Asian crypto stocks surge amid Trump-fueled rally

Quick Take Hong Kong’s OKG Tech saw its stock jump 42.6% at Monday’s close. Japan’s Metaplanet closed up 21.15%. The broader stock markets in Asia experienced mixed performances today.

Cryptocurrency-related stocks in Asia saw significant gains on Monday amid a broader crypto market rally fueled by U.S. President Donald Trump's Sunday social media posts about establishing crypto reserves.

Shares of Japan's Metaplanet closed up 21.15% on Monday, surging to 4,010 yen from the previous close of 3,310 yen within the first hour of trading upon opening. The company also announced on Monday that it acquired an additional 156 BTC ($13.4 million) to expand its total holdings to 2,391 BTC.

Hong Kong-based crypto firm OKG Tech saw its stock jump 42.6% today, closing at HK$0.184.

Boyaa Interactive, a Chinese game developer and Asia's largest public corporate holder of bitcoin, saw its Hong Kong-listed shares rise 23% to close at HK$4.17 on Monday. Boyaa announced on Sunday that it bought an additional 100 BTC for $7.95 million, boosting its total holdings to 3,350 BTC.

Japan’s benchmark Nikkei 225 added 1.7% on Monday, while South Korea’s Kospi fell 3.39%. Hong Kong’s Hang Seng index remained nearly flat, edging up 0.29%. The Shanghai Composite index inched down 0.12% today.

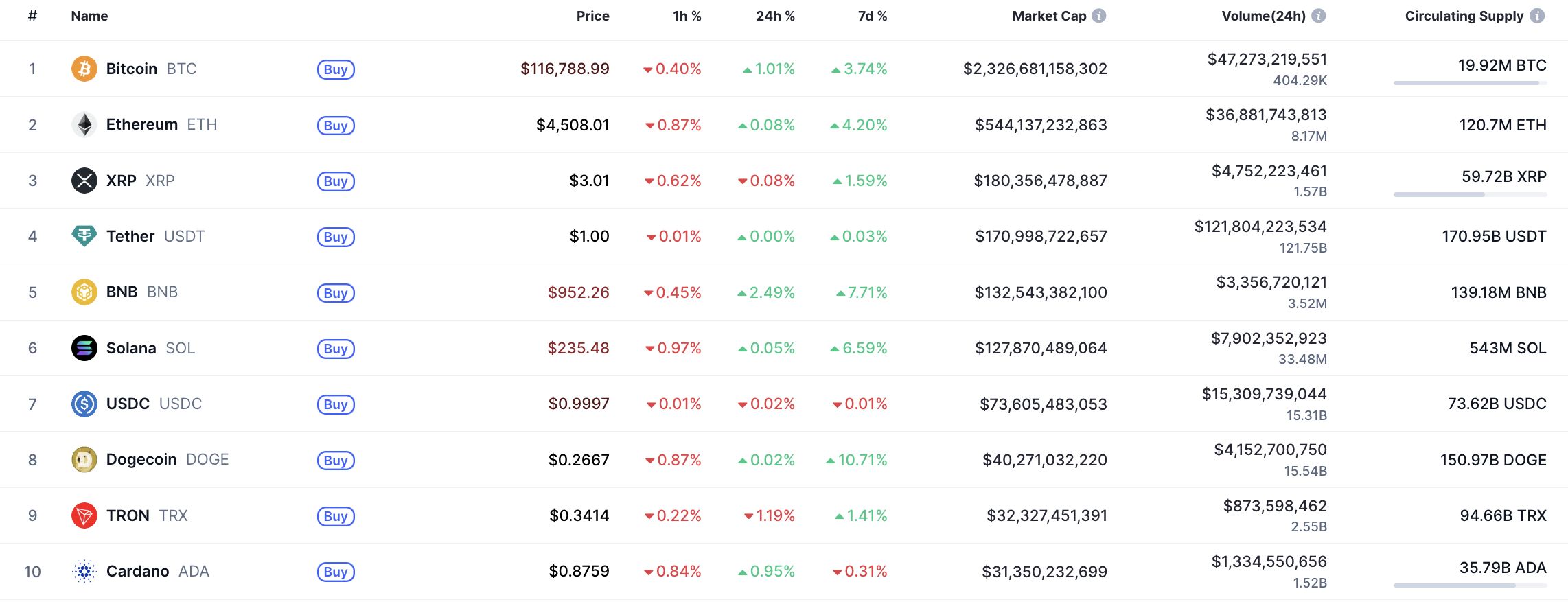

The surge in Asian crypto stocks coincided with a broader crypto market rally that extended from Sunday, following Trump's social media posts announcing the possible inclusion of SOL, XRP and ADA in the U.S. crypto reserve alongside bitcoin and ether.

Bitcoin traded up 6.9% over the past 24 hours at $92,326 at the time of writing, after surging beyond the $94,000 level at one stage earlier today, according to The Block's Bitcoin price page .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Could Remain Rangebound Near $230–$240 After False Breakout, Possibly Testing $220–$230

Midweek CoinStats: DOGE May Consolidate Near $0.27, Could Break Toward $0.30–$0.35

SHIB May Remain Sideways Near $0.000013 After False Breakout, Could Test $0.00001290