Bitcoin drops to yearly low in crypto sell-off as Trump tariff uncertainty hits markets

Quick Take: Bitcoin, ether and other major cryptocurrencies suffered a significant price drop in the past day. Wider market sentiment remains under pressure following Donald Trump’s new Canada and Mexico tariff announcement.

The world’s largest cryptocurrency fell 6% to $89,617 in the 24 hours leading up to 4:50 p.m. Tuesday in Hong Kong, according to The Block’s bitcoin price page . Earlier, bitcoin dropped to a low of $88,355, Yahoo Finance data shows.

Steeper declines were seen in major altcoins, where Ether lost 10.45% to $2,410, XRP dipped 10.5% to $2.21 and Solana dropped 12.6% to $138.6. The entire crypto market is down 6.8% in the past day, while the GMCI 30 Index, measuring the performance of top 30 cryptocurrencies, fell 8.96%.

Crypto pullback comes amid wider market uncertainty

Equity markets have faced pressure since U.S. president Donald Trump announced on Monday his intention to impose tariffs on Canada and Mexico once the 30-day suspension expires next week.

Standard Chartered Global Head of Digital Assets Research Geoffrey Kendrick noted that the resulting risk-off sentiment in traditional markets has impacted the digital asset sector. This growing bearishness is reflected in the Crypto Fear and Greed Index — a key market gauge that analyzes social media activity, volatility, trends, and prices — which recently fell to a five-month low of 25.

“While Bitcoin trades relatively well within the digital asset complex, it is now caught up in the Solana meme coin-driven selloff and now the broader risk-off nature of markets,” Kendrick said in an emailed note.

He also pointed out that the average spot Bitcoin exchange-traded fund (ETF) purchase price since the U.S. election has risen, to now stand at $96,500. “Those purchases are already well underwater,” he added.

Signs of a recovery in the medium-term

However, Kendrick anticipates a potential rebound in the medium term, noting that lower U.S. Treasury yields — driven by risk-off sentiment following Friday's PMI data — could ultimately benefit Bitcoin . “But do not buy the dip yet, a move to the low BTC $80,000s is on,” he said.

HashKey Global Managing Director Ben El-Baz pointed out that the crypto market's strong correlation with U.S. equities has triggered a decline in digital asset prices as investors offload risk assets like Bitcoin.“Crypto prices are reaching past critical support levels that need to be regained if there are any hopes of avoiding a longer-term bear market,” he said.

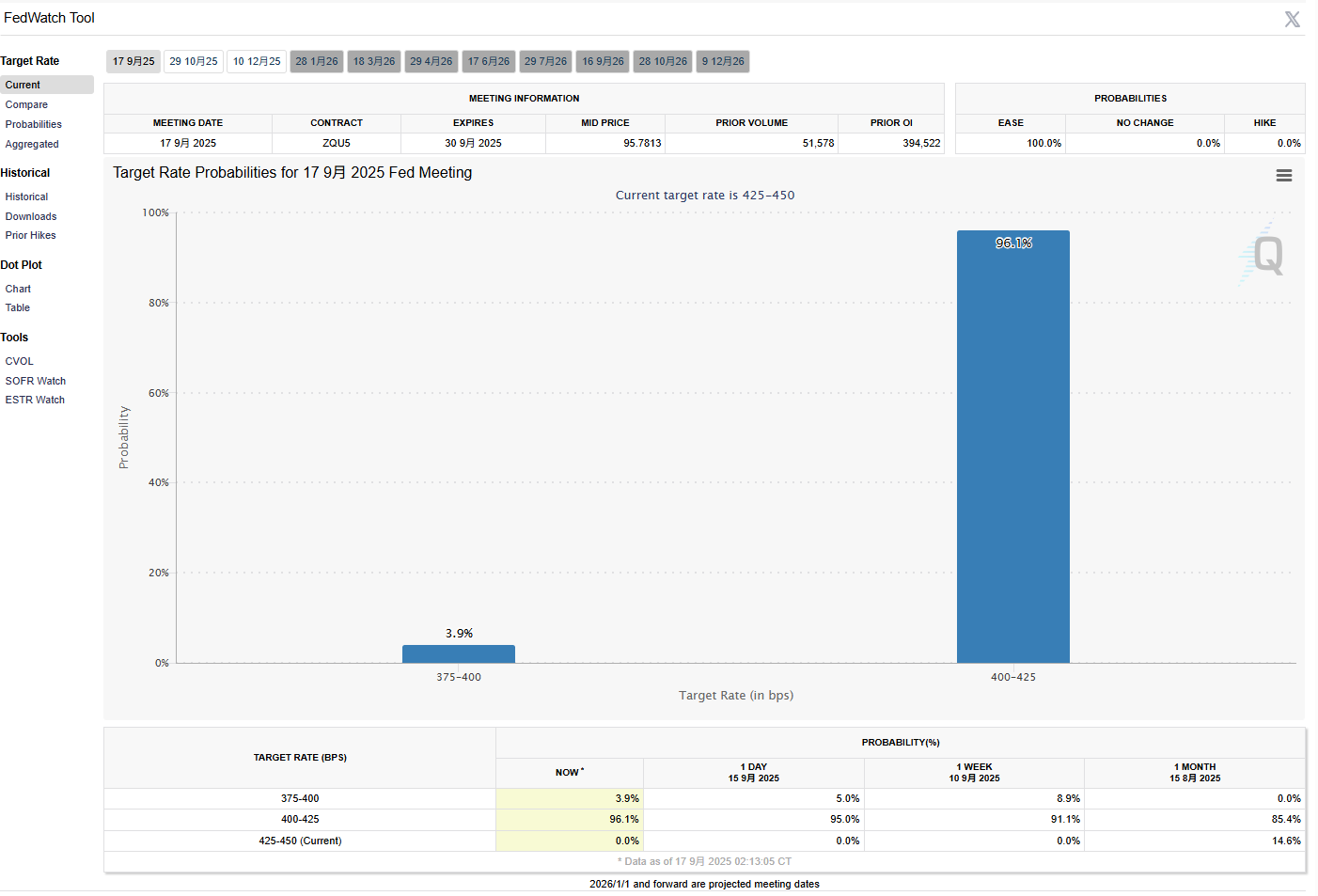

Amid crypto's recent struggles from macroeconomic pressures and new U.S. tariffs on Canada and Mexico, traders will be closely watching January's U.S. personal consumer expenditures price index. Set for release on Friday, this data is widely regarded as one of the Federal Reserve's preferred inflation indicators. "If inflation looks like it is dropping to near the Fed’s 2% target and rates soften, a mid-term bullish turn could emerge,” Kronos Research Analyst Dominick John told The Block.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin price gains 8% as September 2025 on track for best in 13 years

Ethereum unstaking queue goes ‘parabolic’: What does it mean for price?

ETH’s run vs. BTC: Finished, or early days?

Any indication the FOMC is less dovish than anticipated could weigh on crypto, industry watcher says