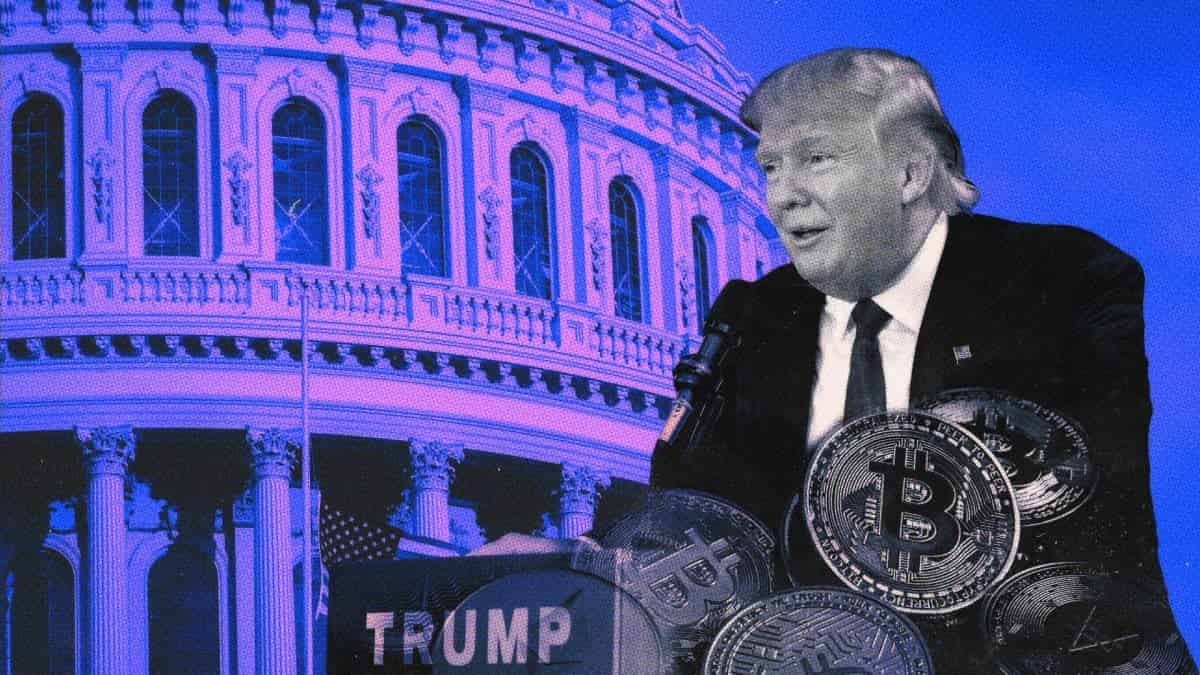

Trump says Crypto Strategic Reserve will include Bitcoin and Ethereum: Truth Social

Quick Take In a new Truth Social post, Trump said his planned U.S. Crypto Reserve will include Bitcoin and Ethereum “at the heart of the Reserve.” Trump announced Sunday morning that the Reserve would also include Cardano, Solana, and XRP. Trump’s crypto executive order signed in January referred only to the creation of a digital assets “stockpile,” which would have key differences to a reserve.

President Donald Trump clarified on Truth Social that his planned Crypto Strategic Reserve will also have Bitcoin and Ethereum, the two largest cryptocurrencies by market capitalization, "at the heart of the Reserve."

"I also love Bitcoin and Ethereum," Trump wrote .

The clarification comes after Trump's post Sunday morning directing his Presidential Working Group on Crypto to "move forward" on the creation of a "Crypto Strategic Reserve" holding Cardano, XRP, and Solana. The price of all three cryptocurrencies jumped considerably following the announcement.

However, observers were unsure whether the reserve would also hold BTC and ETH, given prior reporting that Trump was considering coins developed in the United States for an "America-first" reserve.

Trump's crypto exeuctive order signed in January refers to a "national digital asset stockpile...potentially derived from cryptocurrencies lawfully seized by the Federal Government through its law enforcement efforts."

However, Trump's posts on Sunday mark the first time he referred to the stockpile as a "Crypto Strategic Reserve." The terms "reserve" and "stockpile" have been used interchangeably by some, but signify key differences.

“From my understanding, a stockpile would mean that the government would hold onto the crypto they have accumulated from various cases whereas a reserve would ultimately be what the Treasury Department determines to purchase and hold," said Rebecca Rettig, chief legal officer at Jito Labs, in a prior interview with The Block .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.

Prize pool of 60,000 USDT, “TRON ECO Holiday Odyssey” annual ecological exploration event is about to begin

TRON ECO is launching a major ecosystem collaboration event during Christmas and New Year, offering multiple luxurious benefits across the entire ecosystem experience!