-

TRON’s TRX token faces volatile trading conditions as recent market activity suggests strong accumulation amid selling pressures in derivatives.

-

Despite a month-long downtrend, the network’s revenue is surging, indicating an uptick in transactional activity that could impact pricing.

-

According to a recent analysis by COINOTAG, “the fundamentals behind TRX’s minor price decline suggest a potential for price recovery,” contingent on market dynamics.

This article explores the current state of TRX, analyzing its price challenges and growth potential as trading dynamics shift. Key insights included.

Spot traders drive accumulation, keeping TRX stable

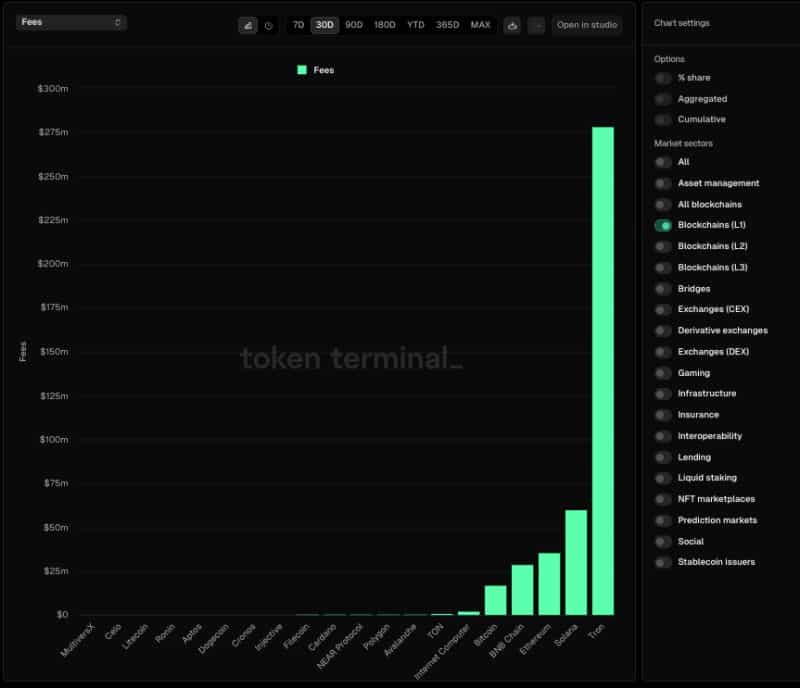

Recent data reveals that the TRON blockchain has achieved a significant revenue milestone, outperforming other major chains such as Ethereum and Bitcoin over the past week. With $12.75 million in revenue recorded and a 2.2% increase in transactions to 60.5 million, TRON’s growth trajectory looks promising.

Source: DeFiLlama

This impressive revenue growth can be attributed to an increase in the stablecoin market, which now stands at $62.27 billion on the TRON network. Moreover, the surge in active addresses, now at an all-time high of 127.5 million, reveals a robust engagement level from users, indicating a strong foundation for future price stability.

Evidence from IntoTheBlock indicates that spot traders are playing a pivotal role in TRX’s stability as they continue to purchase significant amounts. In the past 24 hours, spot traders accumulated 133.43 million TRX, valued at approximately $29 million, reflecting a healthy demand amid market fluctuations.

Source: Token Terminal

Traders sentiment suggests potential for recovery

As the spot trading environment remains active, the sentiment leans toward potential recovery. Analysts predict that if the influx of purchases continues, TRX may soon reverse its recent bearish trend. However, it is essential to note that not all market segments currently share this bullish outlook.

Sellers limit TRX’s upside potential

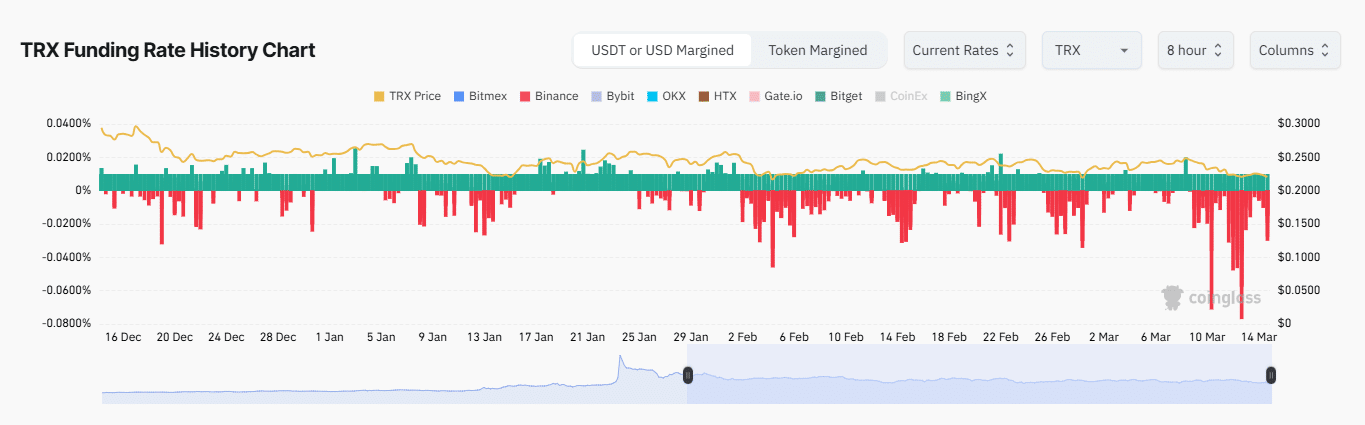

The recent drop in TRX’s price can largely be attributed to bearish activity in the derivatives market. Over the last 24 hours, Open Interest in derivative contracts has declined by 3.38% to $156 million, paired with a decrease in trading volume indicating an excess of selling pressure.

Source: Coinglass

The negative funding rate, currently at -0.0086, suggests that short traders are benefitting, as they are periodically compensated by long traders. Continued selling in the derivatives market may allow spot investors to secure TRX at discounted rates, potentially setting the stage for a future rally.

Conclusion

In summary, TRX’s current price challenges stem from contrasting activities in the spot and derivatives markets. While spot traders are accumulating the asset, the pressure from derivative sellers could dampen bullish prospects. If this accumulation trend holds and sellers continue to dominate futures markets, TRX may find itself in a position for recovery in the near term.