- The SEC has dropped or paused lawsuits and investigations against multiple crypto firms, including Binance and Coinbase.

- Most cases were dismissed in February and March 2025.

- Meanwhile, Ripple’s case remains active in the appellate court.

In recent weeks, the U.S. Securities and Exchange Commission (SEC) has paused or dismissed multiple lawsuits and investigations involving major cryptocurrency firms. This has marked a big change in regulatory enforcement.

The move comes after leadership changes inside the agency and the creation of a Crypto Task Force to rethink enforcement priorities.

Companies such as Binance, Coinbase, Kraken, and Uniswap are among those affected. The decisions, announced between February and early March, suggest a coordinated change in approach.

SEC Lawsuit Wave: Suddenly Halted

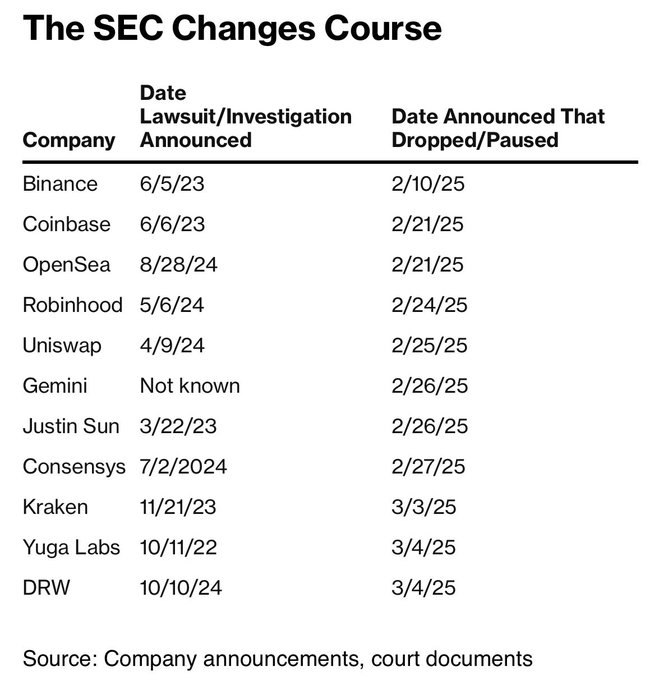

The SEC had previously filed lawsuits and launched investigations against various crypto companies over alleged securities violations. Binance and Coinbase were sued in June 2023, while Uniswap, Kraken, and OpenSea came under scrutiny in 2024.

However, recent announcements confirm that these actions have either been dropped or put on hold. The dismissals followed a pattern, with Binance’s case dropped on February 10, Coinbase and OpenSea on February 21, and others following suit by early March.

Specifically, investigations against crypto firms that have concluded include cases against OpenSea, Robinhood, Uniswap, Gemini, Justin Sun of Tron, ConsenSys, Kraken, Yuga Labs, and DRW.

Related: Ripple SEC Case & ETF Impact on Price — Where’s XRP Headed?

In January, Acting SEC Chair Mark Uyeda appointed Commissioner Hester Peirce to lead the newly established Crypto Task Force. The unit is expected to oversee non-fraud-related crypto cases, contributing to a more relaxed enforcement strategy.

The SEC’s recent legal reversals align with this shift, with lawsuits being paused under the task force’s oversight.

Ripple Case: Still in SEC Crosshairs

Despite the SEC’s recent decision to drop or pause lawsuits against Binance, Coinbase, and other crypto firms, the ongoing case against Ripple remains active. The SEC has not included Ripple in the wave of dismissals, raising questions among XRP enthusiasts.

Related: Ripple CEO Applauds SEC for Dropping Coinbase Lawsuit: Time for XRP to Shine?

Earlier talk mentioned that unlike some of the dismissed lawsuits, Ripple’s case has already made progress in court. A judge ruled in 2023 that automatic XRP sales do not count as securities transactions. However, the SEC appealed parts of that ruling, especially concerning institutional sales. The case is still not settled.

With no new filings in Ripple’s appeal coming up in April, people are guessing that the SEC could totally drop the appeal. This guess is based on their changing regulatory approach. Plus, there are no fraud allegations against Ripple. This makes a resolution more likely.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.