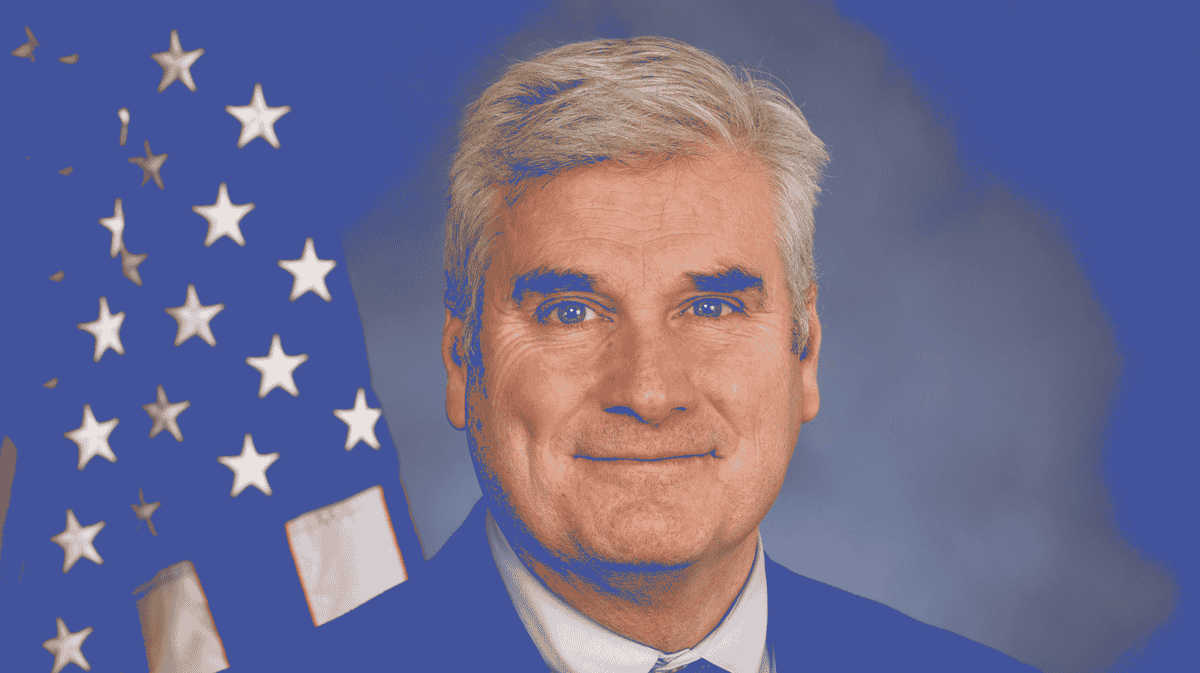

Reps. Emmer, Soto reintroduce Securities Clarity Act as Congress eyes crypto legislation

Quick Take Rep. Tom Emmer’s bill could be a “precursor” for market structure legislation that lawmakers are hoping to get passed into law. The bill, called the Securities Clarity Act, looks to differentiate between an asset and a securities contract.

House Majority Whip Tom Emmer has reintroduced a bill that could be a "precursor" to market structure legislation that lawmakers hope to pass into law.

Reps. Emmer, R-Minn., and Darren Soto, D-Fla., reintroduced the Securities Clarity Act on Wednesday. The act aims to provide clear standards for the digital asset industry.

"Entrepreneurs need clarity to calculate risk accurately, create new investment opportunities and grow our economy," Emmer said in a statement . "Our legislation will help provide these answers and allow American investors to fully participate in digital asset technology without sacrificing consumer protections.”

"Specifically, the Securities Clarity Act specifies that any asset sold as the object of an investment contract, now defined as an 'investment contract asset' is distinct from the securities offering it was originally a part of," lawmakers said.

The bill was included in the text of a large market structure bill called the Financial Innovation and Technology for the 21st Century Act, or FIT21, according to the statement. That bill passed out of the House last year with 71 Democrats voting in support of the bill, including former Speaker of the House Rep. Nancy Pelosi of California.

House Financial Services Committee Chair French Hill, R-Ark., said on Wednesday at The Digital Chamber DC Summit that a revised draft of FIT21 could be coming "in the next few weeks."

The bigger picture

Ron Hammond, senior director of government relations at the Blockchain Association, told The Block that the bill's reintroduction could serve as a "bipartisan precursor" to broader legislation. He called the Securities Clarity Act a key step toward the eventual market structure bill that Congress is expected to unveil in the coming weeks.

Hammond also noted bipartisan support in Washington following votes to repeal a controversial tax rule that garnered some Democratic support, including from Senate Minority Leader Chuck Schumer.

"Fair to say this continued momentum will be evident in the eventual crypto votes in Congress,” Hammond said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Validator's Pendle" Pye raises $5 million, enabling SOL staking yields to be tokenized

There are truly no creative bottlenecks in the financialization of Web3.

DiDi has become a digital banking giant in Latin America

DiDi has successfully transformed into a digital banking giant in Latin America by addressing the lack of local financial infrastructure, building an independent payment and credit system, and achieving a leap from a ride-hailing platform to a financial powerhouse. Summary generated by Mars AI. This summary was produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Fed rate cuts in conflict, but Bitcoin's "fragile zone" keeps BTC below $100,000

The Federal Reserve cut interest rates by 25 basis points, but the market interpreted the move as hawkish. Bitcoin is constrained by a structurally fragile range, making it difficult for the price to break through $100,000. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

The Federal Reserve cut interest rates by 25 basis points with a 9-3 vote. Two members supported keeping rates unchanged, while one supported a 50 basis point cut. In addition, the Federal Reserve has restarted bond purchases and will buy $40 billion in Treasury bills within 30 days to maintain adequate reserve supply.