-

Solana is currently navigating a turbulent phase marked by significant market volatility and mixed investor sentiment.

-

Recent developments such as FTX/Alameda’s massive unstaking and the coin’s integration into the U.S. Crypto Reserve are pivotal moments impacting its future.

-

“Only Bitcoin meets the criteria for being a strategic crypto reserve asset,” said Tyler Winklevoss, questioning Solana’s long-term viability in this respect.

Explore Solana’s current market challenges, including major unstaking events and potential impacts of its U.S. Crypto Reserve integration.

Will Solana’s integration into the U.S Crypto Reserve boost its market position?

Solana recently garnered attention with its integration into the U.S Crypto Reserve, a move that positions it as a potential player in government-backed blockchain initiatives. With strategic U.S. backing, Solana could attract greater institutional interest, bolstering its appeal in government pilot programs. However, industry leaders have raised concerns about its suitability for such roles.

For example, Tyler Winklevoss, Co-founder of Gemini, recently stated that assets like Solana, XRP, and ADA are not suitable for a strategic crypto reserve. According to the executive, only Bitcoin meets the criteria for this important role. Therefore, despite Solana’s new status, its long-term potential in the reserve may face challenges.

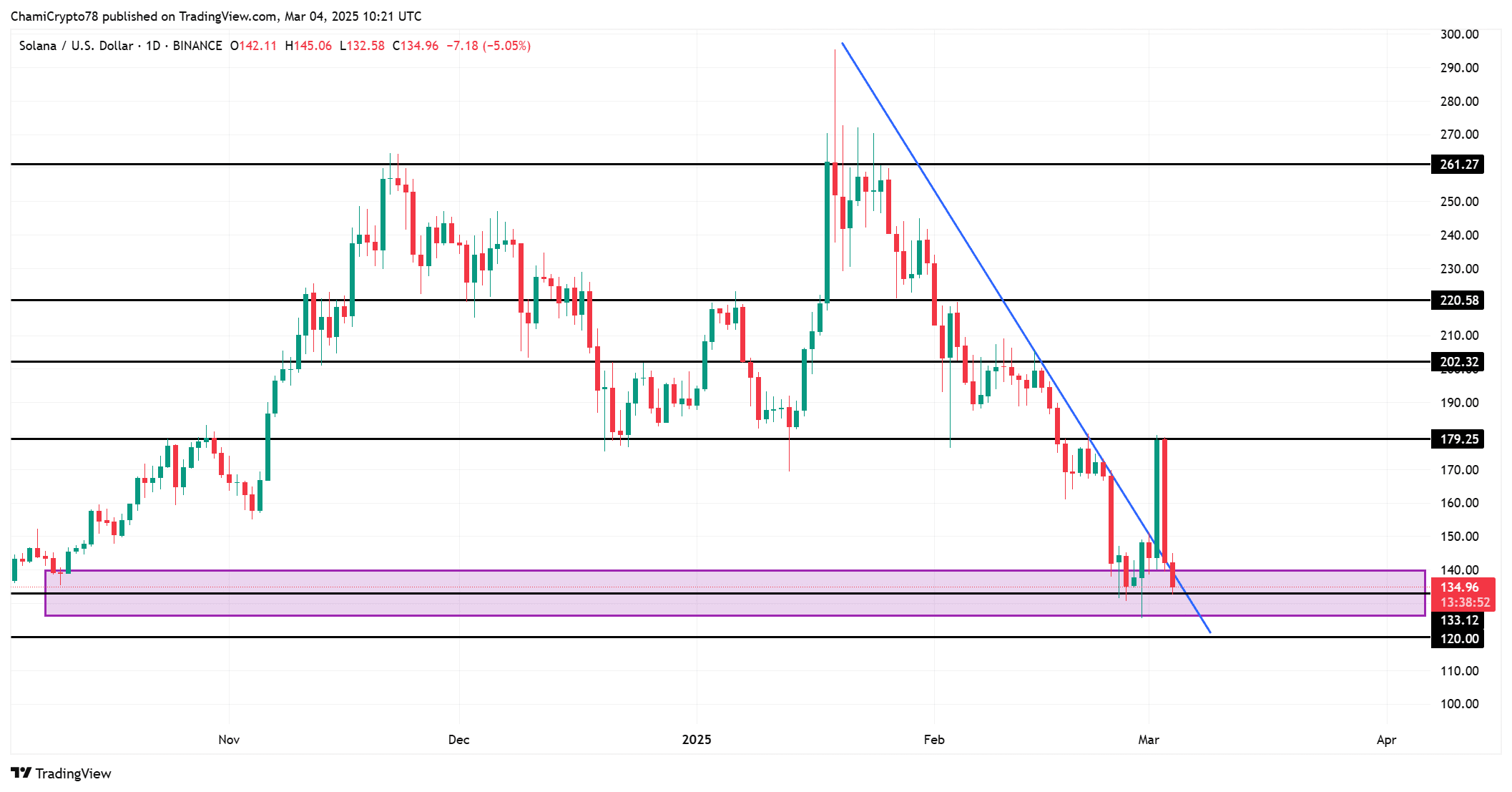

SOL’s price action and key levels

Solana, at the time of writing, was testing crucial support levels, with the price recently dropping to $136.88 – an important accumulation zone. Traders are keeping a close eye on this level as it may determine Solana’s next move. If Solana can hold above this level, a potential bounce to resistance levels such as $179.25 may follow.

However, if the price falls below $133, the next support target will be around $120, signaling a possible deeper downturn. The descending trendline seen on the chart adds further pressure to any potential upside, making this a critical period for Solana’s price action.

Source: TradingView

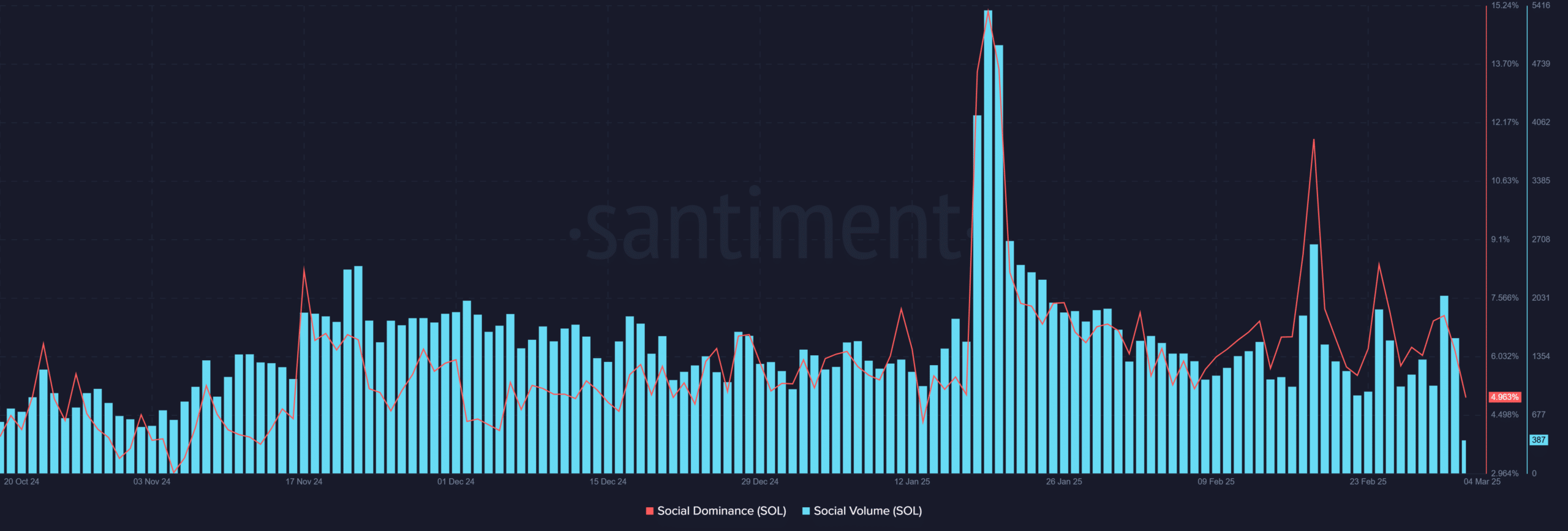

Declining social volume and dominance – Meaning?

Despite the positive news surrounding its integration, Solana’s social volume and dominance have been declining lately. For instance, social volume fell to just 387, while social dominance dropped to a mere 4.96%.

This hints at a fall in public interest and could signify that market participants are losing confidence in Solana as a whole.

Additionally, such a decline in social metrics often alludes to lower buying pressure, further complicating the outlook for the token in the short term.

Source: Santiment

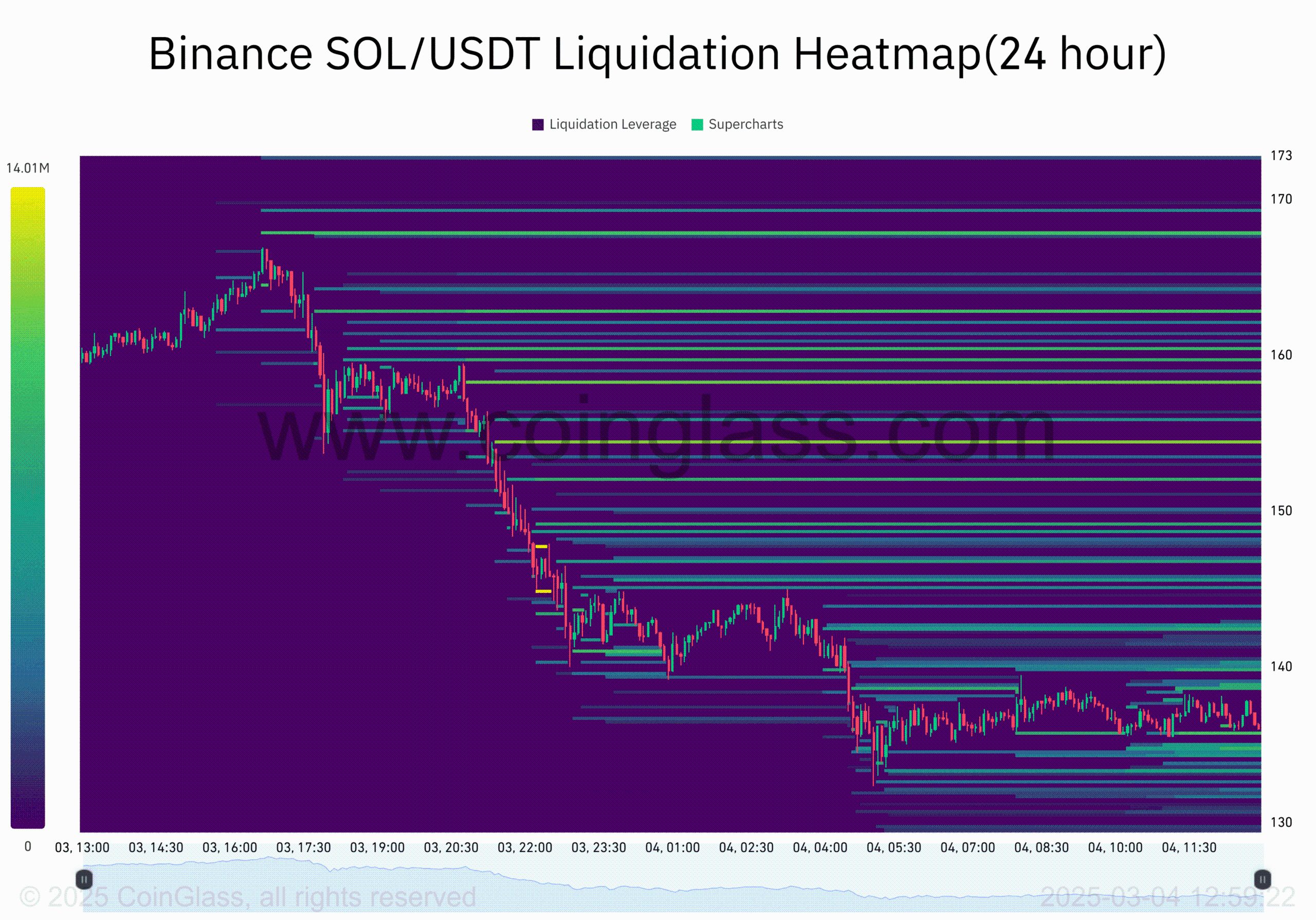

What do Open Interest and liquidation heatmaps say?

Solana’s market sentiment has also been negatively affected by a 17.41% fall in Open Interest. This decline indicates that fewer investors are willing to place leveraged bets on the token.

The liquidation heatmap revealed significant liquidation zones around the $140 – $150 range. This indicates that if the price continues to drop, many leveraged positions could be liquidated, amplifying selling pressure in the market.

Source: Coinglass

Can Solana weather this storm?

Solana faces significant challenges ahead. Despite its latest integration, the recent unstaking by FTX/Alameda, declining social metrics, and bearish market sentiments are combining to create a tough environment for the token.

If Solana can hold critical support levels and absorb the large-scale unstake, it may be able to recover. However, the road to recovery will be challenging, and further price drops remain a strong possibility.