Bad news Bitcoin bulls, the long-hoped-for retail is already here: CryptoQuant

Bitcoin bulls who still think the cycle peak has yet to come as retail investors haven’t piled in yet might be using an outdated playbook, according to a crypto executive.

“The idea that the cycle isn’t over just because onchain retail activity is absent needs reconsideration,” CryptoQuant founder and CEO Ki Young Ju said in a March 19 X post.

Ju said that those tracking retail movements using only onchain metrics will not have seen the full picture.

“Retail is likely entering through ETFs — the paper Bitcoin layer — which doesn’t show up onchain,” Ju said.

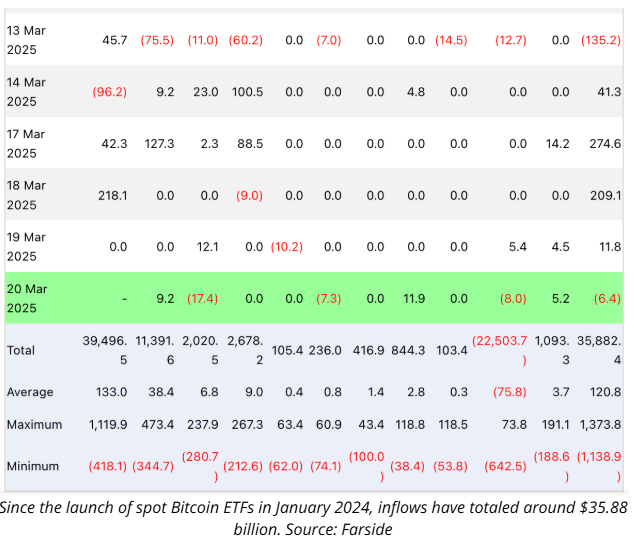

“This keeps the realized cap lower than if the funds were flowing directly to exchange deposit wallets,” he added, noting that 80% of spot Bitcoin

BTC$84,637exchange-traded fund (ETF) flows come from retail investors — a trend that Binance analysts already once observed in October last year.

At the time, the analysts said most of the ETF buying likely came from retail investors moving their holdings from wallets and exchanges into funds with more regulatory protection.

Ju was responding to counter-arguments over his earlier prediction on X that the “Bitcoin bull cycle is over” on March 17.

“I’ve been calling for a bull market over the past two years, even when indicators were borderline. Sorry to change my view, but it now looks pretty clear that we’re entering a bear market,” he said.

Ju explained that certain indicators are showing a lack of new liquidity, which is likely being driven by macro factors.

He also clarified when he said the bull cycle was over, he meant Bitcoin could take “6-12 months” to break its all-time high, not that it’s about to crash.

Traders often look at retail investor activity to spot signs of exhaustion or as a signal to start selling when the market appears overheated.

There are several sentiment indicators which help market participants understand the level of retail interest in the market. One of these is the Crypto Fear & Greed Index, which measures overall crypto market sentiment, reading a “Fear” score of 31, down 18 points from its “Neutral” score of 49 yesterday.

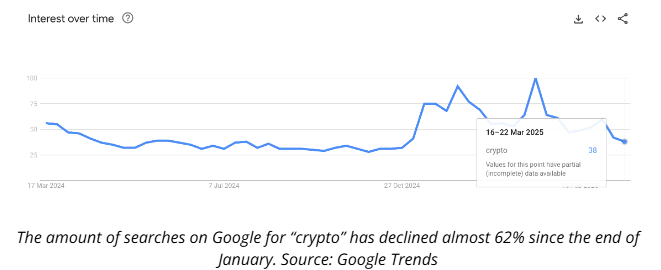

Other common signals used to track the level of retail interest in the crypto market include Google search trends for “crypto” and related keywords and the popularity of crypto applications in major app stores worldwide.

While the Google search score for “crypto” worldwide was at a score of 100 during the week of Jan. 19 - 25, when Bitcoin reached its all-time high of $109,000 and US President Donald Trump’s inauguration, it has since declined by almost 62%.

At the time of publication, the Google search score for “crypto” stands at 38, with Bitcoin trading 22% below its January all-time high.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x 2Z: Trade to share 5,175,000 2Z!

[Initial Listing] Bitget Will List DoubleZero (2Z) in the Innovation and Public Chain Zone

Bitget announcement on the removal of 1 trading pairs under spot bot trading on October 2, 2025

Onchain Challenge (Phase 21) — Trade and share 120,000 BGB in airdrops