- The RSI generates upward trending lows as price continues to stay sluggish which signals an imminent bullish trend.

- XRP could encounter major resistance levels during its price growth which may lead to market stabilization if it fails to break through these barriers.

- The SEC lawsuit settlement will probably not create an immediate price surge but its long-term impact depends on user adoption and business partnerships.

The long-awaited conclusion of the SEC lawsuit against Ripple may bring regulatory clarity to XRP, but analysts warn that investors shouldn’t expect an immediate price explosion. According to a recent post by All Things XRP, the real catalyst for XRP’s surge lies in Ripple’s next moves—adoption, partnerships, and real-world utility.Once the legal chapter closes, XRP’s market activity is expected to go higher.

Recent price action on the XRP chart reveals a notable bullish RSI divergence, which could indicate a potential reversal.This divergence is typically seen as a signal of weakening selling pressure and possible upcoming bullish momentum.

The RSI, currently rising from oversold levels, is approaching the 40 mark, suggesting renewed buying interest. The price rebounded from around $2.00 and is now trading at $2.1914. If momentum sustains, XRP may continue its upward movement towards resistance levels, possibly retesting the $2.70-$3.00 range.

XRP Shows Bearish Momentum but Hints at Potential Reversal

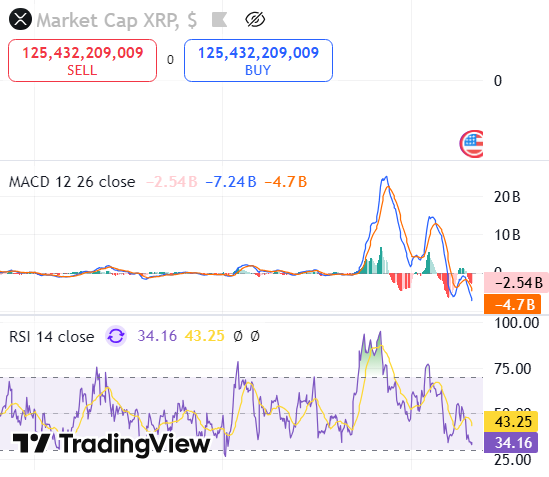

XRP, currently valued at $125.64 billion for both buy and sell positions, indicating a neutral stance in immediate price movement. The MACD line is trading below the signal line reflecting a decline in momentum and potential further downside pressure.

Source: Trading View

Source: Trading View

Additionally, the RSI is currently trading at 34.16 showing that XRP is approaching oversold territory, suggesting possible price stabilization or a rebound if buyers re-enter the market. If RSI breaks above 43.27, bullish momentum could resume, but sustained weakness may lead to further market cap decline.

Potential Key Levels and Market Implications

A confirmed breakout above resistance could shift market sentiment, attracting new buyers and increasing trading volume. However, if selling pressure resumes at resistance zones, consolidation or pullbacks might occur.

Immediate Support is at $2.00 while resistance Levels lies at $2.50, $2.70, and $3.00. The technical aspects of XRP identify a possible bullish trend although its movement depends on wider market variables. Major trading participants will use essential price points to verify ongoing market trends.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.