Crypto-related equities have faced substantial pressure this week, aligning with the broader market downturn that unfolded during the same period. By Friday, all four benchmark U.S. indices concluded the trading day in the red, shedding considerable value.

On March 24, the crypto economy was assessed at $2.82 trillion, but by March 29, it had diminished to $2.67 trillion. This contraction has weighed heavily on crypto stocks, with many bearing the full force of the decline.

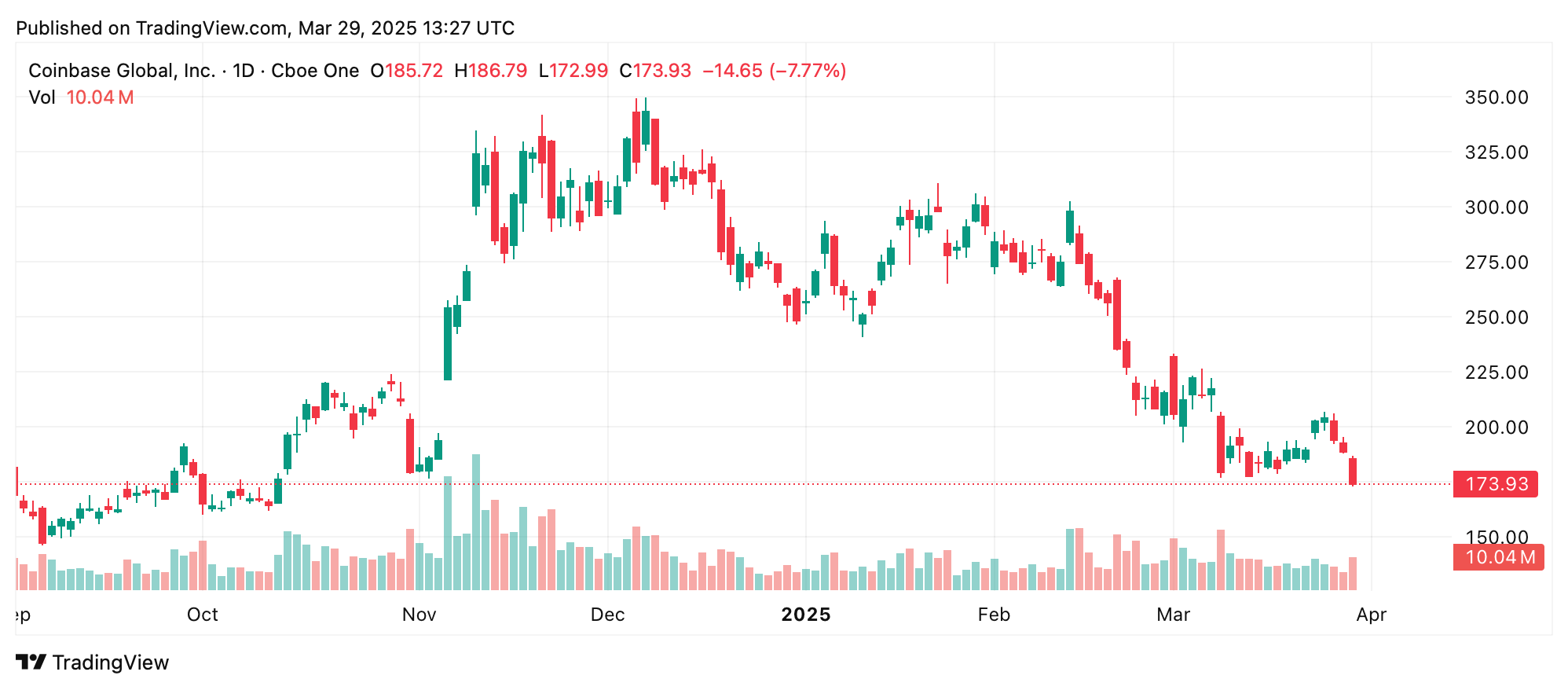

Coinbase (Nasdaq: COIN) on March 29, 2025.

Take Coinbase’s COIN, for example, which has declined by 11.93% against the U.S. dollar since Monday. The current market capitalization of COIN rests at $44.16 billion. Meanwhile, Strategy’s MSTR experienced an 8.46% drop over the span of five consecutive trading sessions. Publicly traded mining firms have also borne significant losses, with MARA Holdings’ shares retreating by 14.64%.

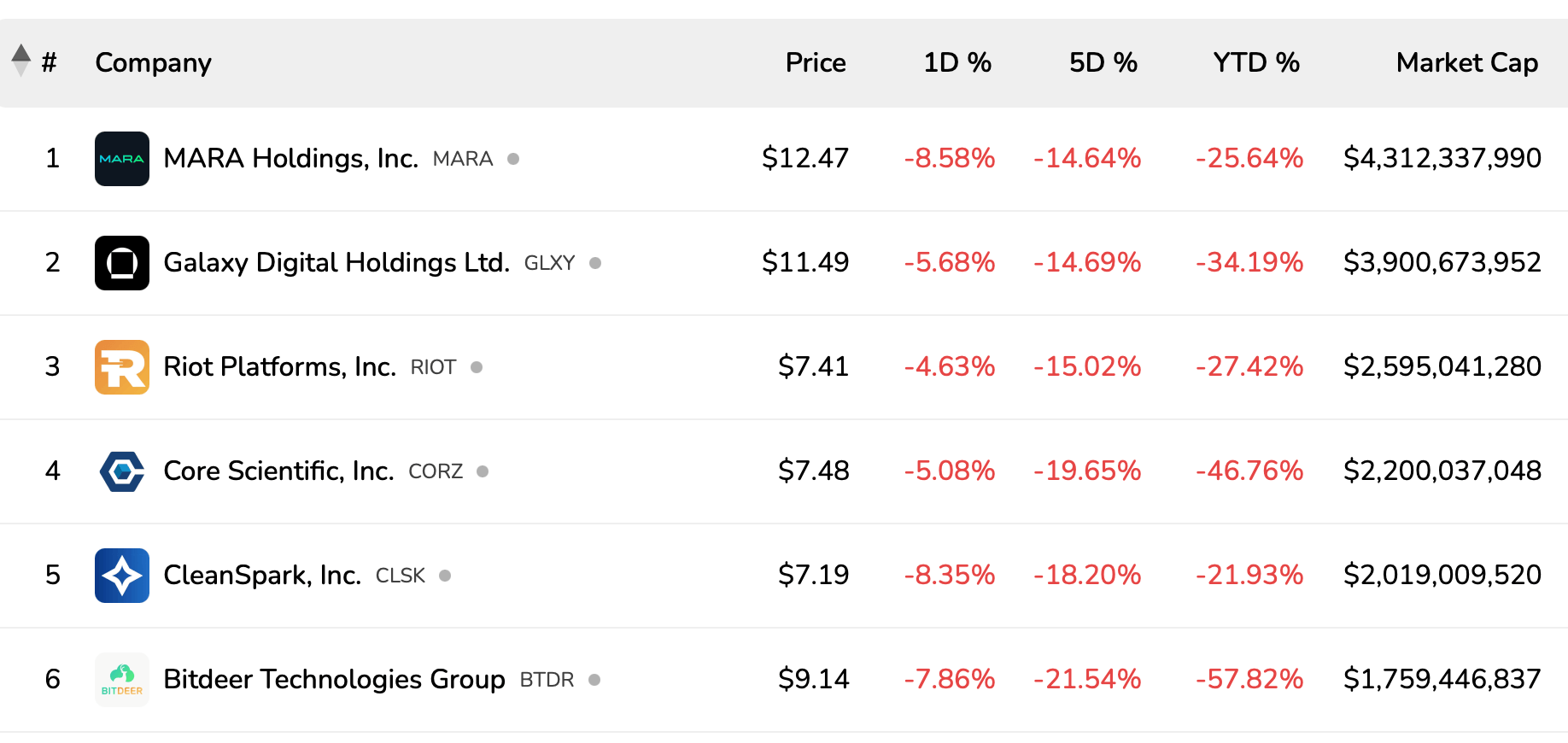

Top six mining stocks by market caps on March 29, 2025, via bitcoinminingstock.io.

Galaxy Digital (GLXY) relinquished 14.69%, Riot Platforms (RIOT) fell by 15.02%, and Core Scientific (CORZ) dropped 19.65% during the previous week. Cleanspark (CLSK) saw its value diminish by 18.2% against the U.S. dollar, while Bitdeer (BTDR) plummeted by 21.54% across the same five-day stretch. Additionally, Iren Limited (IREN) and Applied Digital (APLD) witnessed declines ranging from 21.06% to 28.41%, respectively.

Crypto-related stocks often mirror the spot crypto economy due to their intrinsic ties to digital asset performance. Like crypto assets, these equities are heavily influenced by market sentiment and macroeconomic factors affecting cryptocurrencies. When spot prices decline, investor confidence wavers, prompting sell-offs in both crypto assets and associated stocks.

Additionally, many publicly traded firms hold significant crypto reserves, amplifying their vulnerability to market downturns. This interconnectedness fosters synchronized losses across both domains.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。