-

The recent performance of XRP against Ethereum has raised questions about which cryptocurrency will gain investor favor in the coming weeks.

-

With XRP’s impressive 3.63% increase in the last 24 hours, contrasted with Ethereum’s decline, the market dynamics may be shifting.

-

“With analysts projecting a 25% upside in the XRP/ETH pair, is Ripple positioning itself as the stronger asset?”

Explore how XRP’s recent performance against Ethereum might signal a shift in investor confidence, with crucial insights on market dynamics.

XRP vs. ETH: Which asset is dominating investor interest?

Historically, Bitcoin’s [BTC] range-bound consolidation has been a phase where investors optimize portfolio allocation, rotating into high and mid-cap alternatives as part of a risk-management strategy. Currently, amid ‘extreme’ market fear, the XRP/BTC pair has shown resilience with a 3% gain, evidencing investors’ shifting focus. Additionally, XRP’s Open Interest (OI) has increased by 3.77%, reaching $3.16 billion, indicating growing interest in the asset.

Market Signals Favoring XRP: Accumulation Trends

Recent data shows that the top two whale wallets are engaging in reaccumulation during XRP’s pullback to $1.95, a trend that could indicate rising “dip-buying” interest. If this accumulation phase continues, it positions Ripple for a potential breakout once broader market conditions stabilize adequately. Conversely, Ethereum’s OI has seen only a 2.21% rise to $20.13 billion, while its exchange reserves have only marginally increased, showing weak spot demand.

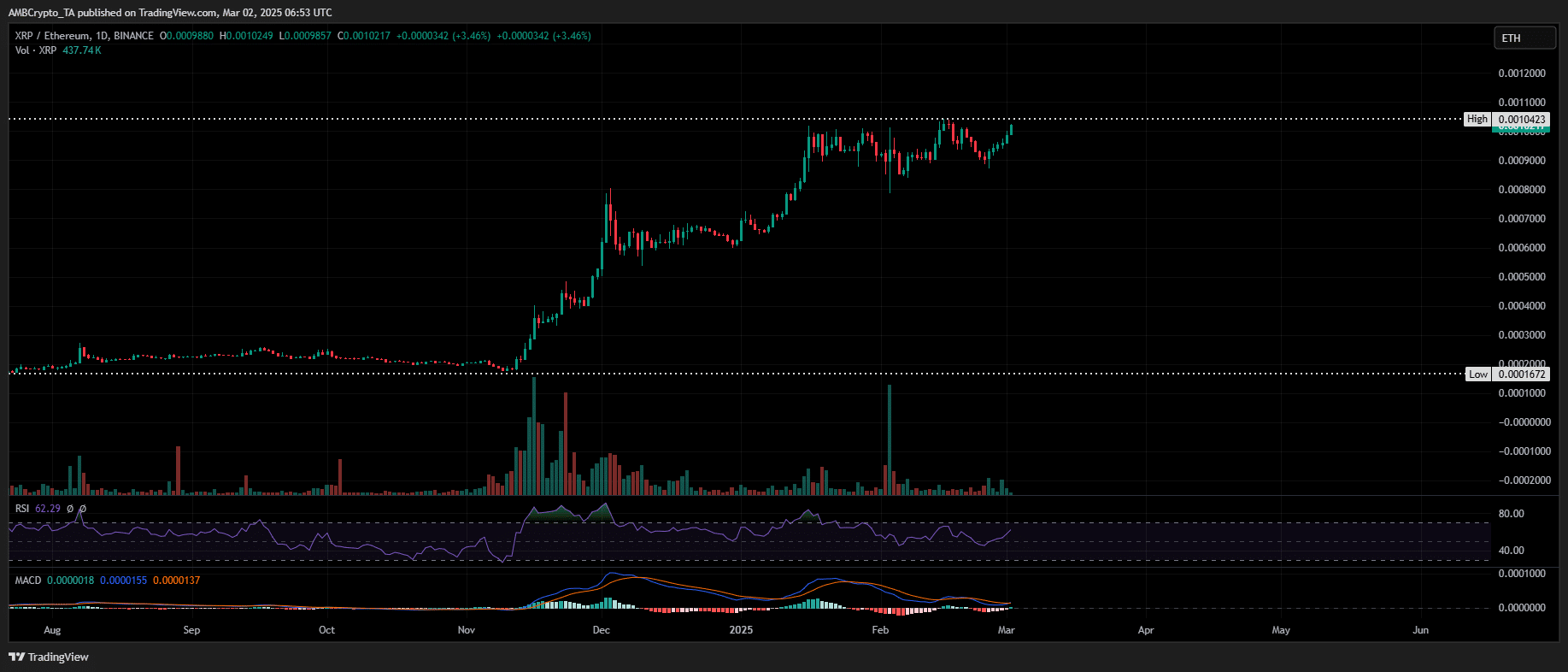

Source: TradingView (XRP/ETH)

Ripple’s Resiliency Amid Market Shifts

As Ripple demonstrates significant price action signaling potential accumulation, the broader appeal of Bitcoin diminishes in the post-meltdown climate, while Ethereum struggles with robust demand. XRP’s movement suggests active capital rotation into the asset, a critical observation for traders and investors alike.

Although $2 is emerging as a potential local bottom, the confirmation of this trend remains pending with key metrics needing to align in the next few days. Should these metrics validate XRP’s upward momentum, Ripple could position itself as a critical asset to monitor as the market rebounds.

Conclusion

In conclusion, the performance of XRP against Ethereum indicates a potential shift in investor sentiment. As Ripple displays signs of strength and accumulation, it may emerge as a more favorable choice. Investors should keep a close watch on the evolving dynamics in the crypto market, as these trends could significantly shape future investment strategies.