A recent CNN poll conducted by SSRS revealed that Americans were becoming less optimistic about President Donald Trump’s economic policies.

The poll revealed that 57% of the respondents thought that the economic policies have created an unsteady situation as some decisions have triggered global trade wars. 51% believed that the economy would worsen a year from now, 7 points higher than in January before the president took office. 55% of the poll’s respondents also believed that Trump’s cuts to federal programs would do more economic harm than good.

The respondents also suggested that the president should try to combat the current high consumer prices. A majority of the respondents also worried that the policies would drive prices up instead of bringing them down.

Trump enacted the import tariffs last week, imposing 25% tariffs on Mexican and Canadian imports and a 10% tariff on Chinese imports. Other policies include tax cuts, reductions in government spending, cuts to federal programs, mass layoffs of federal workers, and deregulation.

The president’s policies have sparked uncertainty on Wall Street and in the crypto markets, leading to plunges in stocks and most digital assets. The markets also experienced major sell-offs on Monday amid the increasing fear.

The Dow Jones Industrial Average dropped 2.08% on Monday and is down 1.25% today. The S&P 500 dropped 2.7% on Monday and is down 1.37% today. Bitcoin dropped below $77,000 this week before recovering to above $80,000. The coin is still down over 2% today, trading at $80,280 at the time of writing.

Trump policies raise stagflation and recession fears

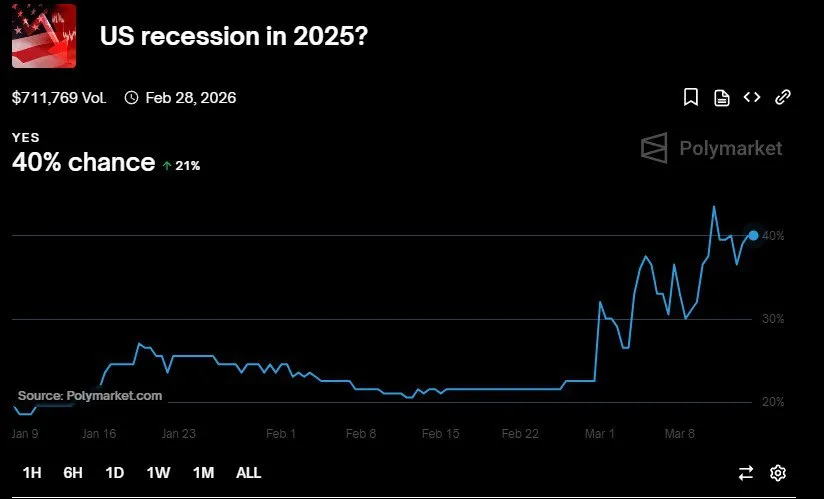

Trump’s policies have raised speculations about the possibility of a recession beginning this year. Several indicators, like the higher unemployment rate in February, show the slowdown in the economy after Trump’s presidency. The February Consumer Price Index (CPI) report also revealed a 2.8% rise in inflation year-on-year. The inflation still cooled down compared to January’s 3.0% rise on an annual basis.

A recession involves a sharp and significant decline in economic activity that lasts more than a few months. Groundwork Collective’s policy and advocacy chief, Alex Jacquez, reportedly mentioned that the economy’s driver depended on businesses investing and hiring and people spending. Jacquez further suggested that spending could be reduced if citizens feared for their jobs or more layoffs in the future.

The CNN poll notably highlighted that respondents were cutting back on part of their spending to sustain their budget. 71% of the respondents changed the kind of groceries they used to buy in order to stay within their budget. To afford necessities, 67% of the respondents had to cut on extra spending like entertainment and extras.

JPMorgan Chase has predicted a 40% chance of recession if Trump continues with his ‘extreme’ economic policies. Goldman Sachs also raised the probability of recession from 15% to 20% due to the slow house market, Trump’s tariffs, and government spending cuts. Economist Justin Wolfers further mentioned that the ‘chaotic’ Trump policies could trigger a recession. The prediction market Polymarket’s poll on ‘U.S. Recession in 2025?’ currently has a 39% vote.

Consumer confidence drops significantly in February

Consumer confidence plunged drastically in February, dropping to the lowest level in three and a half years, dropping from 105.3 in January to 98.3 in February. As Americans indicated anxiety about economic conditions worsening, 12-month inflation worries also rose among consumers.

Consumer Confidence in February Source: Reuters

Consumer Confidence in February Source: Reuters

FWDBONDS chief economist Christopher Rupkey commented on the dropping consumer confidence, mentioning that Americans were being more pessimistic about the future outlook. Rupkey explained that Trump’s administration was the first administration to threaten mass layoffs of federal employees. The economist also mentioned that the policies could cause a halt in the economy as soon as the first quarter of this year.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More