-

Bitcoin has dropped below the $80,000 mark as significant selling from whales reinforces bearish trends in the crypto market.

-

Market analysis indicates that the recent downturn is characterized by unprecedented losses among new investors, which could deter future participation.

-

According to a COINOTAG source, “The selling from whales suggests caution among long-term investors, who may be reassessing their positions in anticipation of market volatility.”

Bitcoin struggles below $80,000 as whales sell off significant holdings, resulting in massive losses for new investors and raising concerns over market confidence.

Bitcoin Experiences Significant Whale Activity and Losses

The cryptocurrency market is witnessing a troubling **decline** in Bitcoin’s price, primarily fueled by **substantial selling activity** from large investors, commonly referred to as whales. This recent pullback has seen Bitcoin’s value plummet from $95,700 to below $80,000, with a notable **6,813 coins** sold in just a week, marking the largest outflow since July.

This sell-off tends to reinforce further bearish sentiment, as many retail investors, particularly newer market entrants, contend with the harsh realities of their investments. The implications of these actions not only reflect immediate price pressures but also prompt critical assessments about the future stability of Bitcoin.

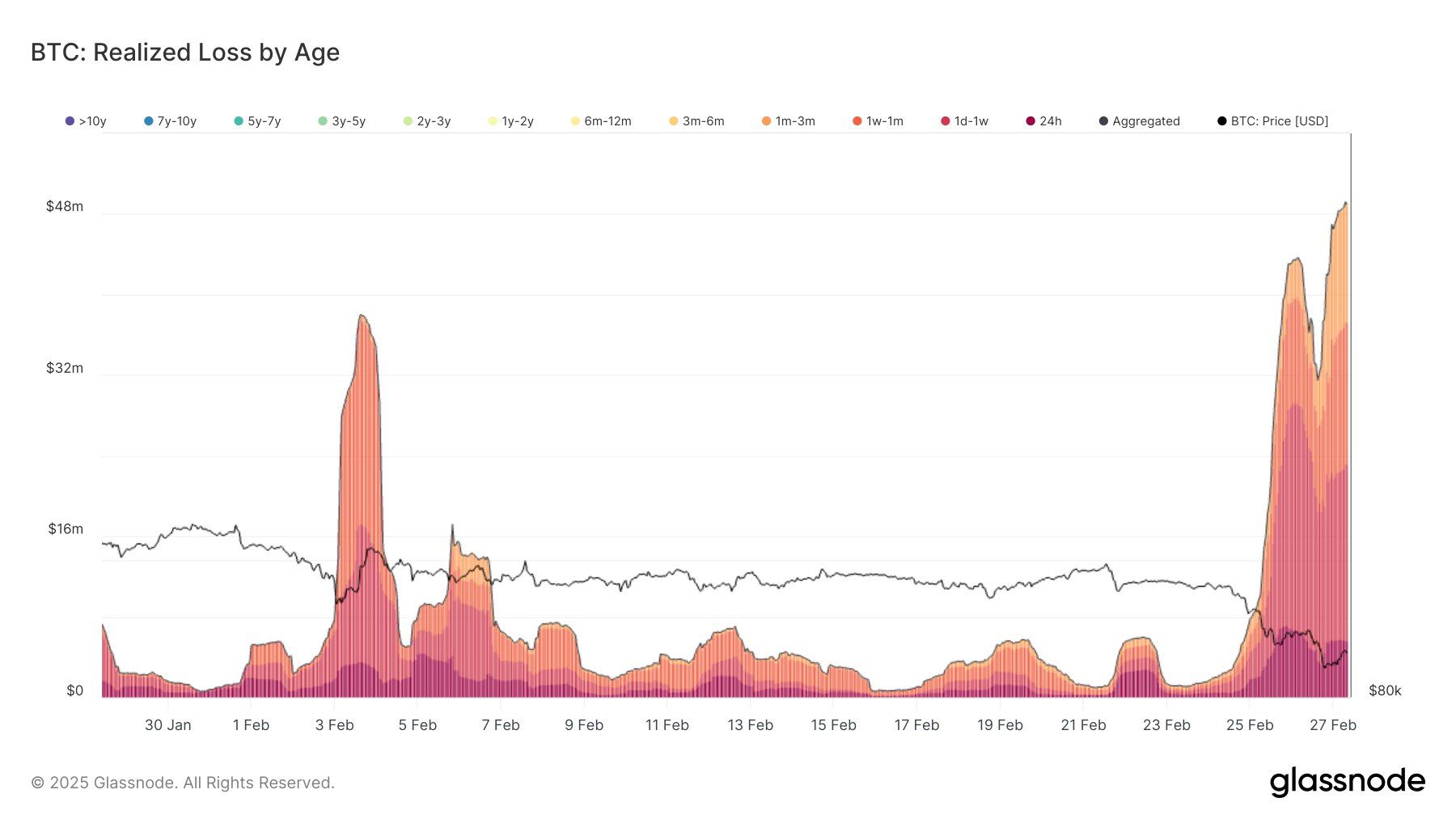

Adverse Market Conditions Reflect in Realized Losses

Recent data indicates that between February 25 and 27, **realized losses** exceeded $2.16 billion, striking a heavy blow to investor confidence. A staggering **$927 million** of these losses was incurred in a single day, showcasing the seriousness of the current market conditions.

This significant loss primarily affects those who entered the market during the latest price surge. With many facing such steep setbacks, potential new participants might be discouraged from investing, further amplifying a cycle of negative sentiment around Bitcoin’s future price movements.

Bitcoin Realized Losses. Source: Glassnode

Current Support Levels and Future Predictions for BTC

Currently trading at approximately **$79,539**, Bitcoin has failed to maintain the crucial support level of **$80,313**. Analysts are now closely monitoring the next critical support level at **$76,741**, which has historically served as a bounce point for price recovery.

However, should the selling pressures from the current bearish market continue, Bitcoin could descend even to **$71,529**. A breach below this level would not only extend losses further but could potentially deepen the bearish trend significantly.

Bitcoin Price Analysis. Source: TradingView

To shift from this bearish sentiment, Bitcoin is required to recapture the **$80,313** level, ideally aiming for a rebound towards **$85,000**. Such a recovery could signify a critical turnaround point and stimulate renewed investor confidence, paving the way for a more bullish outlook.

Conclusion

The recent fluctuations in Bitcoin’s price serve as a reminder of the **volatile nature** of cryptocurrency markets. With whales significantly influencing market dynamics and a concerning trend in realized losses among new investors, the path forward remains fraught with challenges. As stakeholders navigate these turbulent waters, the prevailing market sentiment will play a crucial role in determining Bitcoin’s future price trajectory. Observing key support levels and shifts in whale behavior will be essential for all investors moving forward.