Is Shiba Inu (SHIB) Headed for Another April Crash?

Almost every year, April sneaks up on Shiba Inu (SHIB) with the same predictable twist. March ends with optimism, gains and a sense of forward momentum. SHIB enthusiasts start talking about the good vibes of Q1, but then - bam - April arrives, and it is as if the coin’s entire attitude shifts.

All the good feelings from March suddenly feel like a distant memory, replaced by the usual slump that traders have come to dread.

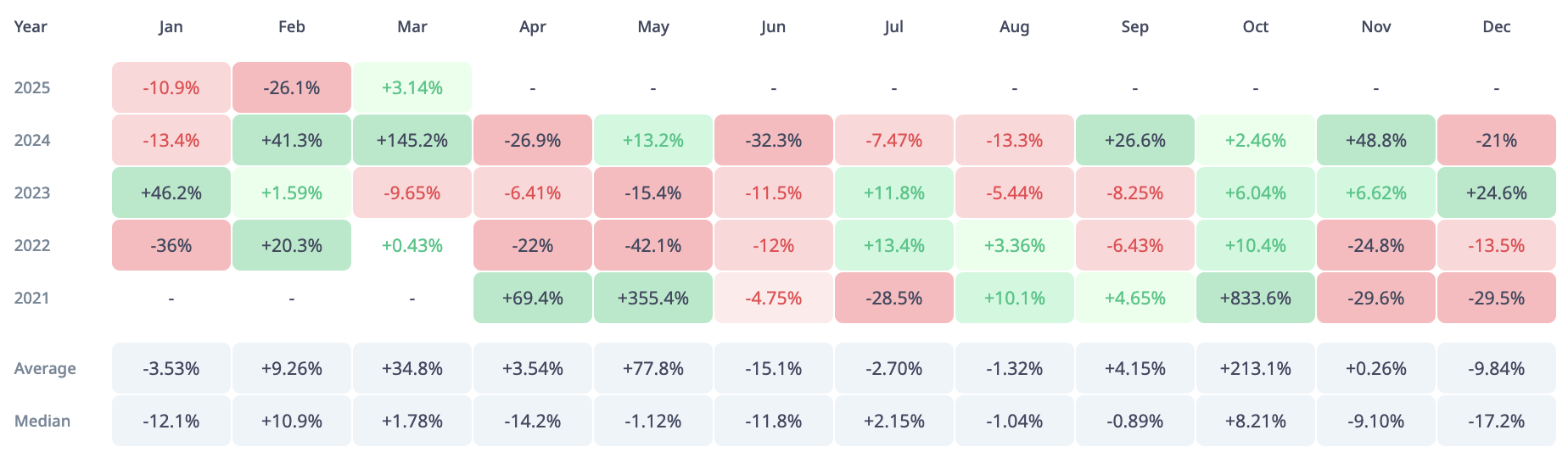

Sure, April has a long-term average return of 3.54% as presented by CryptoRank. On paper, that is not too bad. But dig deeper, and you will find something else - a median return of -14.2%. For the past three years, SHIB has suffered some serious losses each time April rolls around, with even the best April landing a 6.41% drop.

Thus, while the long-term averages might tell one story, more recent data tells another - and it is one that cannot be ignored.

It is strange how little anyone seems to be talking about this consistent slump. Instead, we keep hearing the same old optimistic stories and seeing the same historical patterns, as if what happened with SHIB in April was not so obvious.

It is almost as if we are all quietly assuming that this time will be different. But what if it is not?

Maybe it is just the natural rhythm of the market, with institutional money exiting post-Q1, or maybe it is just the nature of crypto cycles. Whatever the reason, the pattern is undeniable. Three years' bounce in April is more than a coincidence.

However, it is always possible for Shiba Inu to surprise us. April has not been a total disaster for the coin in the past. But after the last three years, can anyone really expect things to turn around this time?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The $150,000 Collective Illusion: Why Did All Mainstream Institutions Misjudge Bitcoin in 2025?

There is a significant discrepancy between the expected and actual performance of the bitcoin market in 2025. Institutional forecasts have collectively missed the mark, mainly due to incorrect assessments of ETF inflows, the halving cycle effect, and the impact of Federal Reserve policies. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

JPMorgan Chase: Oracle's aggressive AI investment sparks concerns in the bond market.

Aster launches Shield Mode: a high-performance trading protection mode designed for on-chain traders

This trading feature, as an innovative protection mode, is dedicated to integrating the full 1001x leveraged trading experience into a faster, safer, and more flexible on-chain trading environment.

Crypto industry leaders gather in Abu Dhabi, calling the UAE the "new Wall Street of crypto"

Banding together during the bear market to embrace major investors!