One of the leading crypto exchange, Coinbase is in plan to acquire the popular crypto derivative trading platform Deribit and their talk has reached an advanced stage, says Bloomberg.

Coinbase, the U.S. based crypto giant, is already listed on Nasdaq and it is plans to expand further with the acquisition of the largest crypto options trading platform. The move aligns with Coinbase’s broader strategy to strengthen its offerings and compete with platforms like Binance and OKX in the crypto derivatives space.

“The companies have notified regulators in Dubai about the discussions as Deribit holds a license there, which would be taken over by any acquirer,” Bloomberg report notes citing an anonymous source.

Deribit, based in Panama, is known for its dominance in Bitcoin and Ethereum options trading, making it a key player in the crypto derivatives market. The acquisition, if finalized, would mark a significant milestone for Coinbase with it allowing the exchange to tap into Deribit’s already established user base and expertise in crypto options trading.

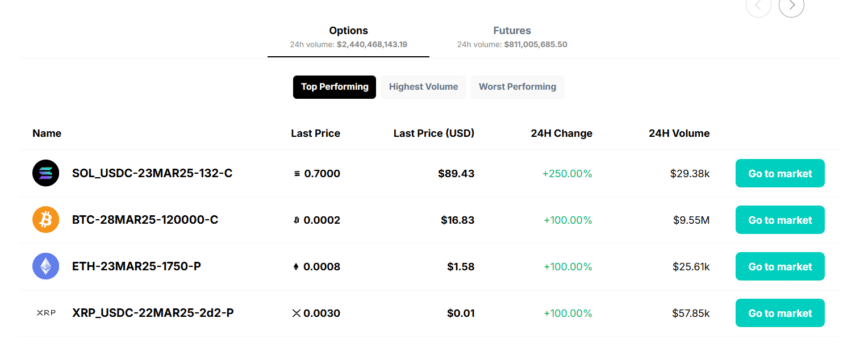

As of latest data, Deribit has a total options trading volume of $2.44 billion while futures trading volume amounting to $811 million in the past 24 hours.

Deribit Trading Volumes – Source: Deribit

Deribit Trading Volumes – Source: Deribit

“A deal for Deribit would mark one of the most significant acquisitions in the industry’s history, and the talks come as Donald Trump’s return to the White House has sparked an initial wave of deal-making,” Bloomberg report says, “Trump has appointed crypto advocates to key government positions and enacted policies benefiting the industry, such as the creation of a Bitcoin reserve.”

While the exact financial terms of the deal remain undisclosed, the potential acquisition could enhance Coinbase’s market position as regulatory scrutiny in the U.S. pushes exchanges to seek global expansion opportunities. Both Coinbase and Deribit have yet to release official statements on the matter.