Key Points

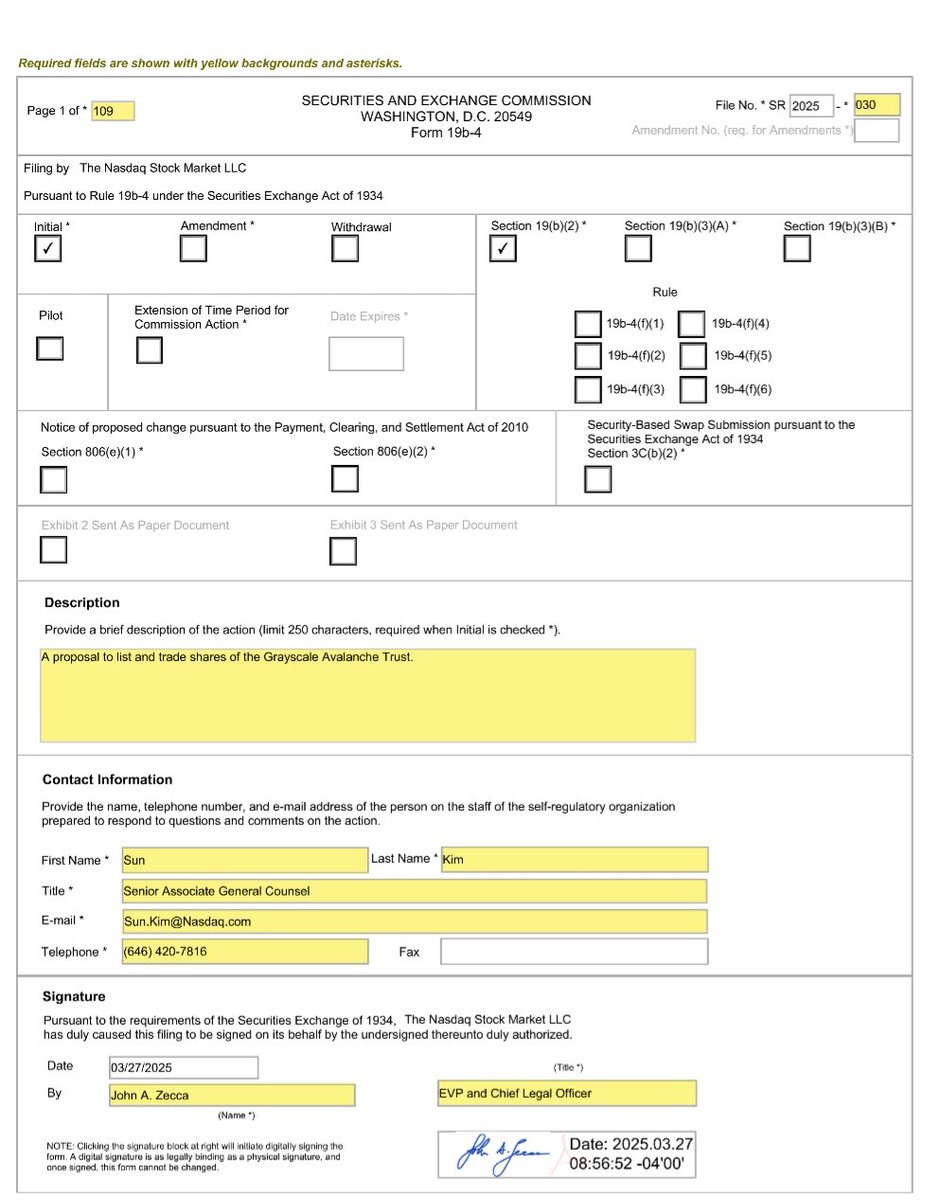

- Grayscale’s submission of a Form 19b-4 for an AVAX ETF shows Nasdaq as custodian.

- Grayscale had previously filed for more crypto ETFs recently delayed by the US regulator.

According to recent official documents, Grayscale has filed for another crypto ETF with the US SEC – Avalanche (AVAX).

Grayscale is one of the most important asset managers in the world and Avalanche is an L1 that functions as a platform for decentralized apps and custom blockchain networks.

Grayscale’s AVAX ETF Application with the SEC

The 19b-4 Form application with the SEC is dated March 27, but the news was revealed today. The official notes show that Nasdaq will be the fund’s custodian.

Official SEC filing

Official SEC filing

The announcement triggered a recent surge in price for AVAX.

AVAX Price Surges

At the moment of writing this article, AVAX is trading above $20.5 with a market cap of over $8.53 billion. The coin debuted an earlier descendant trajectory from around $22, bottoming at approximately $20.2, before a rebound.

Following the AVAX ETF announcement, the digital asset began a price trajectory reversal upwards, surging by around 1% so far.

AVAX price in USD todayThe coin’s earlier price decline was amidst an overall crypto market drop of over 3% today, triggered by more factors, including a significant amount of options that expired today, and caused volatility.

However, the coin continues its upward trajectory following the Grayscale ETF announcement.

Previously, Grayscale had applied for more crypto ETFs, which were delayed by the US SEC earlier this month.

SEC Delayed More Grayscale ETFs

Among the crypto ETFs that have been delayed in the US by the regulator, Grayscale’s other ETF filings include SOL, DOGE, HBAR, XRP, ADA, and LTC.

Other ETF issuers that applied for crypto funds were CoinShares, Bitwise, 21Shares, Canary, VanEck, WisdomTree, and others.

It was reported that the SEC might have delayed these crypto ETFs until Trump’s pick for the new Chair, Paul Atkins, takes office.

Yesterday, he had a hearing with the US Senate, but no news of his confirmation has been released yet.

However, if confirmed, Atkins will return the agency to its core mission to ensure that the US capital markets remain “the envy of thr world,” noted the US Senate Banking Committee via X.

If confirmed to lead @SECGov , Paul Atkins will return the agency to its core mission: ensuring our capital markets remain the envy of the world.

Through legislation like the Empowering Main Street in America Act, we can open up our capital markets to all Americans. pic.twitter.com/9DdrJdQbaQ

— U.S. Senate Banking Committee GOP (@BankingGOP) March 27, 2025

The crypto industry awaits his confirmation and the codification into law of Trump’s executive order.