-

Cardano’s latest price movements indicate a decisive moment for whales as they aggressively accumulate ADA, signaling potential volatility ahead.

-

Whale activity surged with total purchases reaching 190 million ADA in just one day, reflecting heightened interest amid a ten-day price range consolidation.

-

“The synchronized whale buying activity depicted deep whale confidence, which powered ADA’s price rise,” noted analysts from COINOTAG.

This article explores recent whale activity in Cardano (ADA) and its impact on price movements, highlighting crucial market trends and sentiments.

Recent Whale Accumulation and Its Impact on Cardano

The recent surge in Cardano (ADA) accumulation by whales comes as the crypto market witnesses slight price fluctuations, primarily contained between $0.65 and $0.75 over the last ten days. This accumulation by substantial investors signifies a potential shift, drawing attention to Cardano’s market dynamics.

During the period from March 16th to 19th, substantial purchases were recorded, totaling 50 million ADA within just two days. This aggressive buying spree pushed the price of ADA higher, illustrating a strong belief in Cardano’s future value.

Analyzing the Price Factors Behind Cardano’s Stable Range

Despite whale buying, ADA struggled to break free from its tight price range. The cryptocurrency faced significant resistance at approximately $0.75, which was further compounded by an earlier false breakout that led to a steep downtrend. Understanding the prevailing market signals is crucial as they could dictate ADA’s near-future performance.

For ADA to maintain upward momentum and surpass its current resistance, it needs to clear the $0.75 threshold decisively. Such a move could pave the way to target higher zones valued between $0.90 and $1.00. Conversely, slipping below the $0.65 level could exacerbate bearish sentiments, potentially driving prices to retest lower support levels.

Source: TradingView

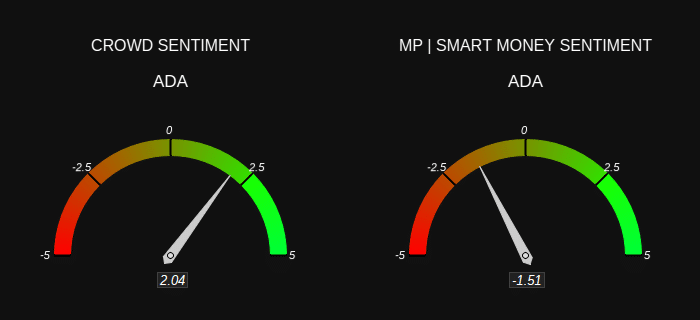

Market Sentiment: The Divergence Between Retail and Institutional Investors

The current market sentiment presents a divergence between different classes of investors. Retail sentiment currently sits at 2.04, reflecting an optimistic outlook towards ADA’s potential for growth. In contrast, institutional sentiment is negative, highlighted by a -1.51 score from Smart Money perspectives.

This disparity indicates that while retail investors are buoyed by recent price movements and whale activity, institutional investors remain cautious, fearing unsustainable growth. Such conflicting views could reshape the market landscape, especially if these sentiments do not realign in the near future.

Source: Market Prophit/X

Conclusion

In summary, Cardano’s current phase is marked by significant whale accumulation amid a consolidation pattern. The response of ADA prices to these dynamics will be crucial in determining the short-to-medium-term trajectory of the asset. Should the bulls secure a breakout above $0.75, the outlook may shift positively; however, the negative institutional sentiment serves as a cautionary indicator that could influence future market activities.