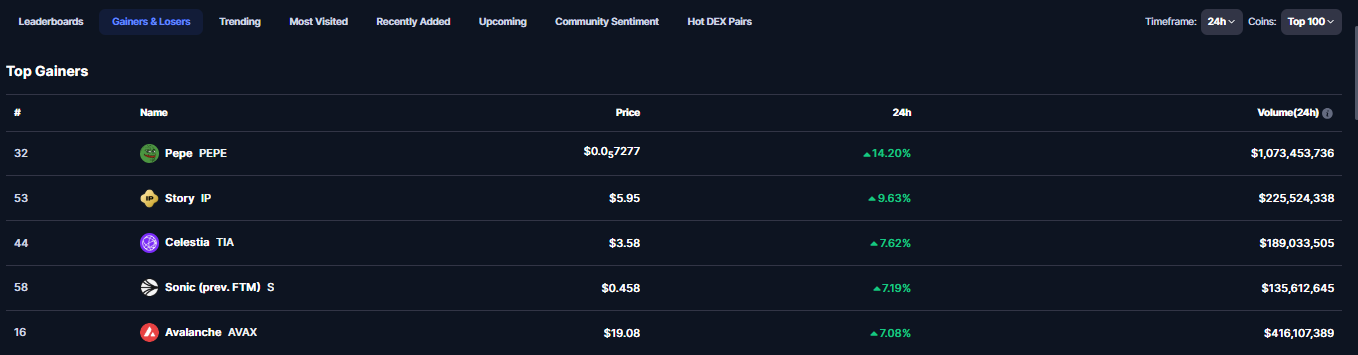

PEPE Leads Market Gains With 14.2% Surge Amid Rising Demand

- PEPE leads with a 14.20% rise and hits $1.07 billion in its trading volume.

- Story (IP) gains 9.63% as market confidence rises, while Celestia (TIA) grows by 7.62%.

- Sonic (S) reaches $0.458 while Avalanche climbs past $19 showing strong market activity.

The market has witnessed price movements in the past 24 hours, with multiple tokens experiencing notable gains. Pepe emerged as the number one performer with a 14.20% rise to reach $0.0007277 and is supported by a $1.07 billion trading volume. Other gainers include Story with a 9.63% increase, Celestia with 7.62%, Sonic with 7.19%, and Avalanche with 7.08%, according to CoinMarketCap data. This upward trend reflects some interesting market interest and a positive attitude when it comes to investor participation across various assets.

Source: CoinMarketCap

Pepe (PEPE) Leads With Over $1 Billion in Trading Volume

Among the leading five tokens, Pepe posted an astonishing 14.20% gain in 24 hours, making it the highest percentage increase. Thanks to a trading volume of $1,073,453,736, the token price rose to $0.0007277, a value associated with increased market demand and PEPE liquidity.

Price and volume spikes suggest steadier confidence among investors in how well the token will perform within the short term. Like other meme coins, it has proved to be highly volatile over time, primarily driven by social media trend observations and speculative trading. However, whether this movement can be sustained ultimately remains uncertain, only because price fluctuations are common in such categories.

Story (IP) and Celestia (TIA) See Strong Gains

Within 24 hours, Story (IP) gained an increase of 9.63%, with a price set at $5.95. The trading volume for the token was $225,524,338, reflecting the common interest of market participants. Also, Celestia (TIA) is showing a 7.62% increase to trade at $3.58, recording a trading volume of $189,033,505. The steady rise of the token is a market signal that modular blockchain solutions have drawn interest from market participants. Further, investors keep a close watch over Celestia as it aids in scaling and enhancing the efficiency of blockchain.

Related: Analyst Observes A Decline In The Creation of Memecoins: The Reason Behind?

Sonic and Avalanche Show Steady Performance

Sonic (S), previously known as Fantom (FTM), increased by 7.19%, reaching $0.458 in 24 hours. The token saw a $135,612,645 trading volume, indicating continued engagement from traders. The recent rebranding and network upgrades may have contributed to the rising demand for S. With a trading volume of $416,107,389, Avalanche climbed 7.08%, reaching a level beyond $19. The token has remained one of the leaders in the blockchain ecosystem, thanks to continuous development and thorough acceptance.

The post PEPE Leads Market Gains With 14.2% Surge Amid Rising Demand appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!