Date: Monday, March 10, 2025 | 10:20 AM GMT

The past week in crypto has been nothing short of headline-worthy. From President Trump announcing the Crypto Strategic Reserve to signing executive orders for a Bitcoin Strategic Reserve and hosting a White House Crypto Summit, the space has been buzzing. But despite all the noise, the broader market hasn’t reacted with the bullish momentum many were hoping for. Instead, the downtrend that began after the November rally is still dragging on.

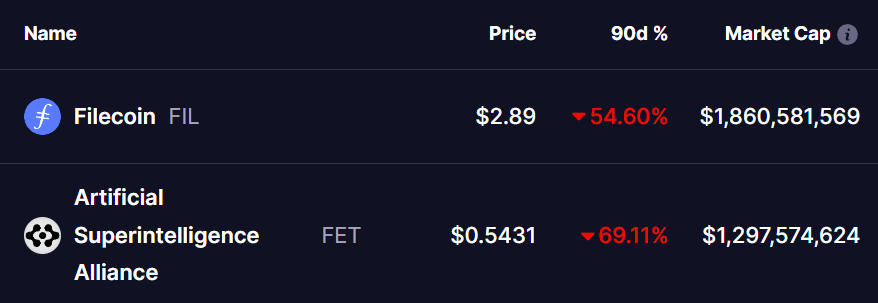

And it’s taking a toll—especially on altcoins like Filecoin (FIL), Artificial Superintelligence Alliance (FET), and SEI, all of which are now testing crucial support zones. With FIL down 54% and FET down a massive 69% over the past 90 days, investors are understandably concerned: Will these tokens bounce back—or is more downside on the way?

Source: Coinmarketcap

Source: Coinmarketcap

Filecoin (FIL)

Filecoin has been stuck in a descending triangle pattern for nearly a year now. Recently after reaching a high of $8.38 in December, the token was sharply rejected at the upper trendline, leading to a massive correction phase.

Filecoin (FIL) Weekly Chart/Coinsprobe (Source: Tradingview)

Filecoin (FIL) Weekly Chart/Coinsprobe (Source: Tradingview)

Currently, FIL is testing a critical support zone at $2.89—a level that has historically acted as a strong launchpad for rebounds. If this level holds, a short-term bounce could be possible, potentially pushing the price back toward the 25-day Simple Moving Average (SMA).

However, if FIL fails to defend this zone at $2.76, the market could see a sharper drop—possibly accelerating the bearish momentum further.

Artificial Superintelligence Alliance (FET)

FET has also been trading within a descending triangle for several months. The latest downtrend kicked off after a rejection near the $2.32 resistance level in early December.

FET Weekly Chart/Coinsprobe (Source: Tradingview)

FET Weekly Chart/Coinsprobe (Source: Tradingview)

Now, the token is holding on to a key support area around $0.54. Just like FIL, this is a make-or-break level. If it holds, we could see a short-term recovery rally. But for a more sustained upward move, FET would need to break above the 100-day SMA, which could flip momentum in its favor.

If this support zone collapses, though, the next significant level lies much lower—around $0.27, potentially opening the door to further downside.

What to Watch Next

The future direction of FIL and FET depends heavily on the overall market sentiment—especially movements in Bitcoin (BTC) and Ethereum (ETH). Currently, technical indicators like the MACD are still showing bearish signals. But a bullish crossover in the coming days or weeks could help spark a broader recovery.

Until then, all eyes remain on these critical support levels. As long as they hold, hope for a bounce remains. But if they break, deeper corrections could follow—and investors should be prepared.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.