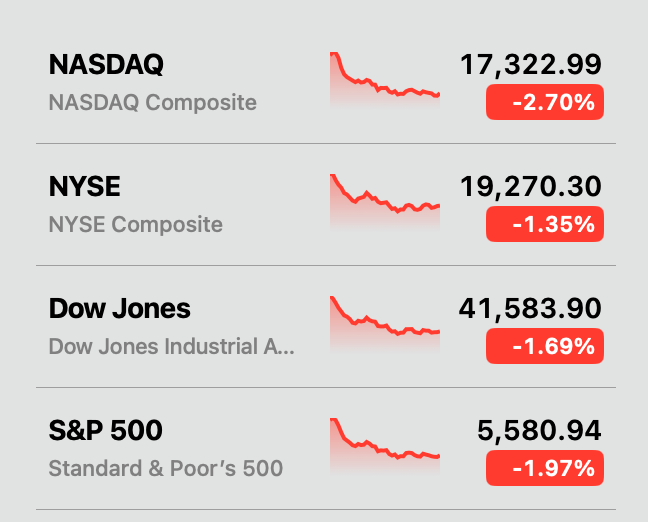

Cryptocurrency markets mirrored equities’ trajectory Friday, as leading U.S. benchmarks plunged abruptly ahead of the session’s end. A trifecta of forces – March’s consumer sentiment figures, new inflationary indicators, and renewed trade hostilities from the Trump administration – coalesced into a perfect storm of financial turbulence.

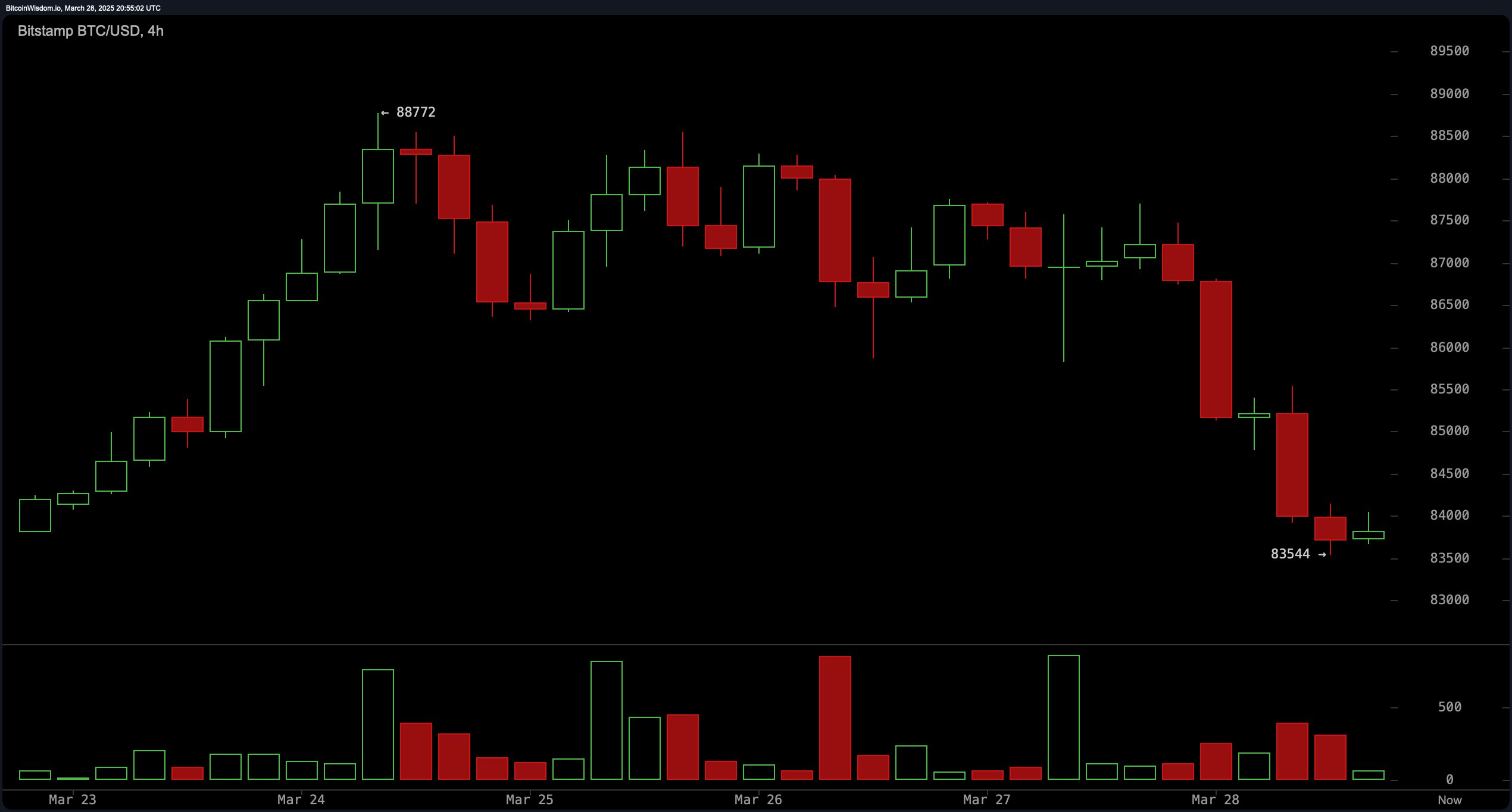

The crypto economy’s valuation eroded 4.14% in 24 hours, settling at $2.73 trillion. Bitcoin commands 61% of this valuation yet plummeted to an intraday nadir of $83,544. The premier digital asset now wages a Sisyphean struggle to breach the $84,000 threshold. Global crypto trading volumes hover near $91.4 billion, with bitcoin seizing $31.53 billion of today’s activity.

BTC/USD at 4:55 p.m. ET on March 28, 2025.

The CFGI registers a “fear” rating of 33/100—a psychological barometer now firmly in frostier territory. BTC’s Friday top trading pairs were anchored by USDT, FDUSD, USD, USDC, and EUR. South Korea’s currency claimed the sixth position in BTC pairings. Upbit—South Korea’s premier trading venue—showed BTC at $85,113 at 4:45 p.m. ET, while global averages commanded $83,883.

Coinglass data reveals $445.25 million in derivatives liquidations today, with BTC long positions absorbing $107 million. Bitcoin’s price gyrations now mirror Wall Street’s pulse, as macroeconomic ambiguity and geopolitical friction illustrate digital assets’ deepening entanglement with conventional finance.

Though bitcoin’s market share and liquidity suggest latent fortitude, the CFGI’s “fear” designation betrays skittishness among traders navigating inflationary headwinds and regulatory pivots. Mass derivatives unwinding reveals an ecosystem maturing through adversity—where speculative excess contends with structural fragility, compelling participants to navigate increasingly complex financial riptides.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。