-

Dogecoin (DOGE) has shown signs of renewed strength in its price action, spurred by impressive network activity and positive market momentum.

-

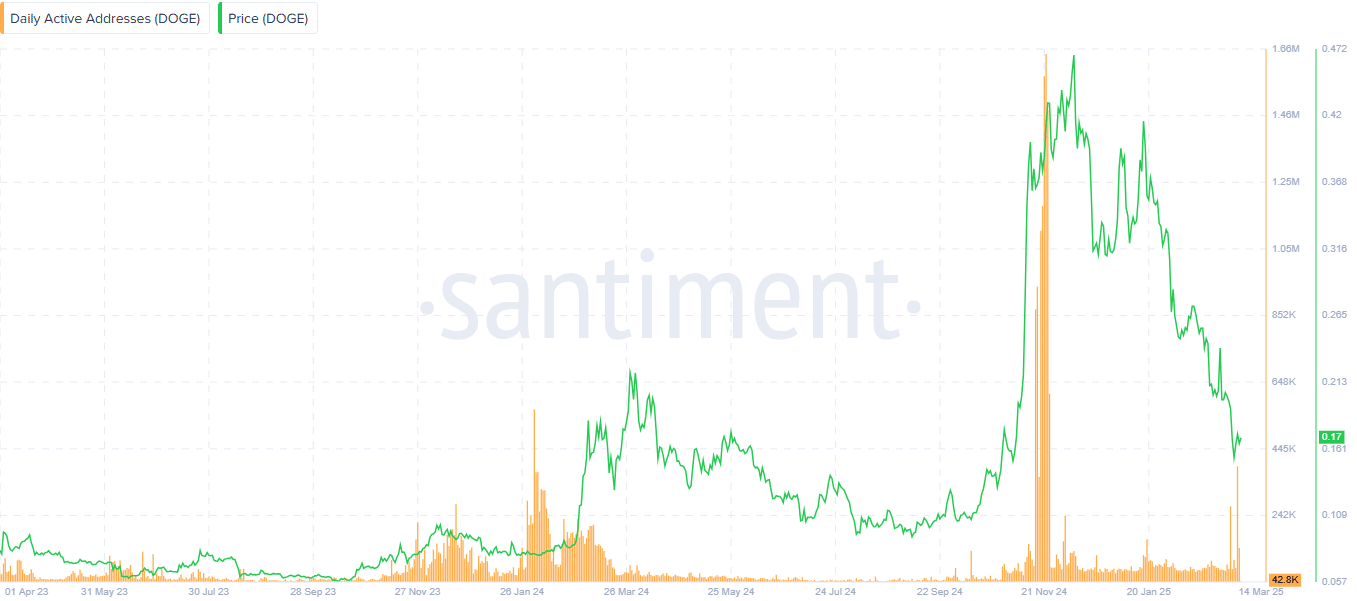

With active addresses surging to nearly 200,000 in a single day, DOGE’s ecosystem demonstrates a compelling increase in user engagement.

-

According to COINOTAG, “The formation of a bullish inverse head-and-shoulders pattern signals a potential breakout for DOGE,” adding to market optimism.

This article examines Dogecoin’s recent price movements, network activity, and trader positioning, highlighting key technical indicators and potential future developments.

Technical Indicators and Short-term Price Action for Dogecoin

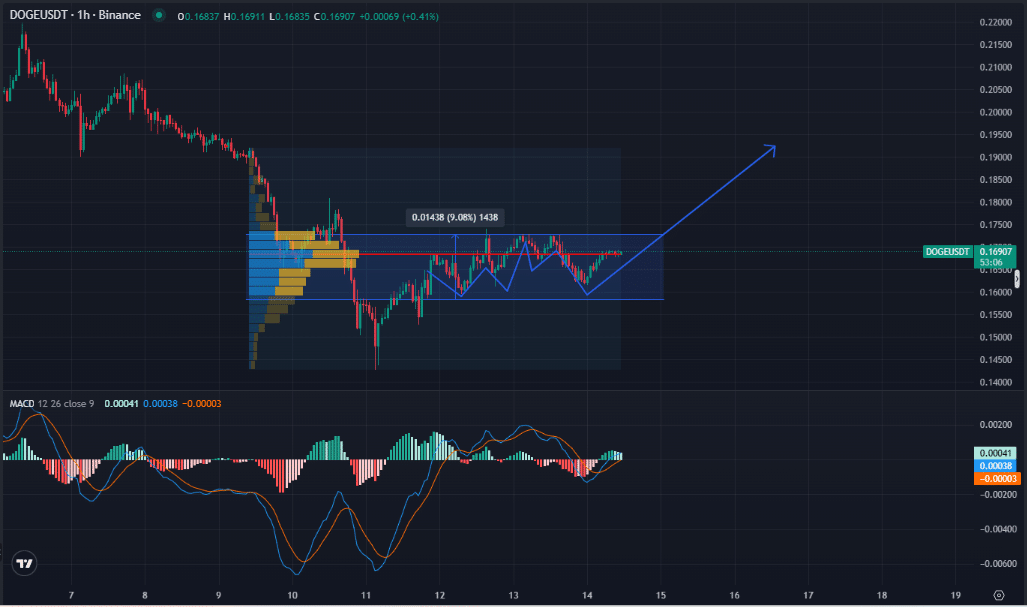

Recent analysis of Dogecoin’s price chart reveals several critical indicators that could shape its immediate trajectory. The formation of an inverse head-and-shoulders pattern is particularly notable, suggesting a bullish reversal. In this pattern, the left shoulder was established at $0.150, the head dipped to $0.1438, and the right shoulder is stabilizing near $0.160. This configuration signals a potential breakout point at the neckline resistance of $0.169.

Network Activity: A Booster for Price Momentum

The surge in DOGE’s network activity cannot be ignored. Active addresses reaching approximately 200,000 in a day reflects heightened interest and engagement among investors. Historically, such spikes in network utilization have often preceded significant price movements. For example, the total active addresses climbed from 42,000 to 1.48 million during past price rallies that saw jumps from $0.057 to $0.368, suggesting a direct correlation between adoption and price increase.

Source: Coinglass

Traders’ Strategies and Market Sentiment

Analyzing the DOGE/USDT trading pair, traders appear to be positioning themselves strategically in reaction to key price levels. The blogosphere has identified a liquidity zone between $0.165 and $0.167, where significant trading activity has been observed. Following the recent price decline from $0.200, this zone serves as a critical support level. The MACD readings further bolster this analysis, indicating bullish momentum with a recent crossover at 0.00041.

Source: Santiment

Future Projections and Potential Outcomes

The future projected developments for Dogecoin will largely depend on its ability to break above the $0.169 resistance. Such a move could catalyze price targets of $0.185 to $0.190, which might represent a 9% upside. If DOGE fails to clear this critical level, a retracement downward towards $0.150 is likely. Traders are cautious, and any significant movement below $0.165 may prompt stop-loss orders at $0.1438, highlighting the vigilance required in this volatile market.

Conclusion

In summary, Dogecoin’s current technical indicators, along with its rising network activity, present a scenario ripe for potential upward movement. The inverse head-and-shoulders formation suggests bullish sentiment among traders. However, failure to breach the $0.169 level could lead to a downturn, emphasizing the importance of monitoring market conditions closely. Strong network growth and price momentum will be key to sustaining bullish activity in the coming weeks.