility leaning bullish after March 28th. This could lay groundwork for future market positioning particularly following Trump’s tariff events which have led crypto markets into a wait-and-see phase.

However, there are also countervailing forces at play - including LIBRA collapse; SOL and ETH falling back to pre-election levels; and Bitcoin's market cap nearing historical highs. Beyond market catalysts alone sustained recovery of altcoins might require substantial progress in real-world adoption and network development rather than simply relying on speculative capital inflows.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

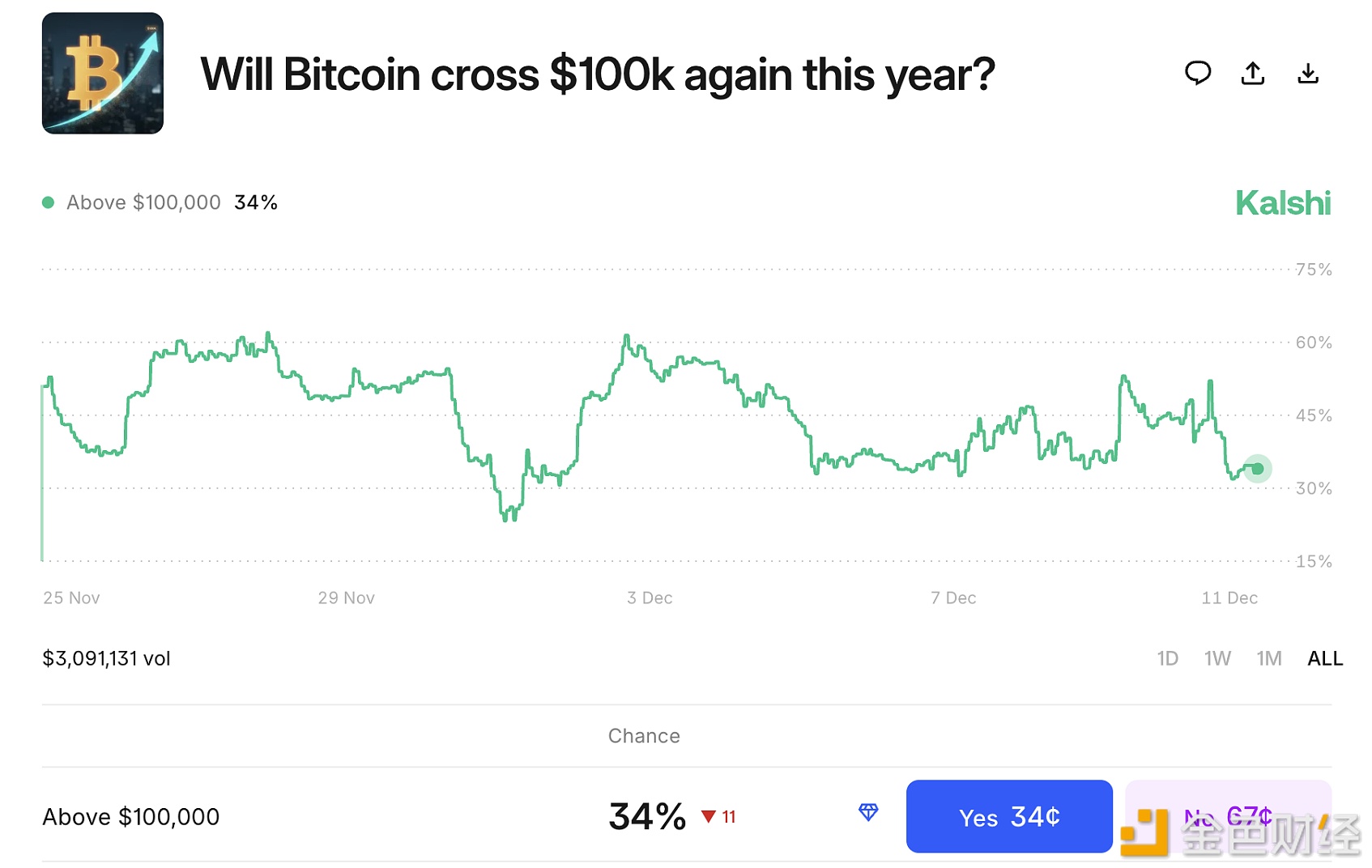

Prediction markets bet that bitcoin will not reach $100,000 by the end of the year

Data: 90,300 SOL transferred from an anonymous address, routed through intermediaries and flowed into Wintermute