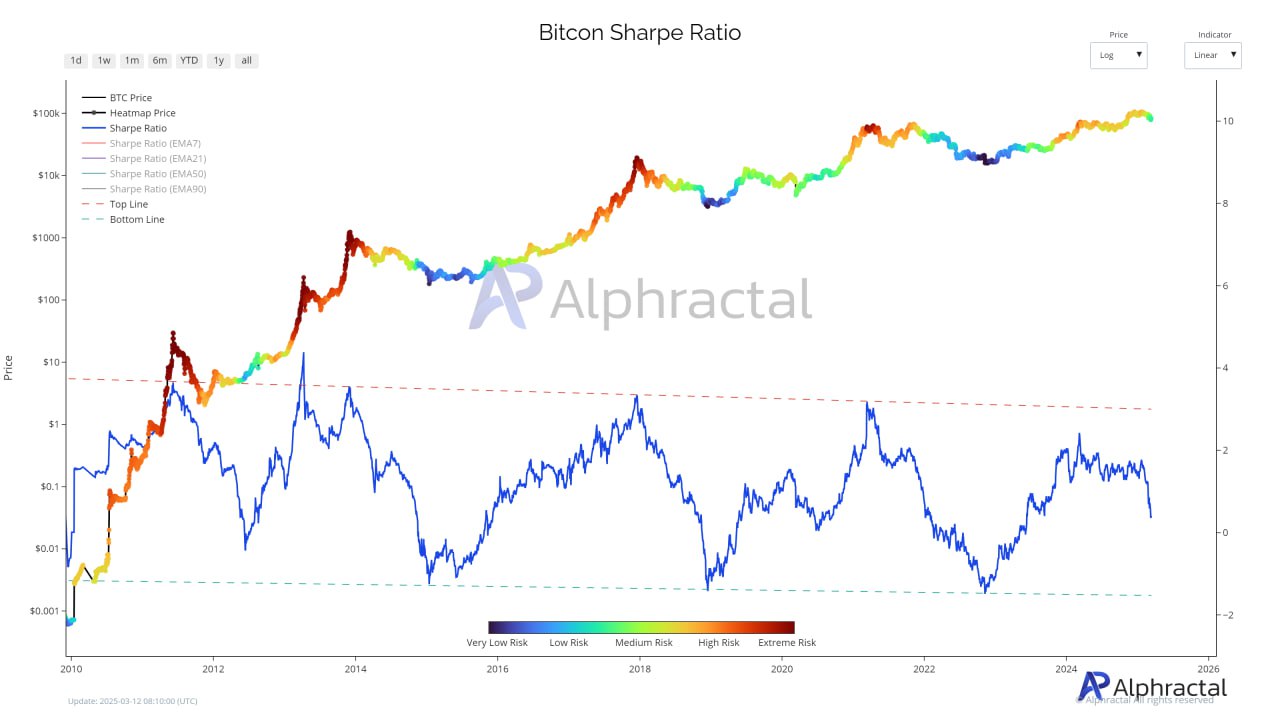

Cryptocurrency analytics firm Alphractal has issued a cautionary statement regarding Bitcoin’s recent market behavior, drawing attention to the decline in the Sharpe Ratio, a key risk-adjusted return metric.

The firm warns that this trend could signal increased market instability and risk for investors.

The Sharpe Ratio measures the returns of an asset compared to its volatility-adjusted risk. When the ratio decreases, it indicates that risk-adjusted returns are weakening and the asset is becoming less efficient at providing returns relative to the level of risk taken.

According to Alphractal, Bitcoin’s Sharpe Ratio has been on a decline since March 2024, even though BTC has surpassed its all-time high of $100,000. Now, with both the price and Sharpe Ratio falling, analysts are questioning their impact on the future direction of the market.

Several key factors are contributing to the downtrend:

- Increased Volatility: Despite reaching new highs, Bitcoin has experienced intense price swings, reducing the efficiency of returns relative to risk.

- Slower Short-Term Returns: After a prolonged bull run, the pace of appreciation has slowed, weighing on average returns and weakening the ratio.

- Macroeconomic Uncertainty: External factors such as tight monetary policies, changing global liquidity conditions and geopolitical tensions have contributed to a higher perception of risk even in a bullish market.

A decreasing Sharpe Ratio indicates increasing risk per unit of return. While the recent price rally that saw Bitcoin surpass its previous record is fueling bullish sentiment, increasing volatility and uncertainty could be a sign of market instability or potential corrections.

Chart shared by Alphractal comparing BTC price to Sharpe ratio.

Chart shared by Alphractal comparing BTC price to Sharpe ratio.

“A falling Sharpe Ratio can predict changes in market conditions and help identify periods when risk-adjusted returns become less favorable,” the firm said in a statement.

*This is not investment advice.