- Bitcoin miners increase selling during downturns, adding liquidity pressure and influencing short-term price volatility.

- Miner-to-exchange flows surged amid price drops, reflecting operational cost burdens and persistent financial strain.

- Ongoing sell pressure from miners fuels uncertainty, though long-term investors may view this as a chance to accumulate BTC.

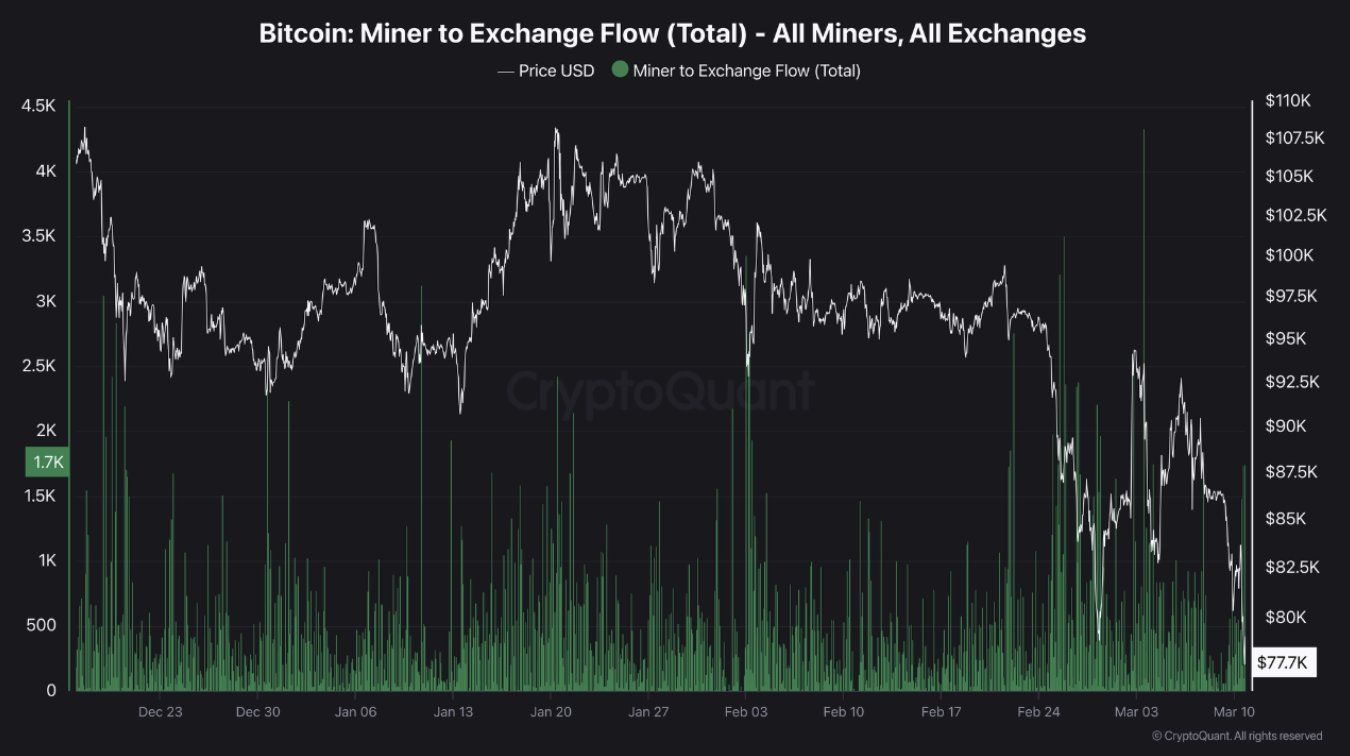

According to CryptoQuant data , Bitcoin miners have ramped up their selling pressure in light of the recent price drops. Over the past three months, Bitcoin’s price has gone through ups-and-downs, and price fluctuations have more or less been in correlation with miner-to-exchange movement.

When the market is down, miners sell off more Bitcoin. This selling pattern therefore impacts liquidity and suggests potential issues resulting from rising operating costs. From above $100,000 in December to roughly $77.7K in March, Bitcoin fluctuated.

Source: CryptoQuant

Source: CryptoQuant

Bitcoin’s Price and Miner Activity Trends

In late December, Bitcoin dropped from above $100K to around $90K. During this period, miner-to-exchange flows surged past 4K BTC. Additionally, heightened miner activity aligned with increased market volatility.

As January began, Bitcoin climbed back to $105K before facing another round of corrections. Miner-to-exchange transfers remained unstable, with periodic surges indicating increased sell pressure . By mid-January, Bitcoin spiked near $107.5K, but another steep decline followed. Miners continued moving BTC to exchanges, likely to cover operational costs.

Moreover, Bitcoin stabilized near $97.5K at the end of January, yet miner activity fluctuated. February recorded intensified selling pressure as another price dip occurred. Bitcoin, which was trading above $100K, dropped toward $95K. Throughout mid-February, BTC maintained levels around $95K before another downturn.

Further Declines and Market Reactions

By late February, Bitcoin’s price fell below $90K. Consequently, miner activity remained high, with continued BTC transfers to exchanges. Besides, the trend indicated a persistent need for liquidity among miners.

March saw additional price corrections, pushing Bitcoin toward $80K. The latest market data shows BTC priced at $77.7K. Miner-to-exchange flows remain elevated , suggesting continued financial pressure in the mining industry.

Moreover, prolonged selling pressure from miners could add to market uncertainty. High exchange inflows often indicate potential sell-offs, affecting short-term price stability. However, long-term investors might see this phase as an accumulation opportunity.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.