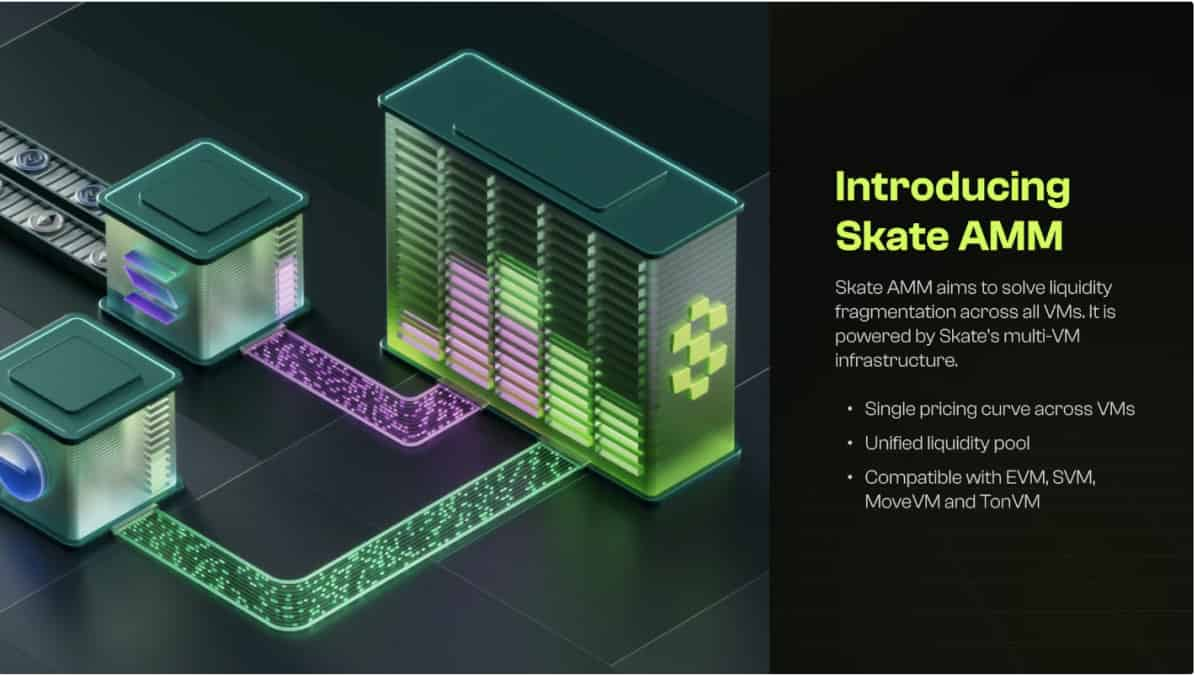

Skate Launches First AMM with Unified Liquidity Across Solana, Ethereum, SUI, TON and more

Skate is launching Skate AMM, an automated market maker (AMM) designed to eliminate liquidity fragmentation in an increasingly fragmented blockchain ecosystem. By separating core AMM logic from asset custody, Skate AMM ensures that liquidity is unified across multiple chains while assets remain securely on their native networks. This design enhances trading efficiency, capital utilization, and user experience for traders and liquidity providers (LPs).

A Breakthrough in AMM Design

Traditional AMMs are siloed on individual chains, leading to fragmented liquidity and inefficient capital deployment. Skate AMM introduces a global liquidity model powered by its CLAMM (Concentrated Liquidity AMM) architecture, which aggregates price states across all supported chains. Unlike conventional cross-chain models, Skate AMM maintains a single, canonical pricing curve across all chains, ensuring seamless and consistent pricing for traders. This approach eliminates bridging risks while providing deeper liquidity and better pricing.

For LPs, the benefits are equally compelling: higher fee revenues, reduced impermanent loss, improved capital efficiency, and a seamless UX compared to managing liquidity across multiple siloed AMMs. With Skate AMM, LPs can provide liquidity to a single, unified market instead of spreading assets across various fragmented pools. By maintaining a unified liquidity state on a dedicated hub chain, Skate AMM optimizes capital utilization and minimizes toxic flow.

Addressing an Increasingly Fragmented Landscape

With the rise of new Layer-1s, Layer-2s, and alternative virtual machines (altVMs), liquidity in DeFi has become increasingly fragmented. This fragmentation forces users to navigate complex cross-chain interactions or accept suboptimal pricing. Skate AMM solves this problem by introducing a unified liquidity model that spans multiple VM environments, ensuring a seamless and efficient trading experience.

Multi-Chain Expansion from Day One

Skate AMM is launching with support for multiple virtual machine environments, including EVM, SVM, MoveVM, and TonVM. The first wave of supported blockchains includes Solana, Base, Sui, Eclipse, TON, Mantle, Movement, Hyperliquid, Berachain, and more. This broad multi-chain deployment ensures that users across different ecosystems can tap into a unified liquidity source, making trading and liquidity provision more seamless than ever.

Powered by Skate’s Cutting-Edge Tech Stack

At the heart of Skate AMM lies a powerful technology stack, featuring three key components:

- Hub Chain – Built with Optimism’s OP Stack and managed by AltLayer, the hub chain serves as the single source of truth for global pricing and liquidity state, while lightweight Periphery contracts on each chain act as gateways for swaps and liquidity provision

- Skate EigenLayer AVS – Secured by $2 billion+ in EigenLayer economic trust, built with the Othentic stack. AVS operators validate state updates across chains, ensuring that liquidity synchronization is trust-minimized and efficient.

- Execution Network – Ensures a seamless, risk-free trading experience by maintaining liquidity across all integrated blockchains without requiring asset bridging.

The Future of Cross-VM Trading

Skate AMM takes a major step forward in DeFi. By solving the persistent issue of liquidity fragmentation and enhancing cross-chain efficiency, it sets a new standard for AMM design in the multi-VM era. Its approach minimizes Loss-Versus-Rebalancing (LVR), reducing arbitrage-related inefficiencies and improving outcomes for LPs.

The full whitepaper is available at skatechain.org/amm-whitepaper.pdf . Traders and LPs can sign up for early access via the Skate AMM waitlist at amm.skatechain.org . In addition, Skate has announced an upcoming community sale on Legion, offering their supporters the opportunity to join them on their journey to end fragmentation.

This post is commissioned by Skate and does not serve as a testimonial or endorsement by The Block. This post is for informational purposes only and should not be relied upon as a basis for investment, tax, legal or other advice. You should conduct your own research and consult independent counsel and advisors on the matters discussed within this post. Past performance of any asset is not indicative of future results.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ETH Price Experiences Volatility: In-Depth Analysis and Outlook

The Truth Behind Dogecoin's Plunge: Why Are Meme Coins the First to Fall in the Storm?

Bitcoin's "Breathing Crisis": Whales Flee, $100,000 Mark Hangs by a Thread