Date: Sat, March 29, 2025 | 05:10 PM GMT

The cryptocurrency market has quickly taken a U-turn from its weekly recovery, as Ethereum (ETH) has declined by over 8.50% in the last 48 hours, dipping to the $1,850 mark from the $2,000 level. This downturn has added selling pressure across major altcoins as well.

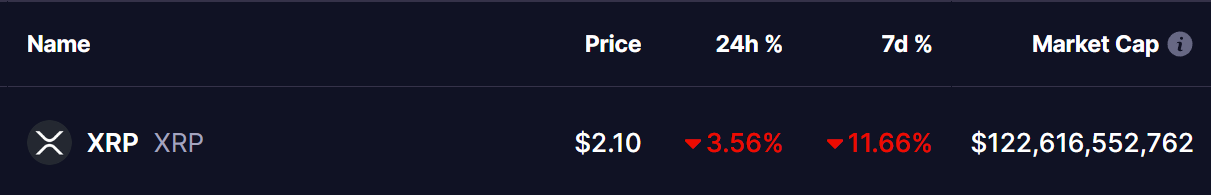

Amid this downturn, XRP has also faced a decline, dropping over 3% today and extending its weekly decline to over 11%. The price action is now at a crucial juncture, where traders are closely monitoring whether it will break down from the symmetrical triangle or bounce back from support.

Source: Coinmarketcap

Source: Coinmarketcap

Symmetrical Triangle Breakdown or Bounce?

According to the latest analysis by crypto chart analyst @JohncyCrypto, Ripple (XRP) is forming a symmetrical triangle pattern on the daily timeframe. Currently trading at $2.11, the price is consolidating near a critical support zone, where a potential bounce is possible.

XRP Daily Chart/Source: @JohncyCrypto (X)

XRP Daily Chart/Source: @JohncyCrypto (X)

If buyers step in and the price manages to break above the descending resistance, we could see an upward move toward the key targets at $2.60, $2.84, $3.00, $3.21, and ultimately $3.40.

However, a failure to hold the support level near $2.00 could lead to further downside, potentially dragging the price to lower levels of interest around $1.77 or even $1.50. The RSI indicator is showing signs of oversold conditions, which may hint at a possible reversal if buying momentum increases in the coming sessions.

What to Expect Ahead?

Traders and investors should keep a close eye on the breakout direction from this symmetrical triangle. A decisive move above the resistance trendline with strong volume confirmation could signal the start of a new bullish phase for XRP. On the other hand, if the support fails to hold, a deeper correction could be in play.

Market sentiment and broader crypto trends will also play a crucial role in determining XRP’s next move. With Ethereum and Bitcoin struggling at key support levels, XRP’s price action might remain volatile in the short term.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies