Cardano (ADA) Trading Volume Surges To $1 Billion In 24 Hours

Cardano (ADA) remains range-bound despite a surge in trading volume and a drop in whale activity. With weak trend signals, traders await a breakout.

Cardano (ADA) has remained relatively stagnant, with its price barely moving from the levels seen seven days ago. Despite this lack of price action, trading volume has surged nearly 28% in the last 24 hours, climbing to $1 billion.

This increase in activity comes while ADA continues to consolidate, with technical indicators signaling indecision in the market. As momentum builds, traders are watching closely for signs of a breakout from this tight range.

Cardano ADX Shows The Lack Of A Clear Direction

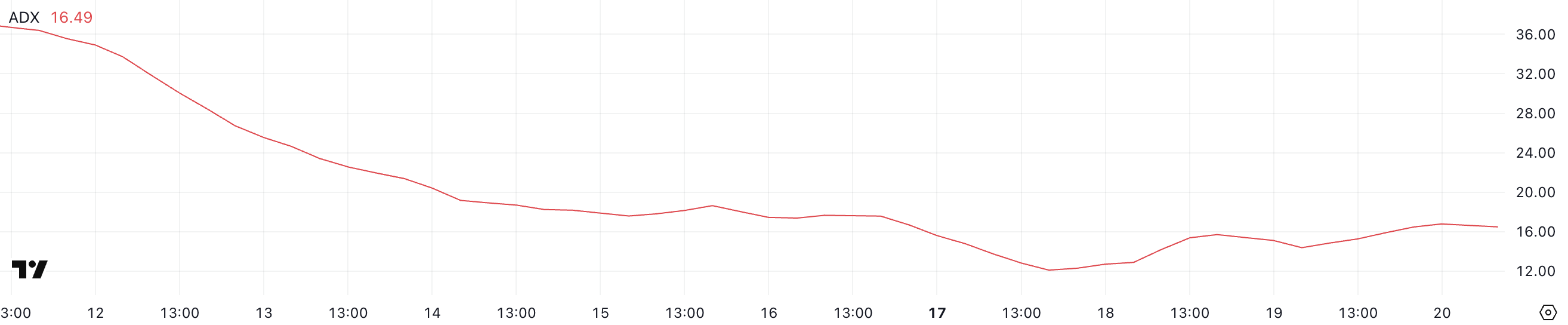

Cardano’s trend strength has remained relatively unchanged, with its ADX currently at 16.49 – roughly the same level it has maintained since yesterday.

This flat movement in the ADX suggests that there hasn’t been a significant shift in momentum, and the market lacks a clear directional trend.

ADA’s price is currently caught in a consolidation phase, with neither buyers nor sellers able to establish dominance, which is reflected in the stagnant ADX reading.

ADA ADX. Source:

TradingView.

ADA ADX. Source:

TradingView.

The ADX (Average Directional Index) is a technical indicator used to measure the strength of a trend without indicating its direction.

An ADX below 20 typically signals a weak or non-existent trend, while readings between 20 and 40 point to a developing or moderate trend, and values above 40 indicate a strong trend.

With ADA’s ADX holding below the 20 mark, it suggests that the current market environment remains indecisive, likely leading to continued sideways movement.

For now, this consolidation phase could persist until a stronger directional move emerges, either through renewed buying momentum or an increase in selling pressure.

Cardano Whales Dip to July 2024 Lows

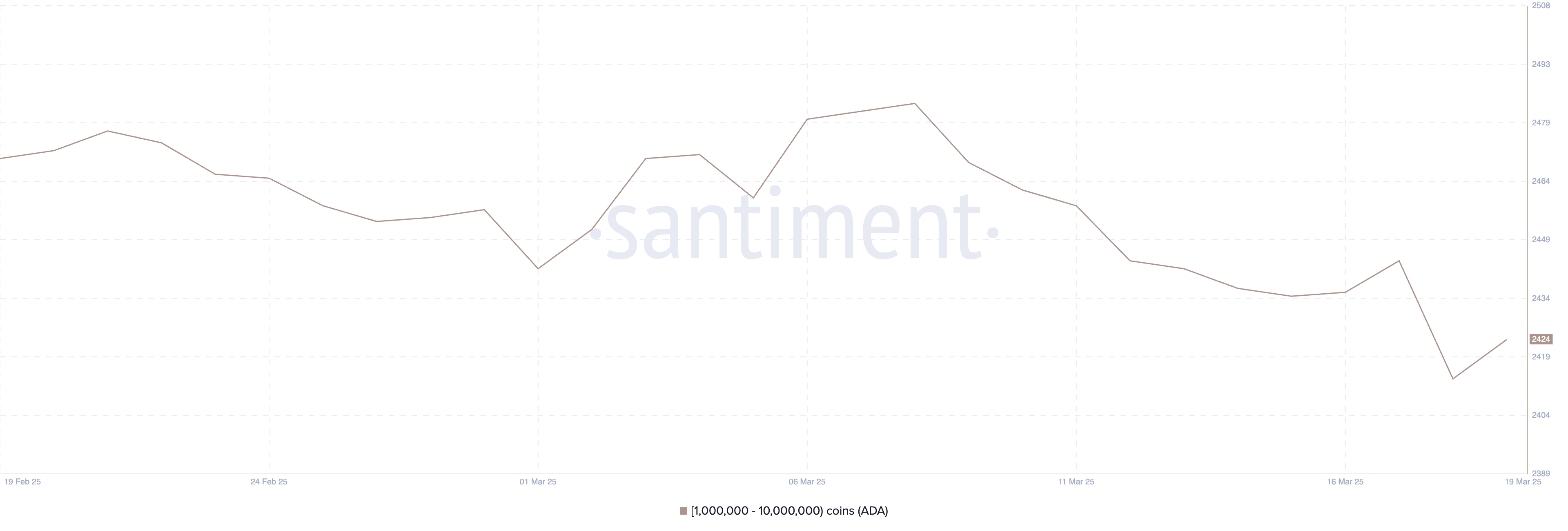

The number of Cardano whales experienced a sharp decline between March 8 and March 18. These are wallets holding between 1 million and 10 million ADA.

According to Santiment data, the number of ADA whales fell from 2,484 to just 2,414, marking the lowest level since July 2024.

On March 19, there was a slight recovery, with the number of whales rising to 2,424.

While this minor rebound shows some renewed accumulation, the overall count remains well below the levels seen in previous weeks, highlighting reduced participation from larger holders during this period.

Addresses Holding Between 1 Million and 10 Million ADA. Source:

Santiment.

Addresses Holding Between 1 Million and 10 Million ADA. Source:

Santiment.

Tracking ADA whales is crucial because these large addresses often play a significant role in influencing price action. Whales can create liquidity shifts and often act as a signal for institutional or high-net-worth investor sentiment.

The current lower whale count suggests that confidence among these key players might still be cautious.

Even with the recent uptick, whale numbers remaining below their earlier highs could point to subdued buying pressure, potentially limiting ADA’s ability to break out of its current consolidation phase in the near term.

Cardano Is Trading Between a Critical Range

Cardano EMA lines signal a consolidation phase. The short-term moving averages remain below the long-term ones but are currently very close together, indicating a lack of strong momentum in either direction.

This setup suggests indecision in the market, but it also leaves room for a potential breakout. If Cardano price manages to build bullish momentum and establish an uptrend, it could first target the $0.77 resistance.

A successful breakout above this level could pave the way for a rally toward $1.02, and if buying pressure continues, ADA might even push as high as $1.17.

ADA Price Analysis. Source:

TradingView.

ADA Price Analysis. Source:

TradingView.

On the flip side, if a downtrend develops, ADA could fall back to test the key support level at $0.64.

Losing this support would be a bearish signal and could trigger a deeper decline toward $0.58.

The current positioning of the EMA lines shows that while there’s no clear trend dominance, both bullish and bearish scenarios remain possible depending on how the price reacts to these critical levels.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x 2Z: Trade to share 5,175,000 2Z!

[Initial Listing] Bitget Will List DoubleZero (2Z) in the Innovation and Public Chain Zone

Bitget announcement on the removal of 1 trading pairs under spot bot trading on October 2, 2025

Onchain Challenge (Phase 21) — Trade and share 120,000 BGB in airdrops