Key Points

- Over $2.85 billion in crypto options will expire tomorrow morning on Deribit.

- BTC trades above $91,000 and ETH trades near $2,300.

This week’s crypto options data is released in a bullish market ahead of the Crypto Summit that will take place tomorrow at the White House.

Over $2.85 billion in Bitcoin and Ethereum options will expire tomorrow at 08:00 (UTC) on Deribit.

Bitcoin and Ethereum Options Expiry Data

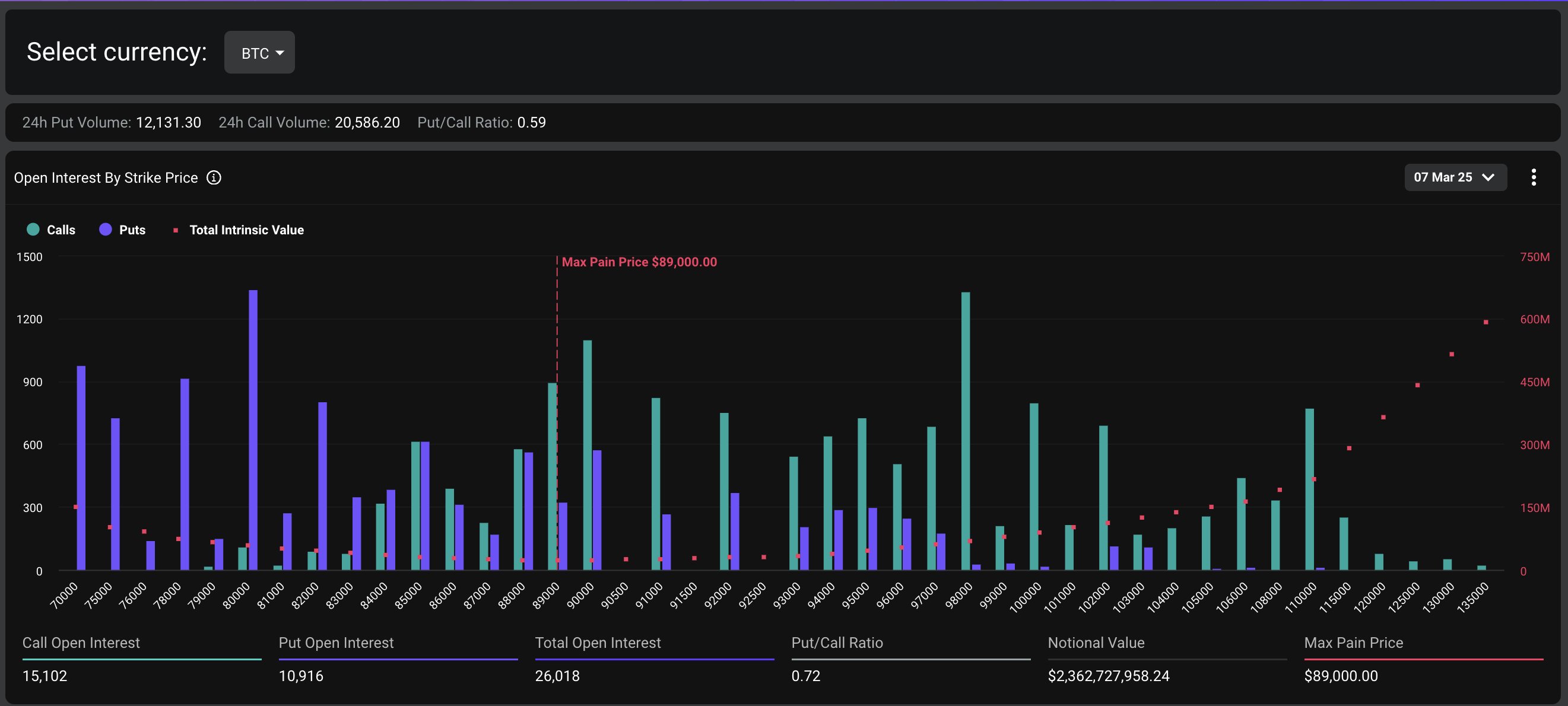

Around $2.36 billion in Bitcoin options are set to expire tomorrow morning with a Max Pain Point of $89,000 and a Put/Call Ratio of 0.72, according to Deribit’s notes on X.

Bitcoin options expiry data – Deribit

Bitcoin options expiry data – Deribit

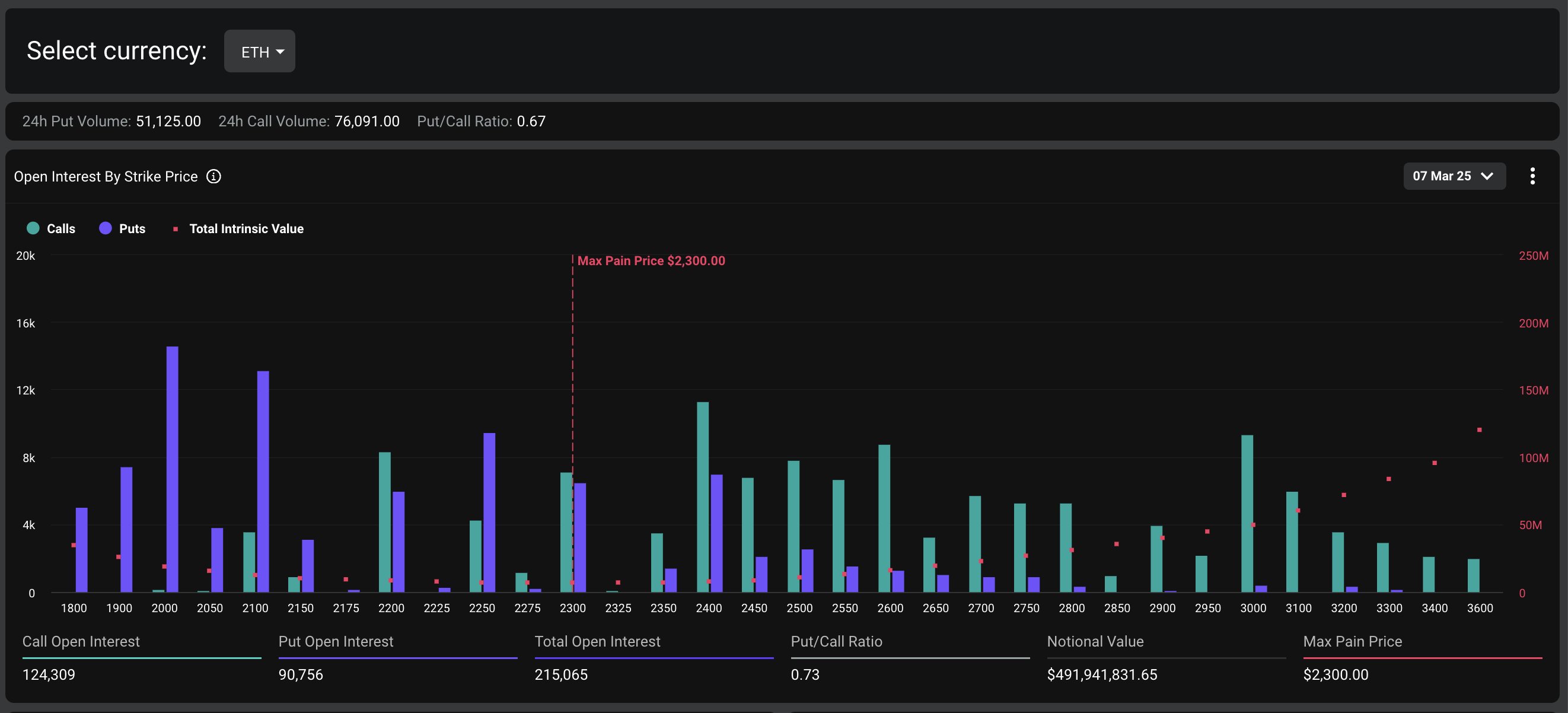

Also, $492 million in Ethereum options will expire with a Max Pain Point of $2,300 and a Put/Call Ratio of 0.73.

Ethereum options expiry data – Deribit

Ethereum options expiry data – Deribit

Today’s options data was released amidst a rebound in the crypto market following recent declines. Today, the overall market is up by over 2.3%, with both Bitcoin and Ethereum trading in the green.

BTC Trades Above $91,000

At the moment of writing this article, BTC is trading above $91,000, up by over 1.5% in the past 24 hours.

BTC price in USD todayBTC’s price surged from a low at $87,000 levels recorded on March 5, reaching prices above $92,700 earlier today, before correcting to current levels.

Bitcoin had a very volatile week, with prices jumping above $94,000 on March 3rd, after US President Donald Trump, announced a Crypto Reserve in the US last Sunday, pushing the general market higher.

Ethereum performed well today as well.

ETH Trades Near $2,300

At the moment of writing this article, ETH is trading above $2,290, up by over 2.5% in the past 24 hours.

ETH price in USD todayETH climbed from $2,163 on March 5 to over $2,315 earlier today, before slightly dropping to current price levels. On March 3rd, following Trump’s bullish announcement during the weekend, ETH reached prices above $2,540.

The crypto industry remains optimistic ahead of tomorrow’s important Crypto Summit that will take place at the White House.