QCP Asia: The sharp drop in U.S. stocks drags down market sentiment, BTC briefly falls below $80K but may welcome a rebound signal

Odaily Planet Daily reports that according to QCP Asia's market analysis on March 11, the optimistic sentiment in the U.S. stock market quickly reversed after Trump's election victory, with the S&P 500 index and Nasdaq falling by 2.7% and 3.8% respectively. The "Magnificent 7" tech stocks evaporated $830 billion in a single day, setting a record for the largest single-day drop in history.

The bearish sentiment has fully returned to the market, with US stock put options trading volume rising to its highest since 2020. In an interview with Fox News, Trump showed indifference towards economic recession, stating that economic downturn might be necessary for fixing America which further intensified market panic.

In terms of cryptocurrency markets, BTC briefly fell below $80,000 as investors rushed to buy put options as a hedge. However, during today's Asian trading session there was demand for long-term call options indicating some investors may be preparing for a rebound near support at $75,000. Despite pessimistic market sentiment not all signals are pointing downwards; US Treasury yields have fallen about 60 basis points and dollar weakened - historically this is usually beneficial for dollar-denominated risk assets (including US stocks and cryptocurrencies). Additionally,the decline in treasury yields also reduces government borrowing costs which is crucially important for Trump’s expansionary fiscal policy (including potential tax cut plans).

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

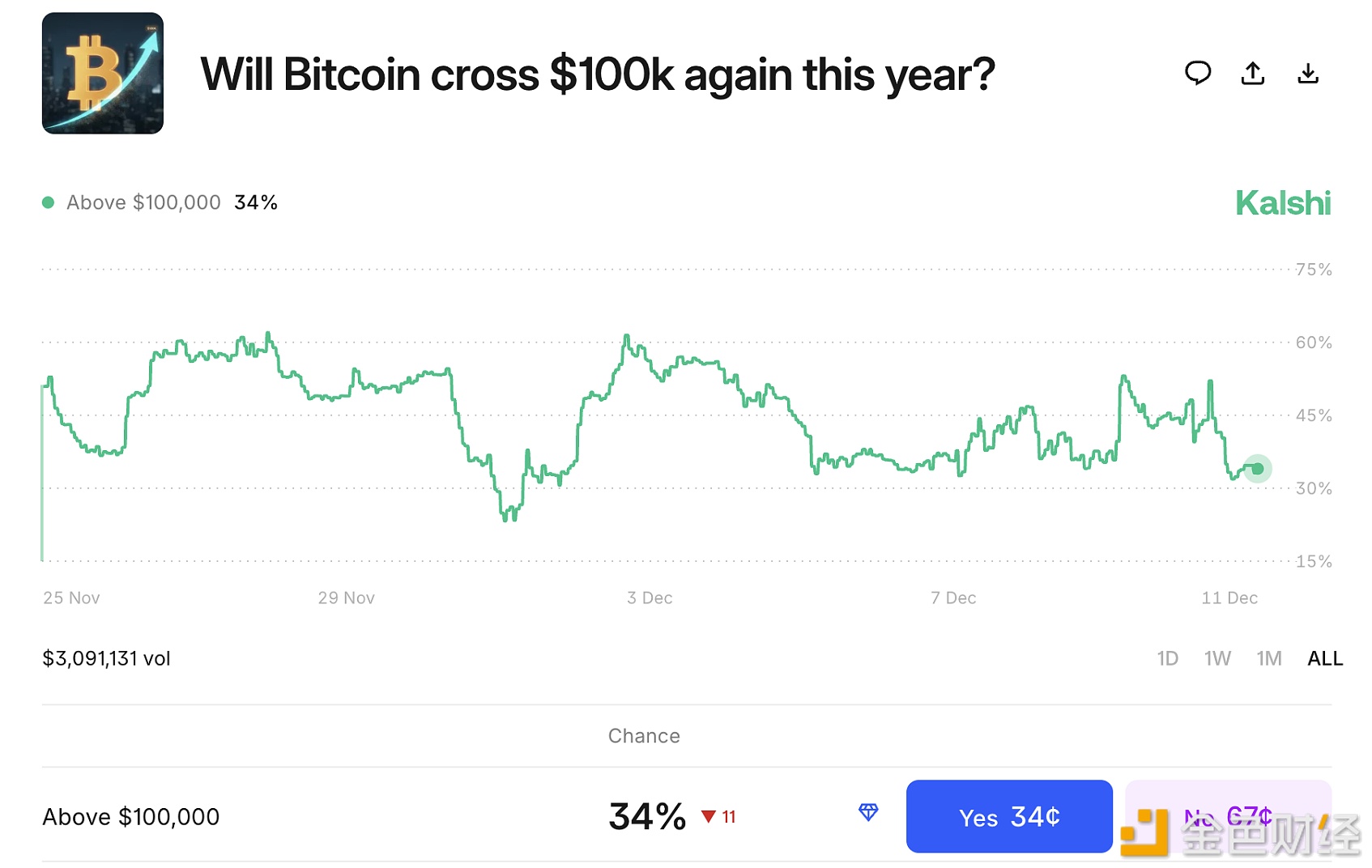

Prediction markets bet that bitcoin will not reach $100,000 by the end of the year

Data: 90,300 SOL transferred from an anonymous address, routed through intermediaries and flowed into Wintermute