Date: Fri, March 21, 2025 | 12:39 PM GMT

In the crypto market, the massive decline that has been active since late 2024 has brought major altcoins to make-or-break levels. However, Ethereum (ETH) managed to post 3% weekly gains, offering a slight relief to the market. Yet, the bearish clouds haven’t faded, and altcoins like Aptos (APT) and Filecoin (FIL) haven’t been spared at all.

Both tokens have taken a heavy hit over the past few months, but noticeable weekly gains and ongoing price action suggest that a potential recovery may be underway.

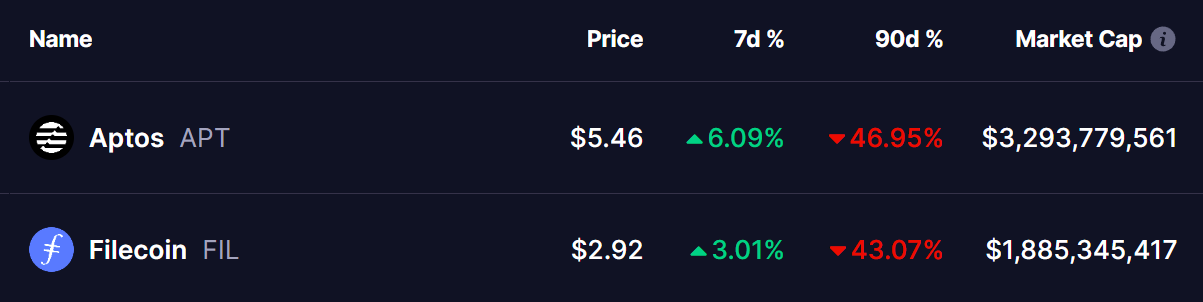

Source: Coinmarketcap

Source: Coinmarketcap

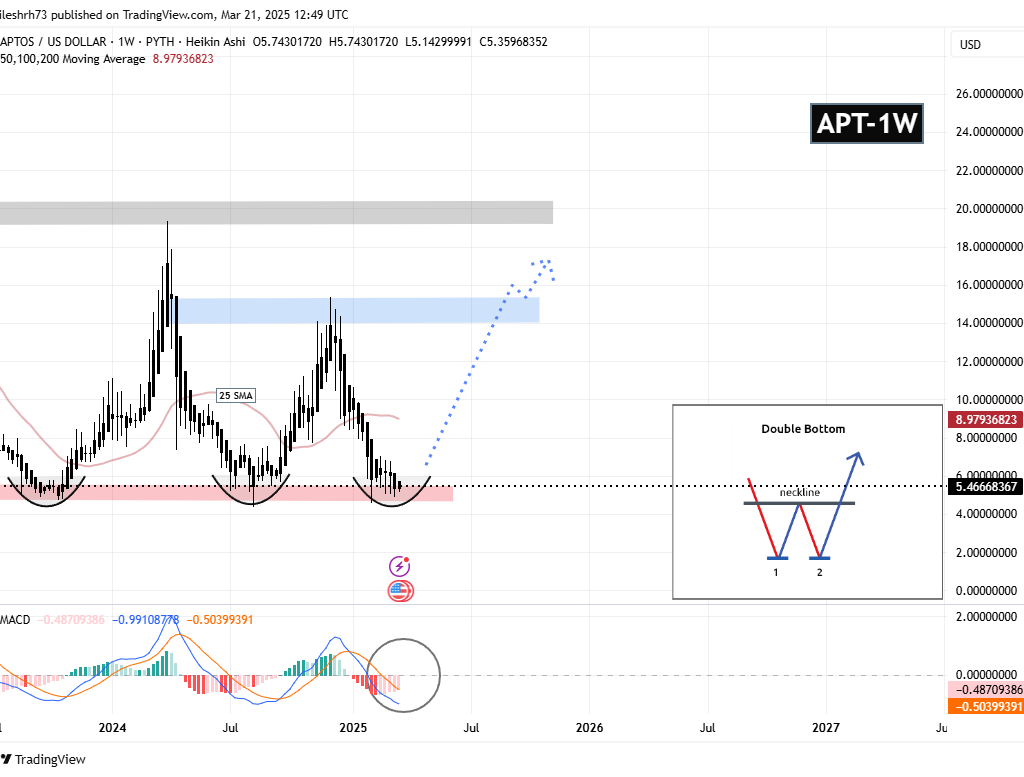

Aptos (APT) Analysis

APT’s weekly chart suggests the formation of a double bottom pattern, which began after the price failed to break the $12.06 resistance in early December 2024. This rejection led to a significant downturn, pushing APT back to its critical $5.00 support zone—a level where buyers have previously stepped in to drive prices higher.

Aptos (APT) Weekly Chart/Coinsprobe (Source: Tradingview)

Aptos (APT) Weekly Chart/Coinsprobe (Source: Tradingview)

At the time of writing, APT is trading at $5.46, showing signs of stabilization at this key level. The MACD indicator is beginning to hint at a shift in momentum, as selling pressure appears to be weakening.

If APT successfully holds support and buyers step in, the next logical target would be a move toward the 25-day moving average (MA) resistance, with a potential rally toward the $12.06 neckline. A breakout above this level could confirm a full reversal, opening the doors for a potential return to the $20+ range in the coming months.

Filecoin (FIL) Analysis

Similar to APT, FIL has also formed a classic double-bottom pattern after experiencing a sharp downtrend that started when it failed to break the $8.38 neckline resistance in early December 2024. Since then, FIL has seen a major correction, plunging 71% from its highs and revisiting the $2.46 support level, marking the second bottom of the pattern.

Filecoin (FIL) Weekly Chart/Coinsprobe (Source: Tradingview)

Filecoin (FIL) Weekly Chart/Coinsprobe (Source: Tradingview)

With this pattern forming, FIL has held this support and is now trading at $2.93, indicating a potential shift in trend. The MACD (Moving Average Convergence Divergence) indicator is also hinting at a possible bullish crossover, suggesting that momentum could be shifting in favor of the bulls.

If FIL successfully maintains support and buyers step in, the next logical target would be a move toward the 25-day MA, which will confirm a recovery. A break above the $8.38 neckline would solidify the reversal, setting the stage for a potential rally towards the $11.80+ range in the coming months.

Will This Pattern Spark a Reversal?

Both APT and FIL are at a make-or-break level, with their double-bottom formations suggest that as long as they hold their key support levels, there is a strong chance for a bounce. However, bullish confirmation will only come if these tokens break above their key moving averages (MAs)—signaling a clear shift in market sentiment.

Another major factor influencing their recovery will be Ethereum’s price action. If ETH starts a strong uptrend, it could trigger a broader altcoin rally, reinforcing bullish momentum in APT and FIL.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrencies.