Date: Sat, March 08, 2025 | 08:02 AM GMT

The cryptocurrency market remains in a corrective phase following the November rally. One of the hardest-hit altcoins in this downturn has been Toncoin (TON), which has suffered a sharp 47% correction over the past two months.

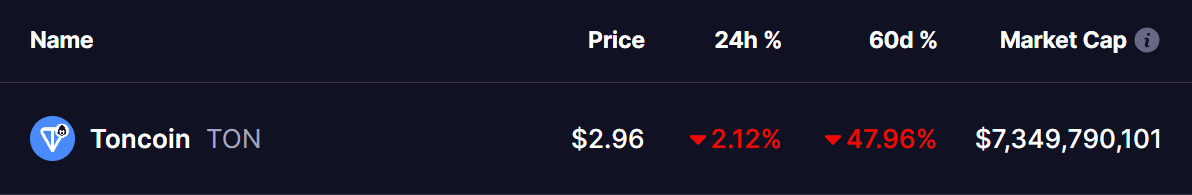

Currently, TON is trading around $2.96, marking a 2% decline that has brought it to a critical “Make or Break” support level.

Source: Coinmarketcap

Source: Coinmarketcap

Testing Ascending Channel Support

The weekly chart shows that Toncoin has been trading within a broader ascending channel since the bull market of 2021. However, the recent rejection from the upper boundary at $8.28 in mid-2024 triggered a substantial correction.

The ongoing sell-off has driven TON’s price down to $2.96, which aligns with the ascending channel’s lower support trendline. In previous instances, TON has bounced from this level, and if history repeats itself, a rebound could be in play.

If TON holds this support, the next significant challenge will be the 150-day and 100-day moving averages. A breakout above these levels would confirm renewed buying strength, potentially setting up a recovery rally toward previous range highs.

However, failure to hold this support could lead to another wave of selling, with the next downside targets at $2.55 and $1.88.

The MACD indicator remains in bearish territory, with the MACD line below the signal line, indicating continued selling pressure. However, if momentum shifts and the MACD starts turning upwards, it could signal an early reversal, making TON’s reaction at this support level even more crucial.

Final Thoughts

Toncoin is at a pivotal point, testing the lower boundary of its long-term ascending channel. If bulls defend this level, a rebound could be in store, with a move toward key moving averages acting as the next hurdle. However, if this support breaks, further downside toward $2.55 and $1.88 could follow. The coming days will be crucial in determining TON’s next major move.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.