- VINE Coin is trading with strong bullish momentum, surging over 121% in the past 24 hours, indicating continued upward movement.

- The community suggests that Elon Musk’s tweet contributed to the surge in VINE’s price.

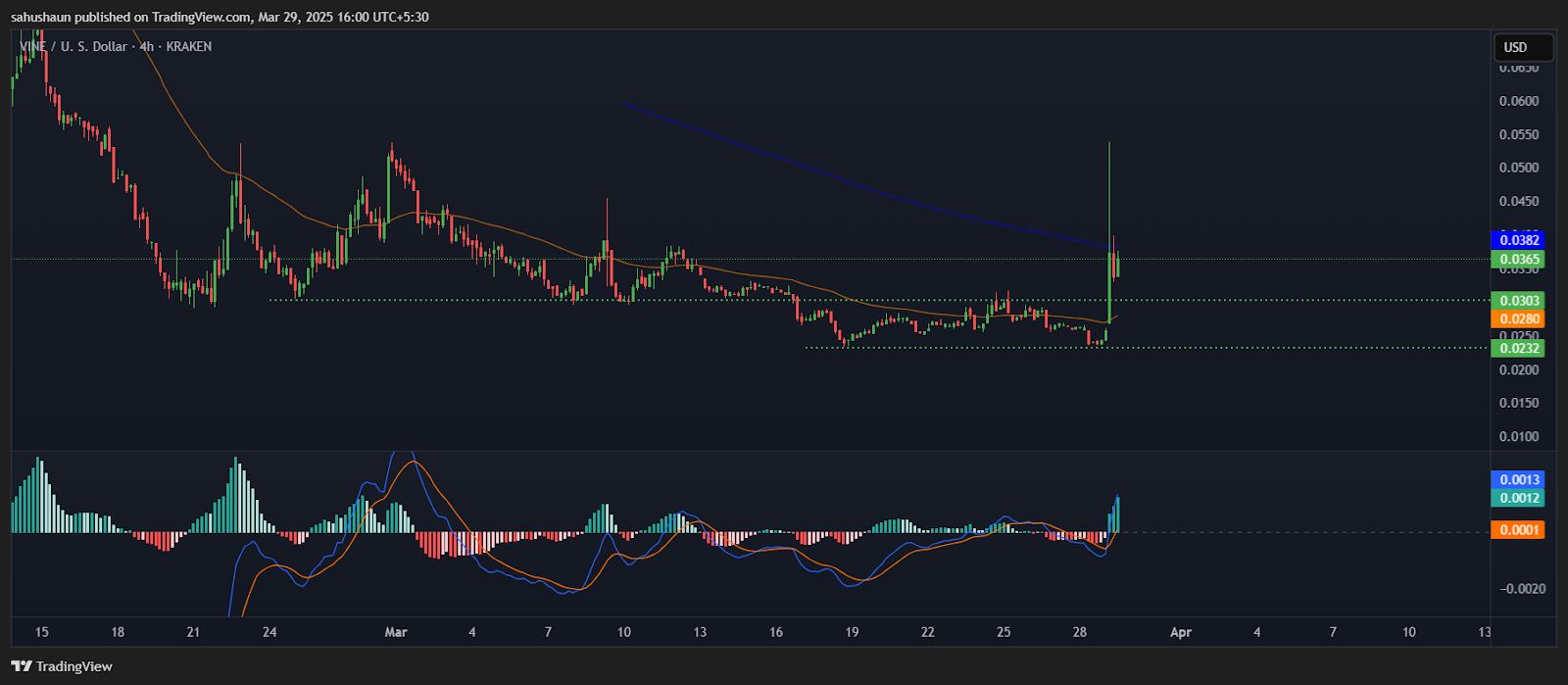

Vine Coin (VINE) has been gaining robust bullish momentum in the last 24 hours, surging approximately 121% and recording an intraday high of $0.05229 before retracing to its current trading price of $0.03698. VINE saw a $938.83K net whale inflow from 46 whales, with robust buying activity. Right now it is among the most trending coins.

Moreover, some X posts suggest that Elon Musk’s tweet is one of the reasons behind the VINE Coin’s price surge. Elon’s reply boosted Vine Coin’s market cap beyond $50M. Additionally, community discussions fueled by speculation about Vine’s potential comeback have also contributed to the price increase.

However, the rally was short-lived lived and the price of VINE Coin dropped around 42% from its intraday high. According to CoinMarketCap data, at the time of writing, VINE crypto price is trading at $0.0303 with an intraday surge of 50%, still indicating bullish trend. The 24-hour trading volume has also surged by 622.90%, suggesting solid buying momentum and the volume-to-market ratio is 664.94%. Currently, the market cap is $36.56 million and the 24-hour trading volume is $242.88 million.

What Next In Vine Coin (VINE) Price?

In a daily VINE/USDT trading pair, Vine Coin is trading above the 50 and 100-day EMAs (exponential moving averages), which are supporting the price momentum.

Source: Tradingview

Source: Tradingview

The MACD line at 0.0013 and the signal line at 0.0001 are both in the bullish territory. A bullish crossover is observed between MACD and the signal curve which signals strength in the momentum of the VINE Coin price. The current value of RSI is 69.64 points suggesting VINE price is in an overbought situation, which might cause pullback but not immediately.

Furthermore, Vine Coin price analysis indicates bullishness, as VINE crypto keeps the gains on the upper side in the bullish zone and ignores the rejections. The bears are still making short positions and trying to cause a pullback in the crypto.

Currently, $0.0400 and $0.052 are acting as strong resistance levels, with $0.052 being the major hurdle. If VINE Coin breaks above this level, it could climb even higher and potentially reach $0.075. On the downside, the key support levels for VINE are $0.0303 and $0.0232.

Highlighted Crypto News Today:

Can XRP Rebound to $2.30 or Face a Further Fall Below $2.00?