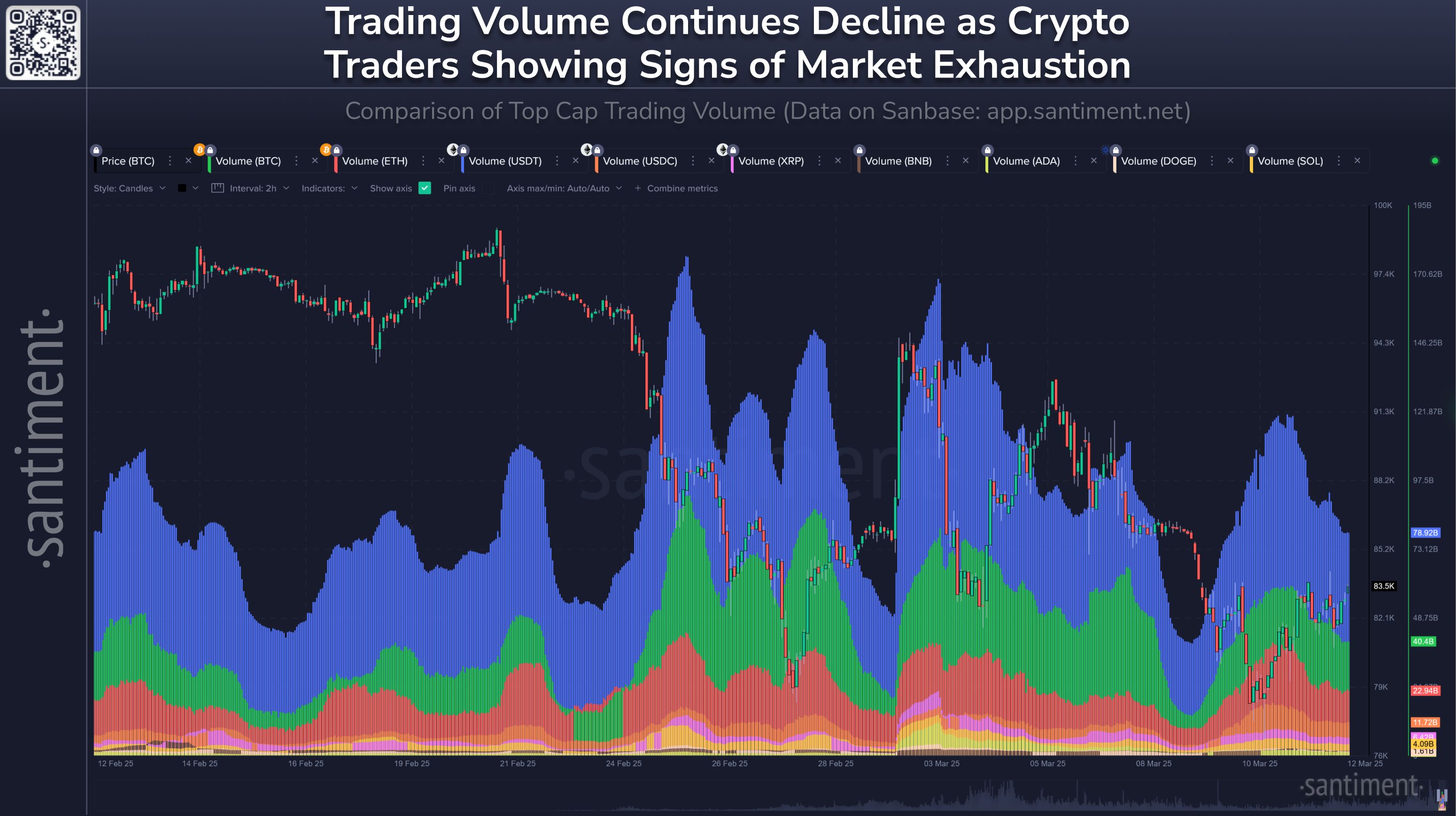

Volume Woes Could Indicate More Lows?

📊 Crypto-wide trading volume has been dropping since its peak back on February 27th (when traders were optimistically buying dipping prices). After further market cap declines these past two weeks, trader behavior indicates a mix of exhaustion, hopelessness, and capitulation.

When trading volume for major cryptocurrencies consistently drops, even during slight price recoveries (like we have seen Wednesday), it typically points toward diminishing trader enthusiasm. In this scenario, traders are becoming cautious, suggesting they might not believe that the current upward price movements will last. Essentially, reduced trading activity reflects uncertainty, as fewer traders are convinced that buying at current levels will yield profitable outcomes.

Moreover, a weakening trading volume amid mild price bounces can serve as an early warning sign of weakening market momentum. Without robust buying participation, price gains can quickly lose steam, as there simply isn’t enough underlying support to sustain the upward trend. This leads to the possibility that any rebound could be temporary, with prices vulnerable to another downturn. Shrinking volume during minor rebounds isn't necessarily a direct bearish signal, but volume is a metric that measures participation from both retail and institutional traders. If both groups are waiting for the other to boost market caps in order to make their next moves, it can lead to price stagnancy with little movement (and a slight tendency to veer toward the downside).

To signal a healthier and more sustainable recovery, bulls generally will want to see both rising prices and rising volumes simultaneously. Until trading activity increases meaningfully, cautious market sentiment is likely to dominate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List Revive (RVV) in the Innovation Zone

New spot margin trading pair — YB/USDT!

Exclusive Mystery Boxes for BGB holders group–Win random token incentives!

YBUSDT now launched for futures trading and trading bots