Research Report | In-depth Analysis of the Walrus Project & WAL Token Valuation

I. Project Overview

II. Project Highlights

-

Massive Cost Advantage By leveraging erasure coding and reducing the replication factor to 4–5x, Walrus cuts storage costs by approximately 80% compared to Filecoin and up to 99% compared to Arweave—approaching the cost-efficiency of centralized cloud storage.

-

Programmable Storage Protocol Storage objects can be created directly on Sui as on-chain assets, operable via smart contracts. This enables composable, transferable, and callable data—supporting diverse use cases such as NFTs, gaming, and AI.

-

Strong Backing and Ecosystem Synergy Developed by Mysten Labs, the core team behind Sui, Walrus inherits robust technical capabilities and ecosystem resources. With backing from top-tier investors like a16z and Electric Capital, the project has strong long-term development potential.

-

Fueling SUI Deflation and On-chain Growth Each data upload consumes SUI tokens. As Walrus scales, it is projected to burn up to 240 million SUI annually, becoming a key driver of Sui network growth and deflationary expectations.

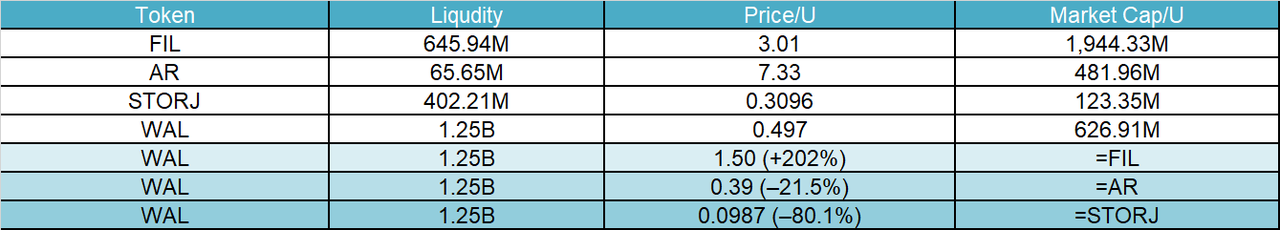

III. Market Valuation Outlook

IV. Tokenomics

-

Total Supply: 5,000,000,000 WAL

-

Initial Circulating Supply: 1,250,000,000 WAL (25%)

-

User Airdrop (10%): Rewards for early users of the Walrus testnet and mainnet, distributed in two phases—4% before launch and 6% after.

-

Community Reserve (43%): Managed by the Walrus Foundation to support ecosystem growth, including community incentives, hackathons, developer grants, and partnerships.

-

Investors (7%): Allocated to participating investment institutions, with linear vesting starting 12 months after mainnet launch.

-

Core Contributors (30%): Rewards for the core development team and early protocol contributors.

V. Team & Funding

VI. Potential Risks

-

High Migration Costs vs. Low User Stickiness Storage protocols often face the paradox of high data migration costs and low user retention. While Walrus targets large-file storage for AI datasets and media content, the willingness of DApps and AI projects to migrate existing data on-chain remains uncertain. Compared to centralized storage providers, Walrus’s API integration, stability, and service guarantees still require further validation.

-

Airdrop-driven Early Activity May Skew Metrics Walrus distributed airdrops in NFT form to testnet users, resulting in over 13 million wallet interactions. However, many of these users may be airdrop hunters rather than genuine developers, node operators, or long-term participants. This could lead to inflated early activity metrics and lower retention during ecosystem bootstrapping.

VII. Official Links

-

Website: https://www.walrus.xyz/

-

Twitter: https://x.com/WalrusProtocol

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After the Curve team’s new venture, will Yield Basis become the next phenomenal DeFi application?

This article analyzes the DeFi hit product YieldBasis, which aims to redefine liquidity providers' profit models by converting volatility into yield in Curve pools, while completely eliminating impermanent loss. The project was founded by the core Curve team and demonstrated strong momentum from its inception.

Grayscale and TAOX take action on two fronts, Bittensor ushers in its institutional moment

This article analyzes how the Bittensor ($TAO) token is accelerating towards compliance and institutionalization, driven by the dual positive factors of Grayscale submitting the Form 10 registration statement and the US-listed company TAO Synergies Inc. ($TAOX) completing a private placement. It is also regarded as a core asset connecting traditional finance with decentralized AI networks.

Morgan Stanley opens crypto investments to a broader client base