Bitcoin Primed for a Massive Rally to a Six-Figure Price, According to Crypto Analyst – But There’s a Catch

A widely followed crypto analyst says that Bitcoin ( BTC ) appears primed to skyrocket to a six-figure price tag but warns investors that it may go through a correction first.

In a new thread, pseudonymous crypto trader Inmoral tells his 230,800 followers on the social media platform X that the crypto king will make a pit stop around the $85,000 level before shooting up to $100,000.

“$90,000 > $85,000 > $100,000.”

Source: Inmortal/X

Source: Inmortal/X

The trader’s chart indicates that the top crypto asset by market cap will once again cross into six-figure territory sometime in May.

According to Inmortal, the $90,000 level is where the flagship digital asset will be tested . However, before it can cross that barrier, its monthly open – or the price it opened up the month with – needs to be retested.

BTC is trading for $87,015 at time of writing, a fractional increase during the last 24 hours. On March 1st, BTC opened up with a price of $84,373.

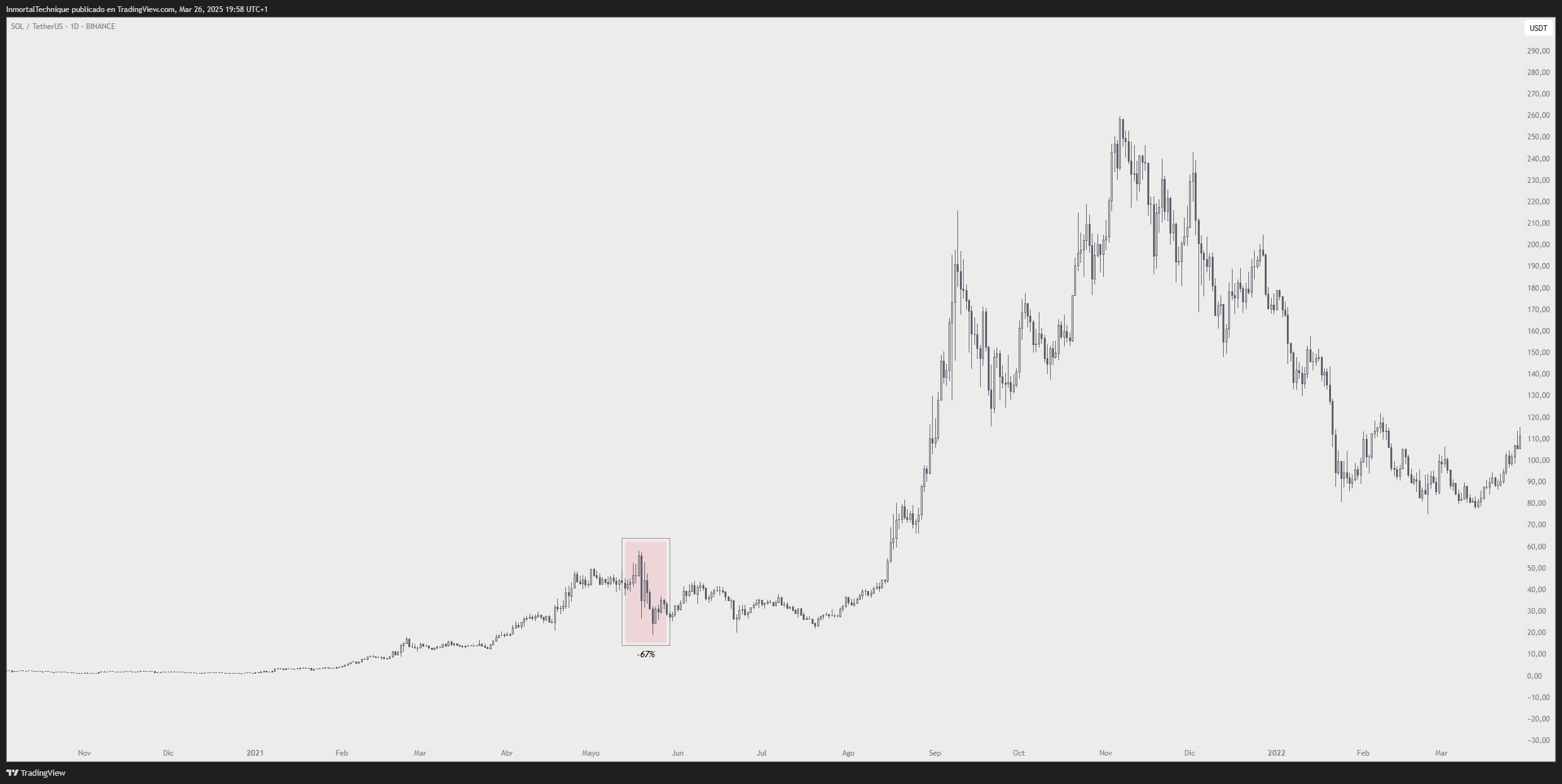

Moving on to the smart contract platform Solana ( SOL ), Inmortal says the Ethereum ( ETH ) rival is primed to bounce back from its recent dip of over 60%, as it did in 2021 before it sparked a massive rally.

“In 2021, SOL did a -67% right before a +1200% Just a reminder, the current -61% dip is not a game over.”

Source: Inmortal/X

Source: Inmortal/X

Solana is trading for $134.60 at time of writing, a 1.2% decrease during the last day.

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!