- Senator Cynthia Lummis states that most digital assets are not securities under U.S. law.

- Bill Morgan links this to Judge Torres’ ruling that XRP itself is not a security.

- Lummis’ comments highlight the debate over the SEC’s enforcement actions and the need for clearer crypto regulations.

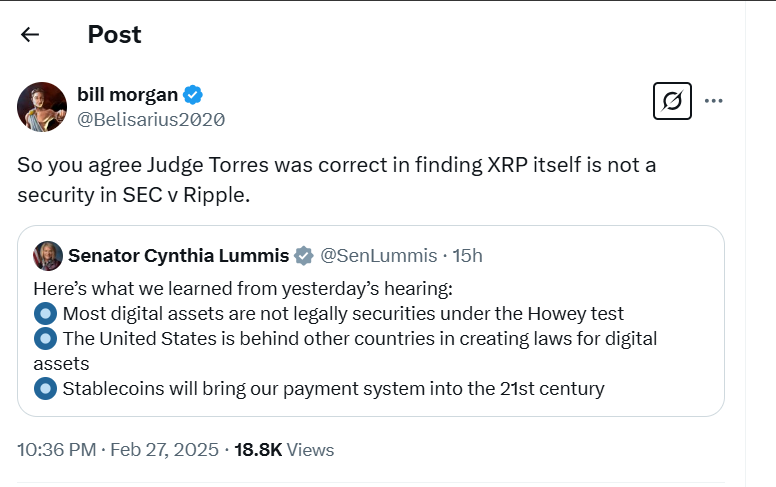

Senator Cynthia Lummis, a known advocate for cryptocurrency legislation, recently stated on X that most digital assets are not securities under the Howey test. In response, attorney Bill Morgan asked whether she agrees with Judge Analisa Torres’ ruling in SEC v. Ripple, which found that XRP itself is not a security.

Notably, Lummis made her comments following a congressional hearing on digital assets, where lawmakers discussed the regulatory ecosystem and the U.S.’s slow progress in establishing clear guidelines. She also highlighted the role of stablecoins in modernizing payments.

Lummis’s Statement and the SEC v. Ripple Case

However, her assertion that most cryptocurrencies are not securities raised questions about the SEC’s approach to enforcement, particularly in its case against Ripple.

Related: Ripple CEO Applauds SEC for Dropping Coinbase Lawsuit: Time for XRP to Shine?

Judge Torres ruled in July 2023 that XRP itself is not a security, though certain institutional sales violated securities laws. The SEC has since appealed aspects of the decision, pushing for a broader interpretation of securities regulations.

Morgan’s response suggests that Lummis’ statement reinforces the legitimacy of the ruling and challenges the SEC’s claims.

Regulatory Uncertainty and the Push for Clearer Crypto Laws

The U.S. remains behind other countries in crypto regulation, with jurisdictions like the European Union implementing clear frameworks through initiatives such as MiCA.

Lawmakers, including Lummis, have pushed for legislation to define the legal status of digital assets. Under Mark T. Uyeda, the SEC has been moving toward a more crypto-friendly regulatory environment, including forming the SEC Task Force.

Shift from Gensler Era: SEC’s New Approach

This contrasts with former chair Gary Gensler’s administration, which stated that many cryptocurrencies qualify as securities, leading to enforcement actions against several firms.

Related: SEC Clears Path for Consensys After Dropping Legal Battles with Coinbase, Gemini, and More

The debate over XRP’s classification is part of a larger discussion on the SEC’s role in regulating digital assets.

Meanwhile, with the crypto task force led by SEC Commissioner Hester Peirce pushing for clearer regulations rather than aggressive litigation, Ripple may find itself in a more favorable position moving forward.

For context, the SEC has closed civil enforcement actions against multiple crypto firms, including Coinbase, Robinhood, and Tron. This brings hope that a similar initiative would follow suit for Ripple.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.