Bitcoin and Crypto About To Be Boosted by Global Money Supply Explosion: Former Goldman Sachs Executive

Real Vision CEO and former Goldman Sachs executive Raoul Pal believes increasing global liquidity will soon send Bitcoin ( BTC ) and other digital assets soaring on a new leg up.

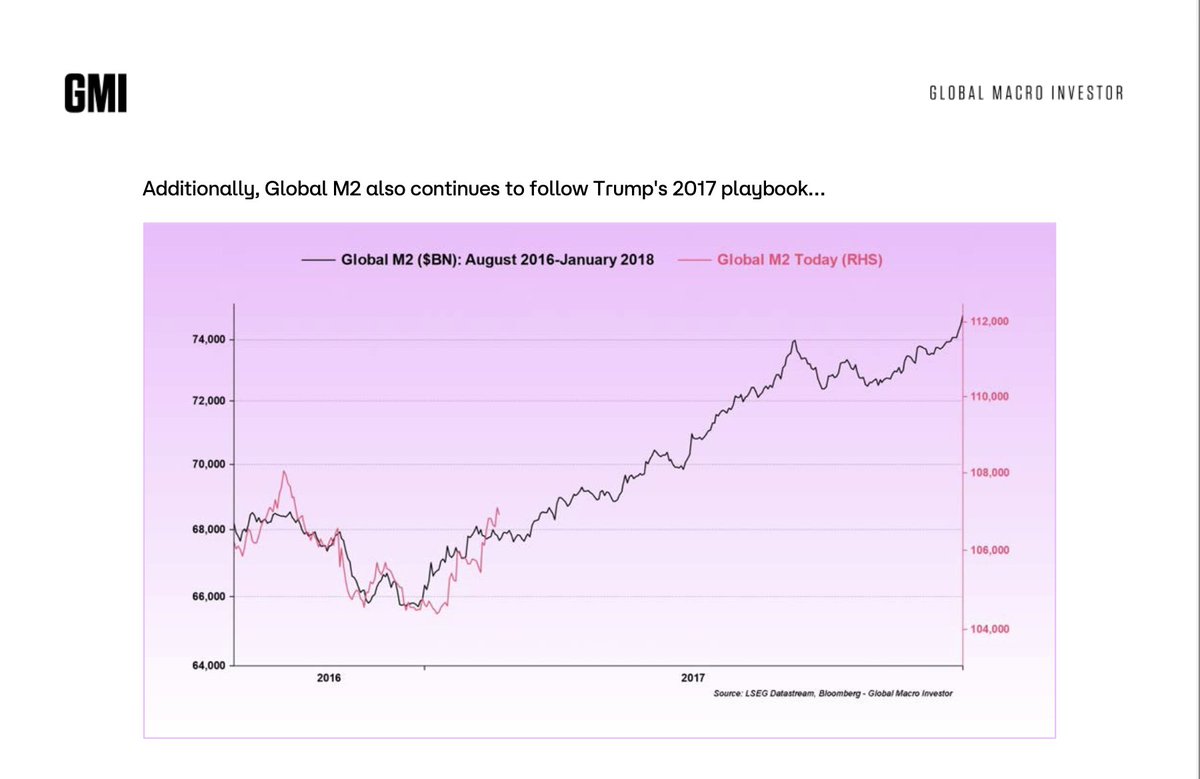

Pal tells his 1.1 million followers on the social media platform X that a historical relationship between Bitcoin and the global money supply (M2) metric suggests that the top digital asset by market cap is gearing up for a massive breakout.

“This too shall pass. Crypto is still feeling the tightening in liquidity from the stronger dollar and higher rates in Q4 2024. That is almost done and financial conditions are easing fast and M2 is headed back to new highs. This is just a regular correction.”

Source: Raoul Pal/X

Source: Raoul Pal/X

Pal believes Bitcoin is repeating a similar 2017 price pattern correlated with the M2 metric, when President Donald Trump came into office for his first term. Bitcoin had a steep correction in 2017, but then took off on a series of rallies.

“We had the exact same correction in 2017 caused by the same reaction to Trump policies (higher dollar and higher rates which then reversed).”

Source: Raoul Pal/X

Source: Raoul Pal/X

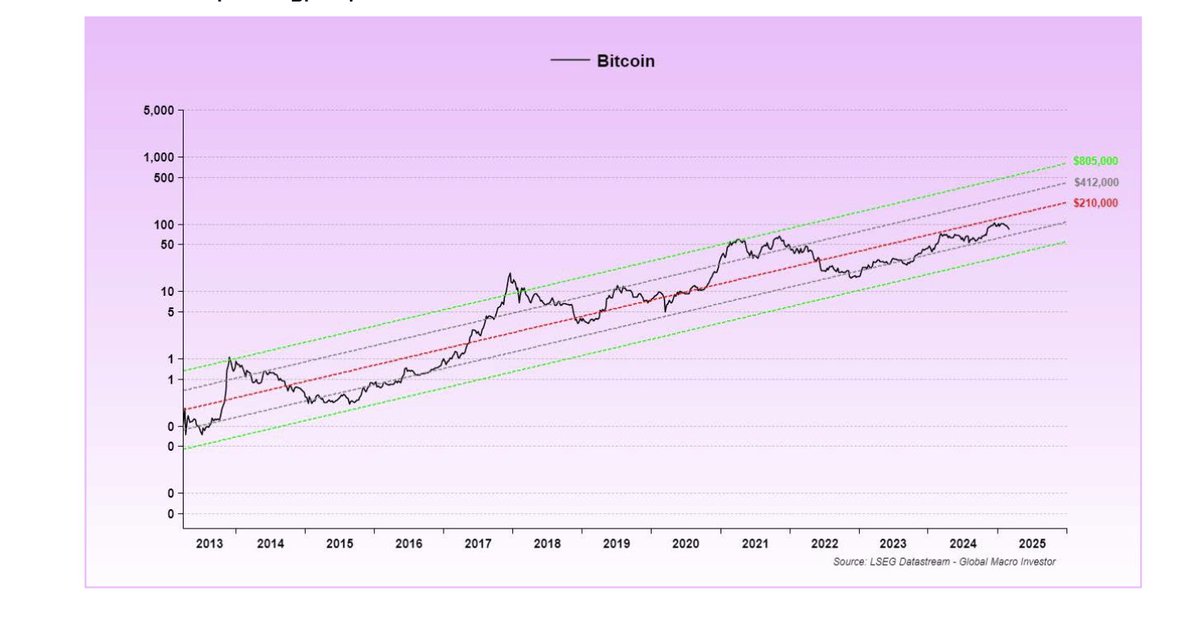

Pal also believes Bitcoin will start trading higher within a logarithmic regression channel, a form of technical analysis that aims to show the approximate highs and lows of an asset’s long-term trend.

“Over time, we just keep climbing the log regression channel. Whether we stay at the main (red) or climb above it by another standard deviation or two remains to be seen as the cycle develops.”

Source: Raoul Pal/X

Source: Raoul Pal/X

Bitcoin is trading for $80,703 at time of writing, up 1.4% in the last 24 hours.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X , Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin due 2026 bottom as exchange volumes grind lower: Analysis

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.