Solana (SOL) Futures Market Hints at More Losses Below $130

Solana’s futures market signals trouble as bearish sentiment grows, with declining open interest and negative funding rates pointing to potential losses. SOL risks dropping below $130 unless bulls regain control.

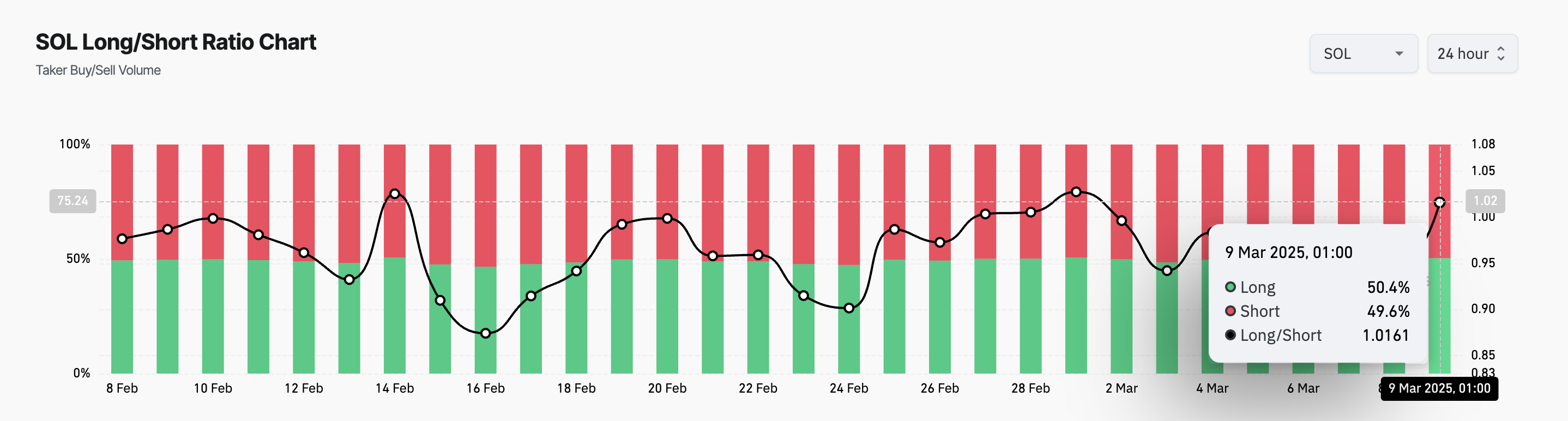

Solana’s price has faced significant volatility over the past week due to recent market troubles. This has led to a sharp decline in its futures market sentiment as leveraged traders appear reluctant to take bullish positions.

This lack of confidence increases the risk of a further price drop, with SOL eyeing a dip below the $130 level in the near term.

Solana Struggles as Traders Exit

SOL’s negative funding rate is an indicator of the waning bullish bias among its futures traders.

According to Coinglass data, SOL perpetual futures have maintained a negative funding rate for the past three days, indicating that short sellers are paying to hold their positions. At press time, this stands at -0.0060%.

SOL Funding Rate. Source:

Coinglass

SOL Funding Rate. Source:

Coinglass

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts to keep the contract price aligned with the spot market.

As with SOL, when this rate is negative, it means that short sellers (those betting on a price decline) are paying fees to long traders, indicating a bearish sentiment in the market.

Therefore, more traders are positioned for a price drop, reinforcing the downward pressure on the coin’s price.

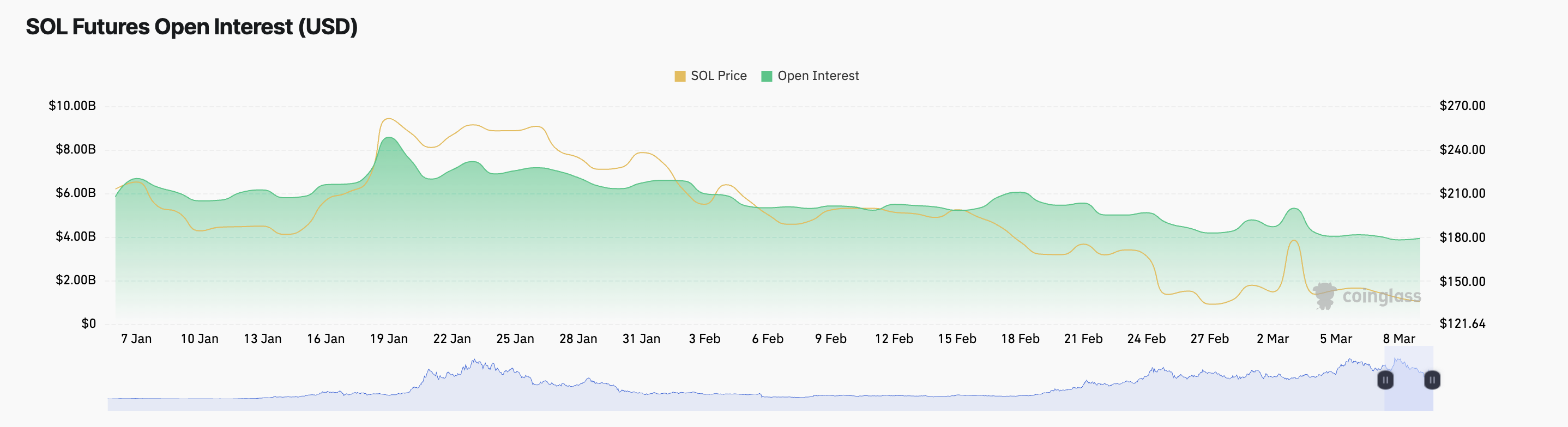

Moreover, the lack of confidence among SOL futures traders is reflected by its plummeting open interest. At press time, this is at $3.94 billion, falling 19% since the beginning of March.

SOL Open Interest. Source:

Coinglass

SOL Open Interest. Source:

Coinglass

An asset’s open interest tracks the total number of active futures contracts that have not been settled.

When this falls, especially during a period of price decline, it suggests that traders are closing positions without opening new ones. This confirms the reduced conviction in a short-term SOL price recovery among its futures traders.

Solana Bulls Weaken—Can They Prevent a Drop Below $130?

At press time, SOL trades at $137.70, resting just above the support floor of $136.62. As bullish sentiment tapers, this level risks being flipped into a resistance zone.

Should this happen, SOL’s price could slip below $130 to exchange hands at $120.72.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

On the other hand, if bullish momentum returns to the SOL market, this bearish projection will be invalidated. In that scenario, new demand could drive the coin’s price to $182.31.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!