Investor Dan Tapiero Predicts Bitcoin Rallies, Says New Liquidity and Lower Rates Needed

Investor and venture capitalist Dan Tapiero says Bitcoin ( BTC ) rallies are around the corner again amid what he thinks is an alignment of several bullish macro factors.

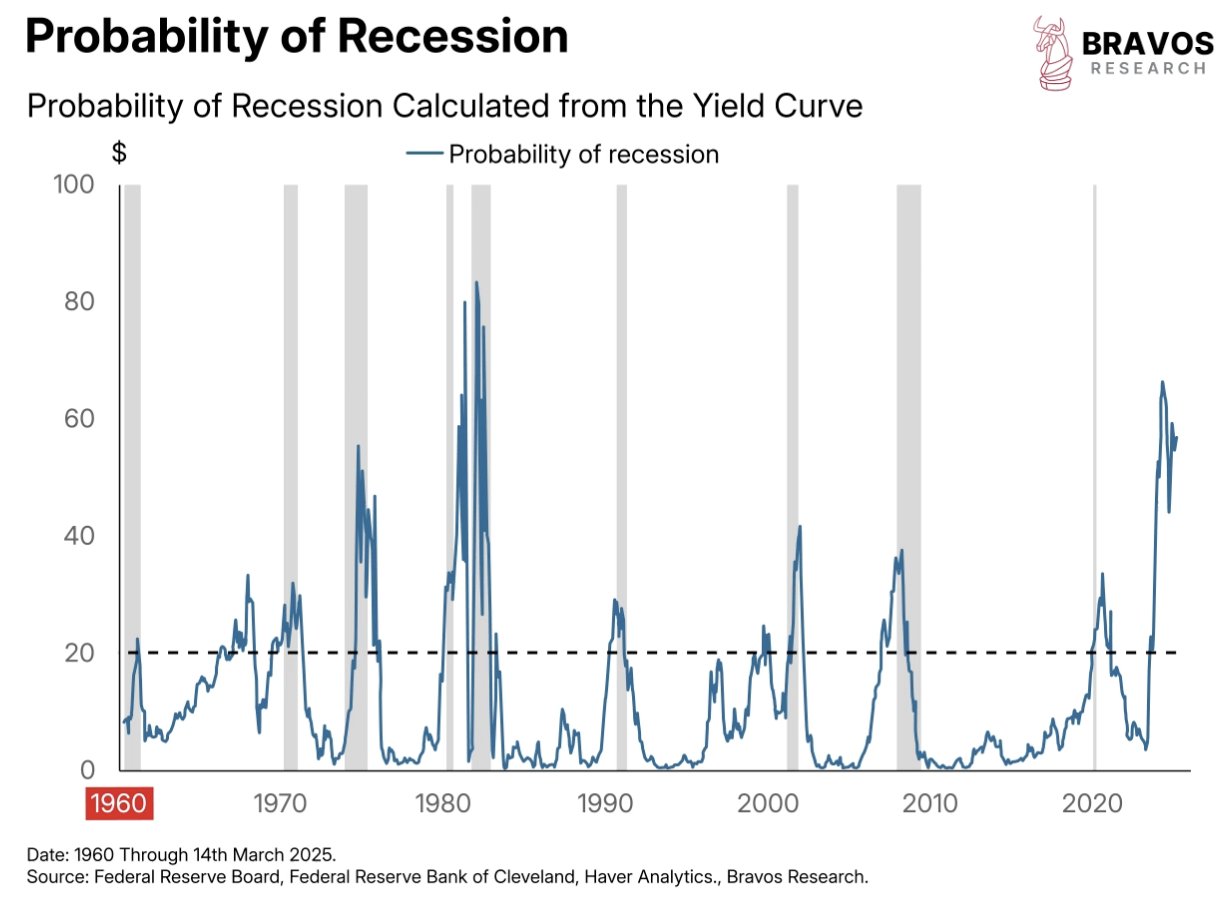

Citing a recession probability indicator from the market analysis firm Bravos Research, Tapiero says that the Federal Reserve will likely add new liquidity and lower interest rates in order to stimulate the economy.

According to the investor, the loose monetary environment will trigger new Bitcoin rallies.

“Unlikely recession coming given Fed has room to cut interest rates – 400 basis points possible to 0 if needed…

But this indicator has never been higher and a recession not followed.

Slowing growth ahead clear, guaranteed by fiscal tightening.

Rates must drop. Liquidity needed.

BTC.”

Source: Dan Tapiero/Bravos Research/X

Source: Dan Tapiero/Bravos Research/X

According to Tapiero, the stock market is in for another 10% drop or so before the Federal Reserve cuts rates “regardless of coincidental data.”

In a recent interview with crypto personality Scott Melker, Tapiero forecasted a $180,000 price tag for Bitcoin.

On when Bitcoin could reach the massive price target, Tapiero says,

“I know some people have been more aggressive but I think this bull phase, we can hit that [$180,000] this year or potentially early next year. But I’m thinking more this year…

So it’s just the way markets work, right – you got 85% or 90% bulls up at $100,000 and now you’re down at, what is it? 15%? And people are despondent, they think the world is over, and yet it’s at $80,000, which is still up, you know, 2x, 3x from 18 months ago. It’s pretty, pretty incredible.”

At time of writing, Bitcoin is worth $82,924.

Follow us on X , Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!