EU Regulatory Authority: Hopes that insurance companies' cryptocurrency holdings achieve 100% capital coverage

The European Insurance and Occupational Pensions Authority (EIOPA) proposed in a technical advice report submitted to the European Commission on March 27 that insurance companies should maintain funds equivalent to the value of their cryptocurrency holdings as a measure to reduce policyholder risk. The standard of this proposal is much stricter than other asset classes such as stocks and real estate, where the capital requirements do not even need to reach half. In a separate statement, EIOPA said: "Given the inherent risks and high volatility of these assets, it is prudent and appropriate for cryptocurrencies to be depreciated by 100% in the standard formula." Furthermore, EIOPA pointed out that this measure will fill regulatory gaps between Capital Requirements Regulation and Markets in Crypto-assets Regulation (MiCA), because current EU insurance company regulatory framework lacks specific provisions about crypto-assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South African fast food chain WIMPY now supports Bitcoin payments at 450 locations

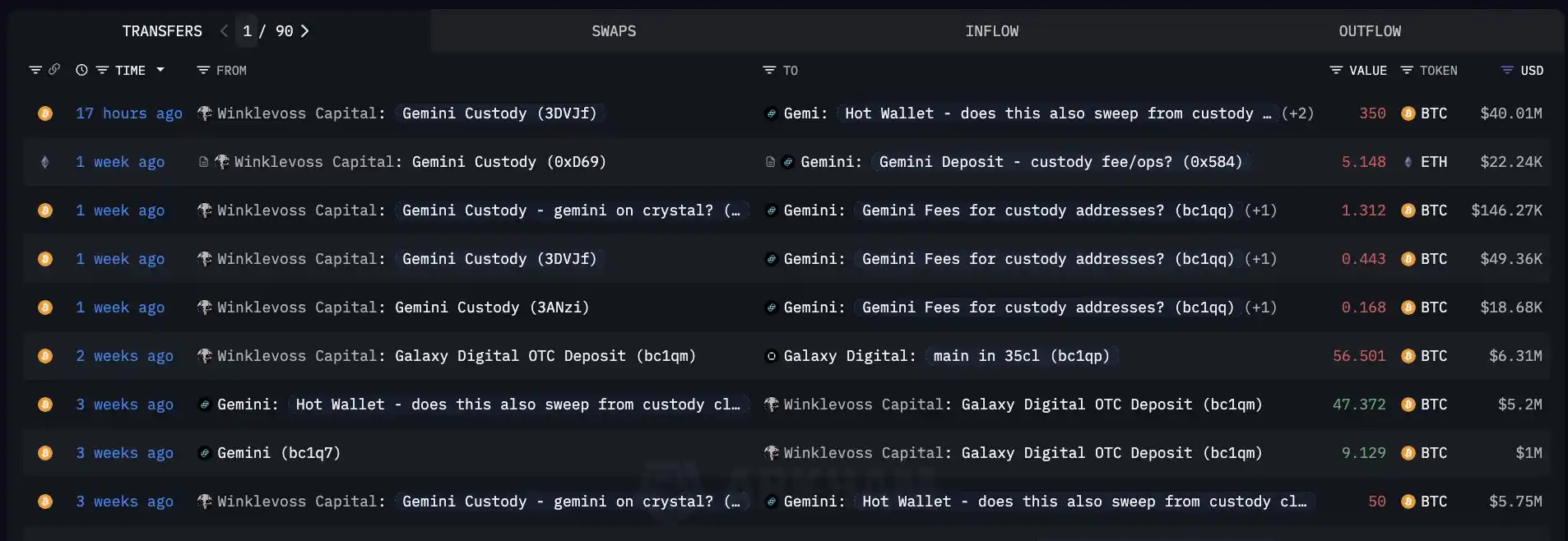

Before the exchange's listing, Winklevoss Capital transferred 350 BTC from the exchange's Custody address.

Bitcoin Core releases v30.0rc1 version, now open for testing

MoonPay launches MoonTags feature, allowing users to send and receive cryptocurrencies via personalized identifiers.