Date: Sun, March 30, 2025 | 08:48 AM GMT

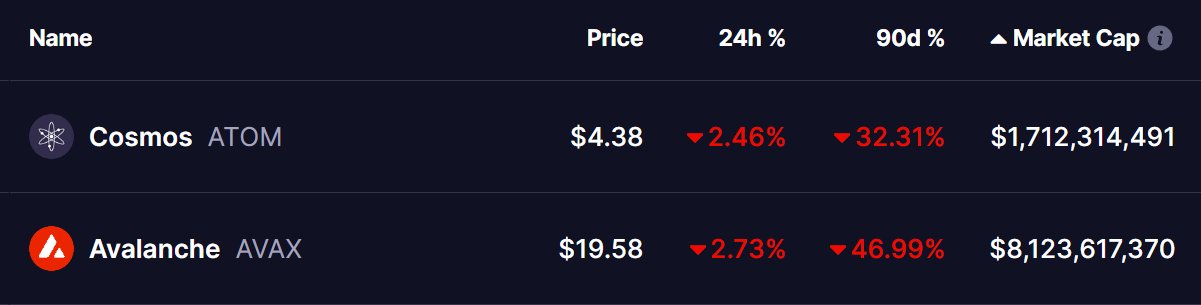

The cryptocurrency market is once again facing selling pressure, wiping out the recovery gains made earlier this week. Ethereum (ETH) has plunged more than 8% over the past two days, slipping below $1,850 after briefly touching the $2,000 mark. This decline has triggered a broader sell-off in altcoins , including Cosmos (ATOM) and Avalanche (AVAX), both of which are trading in the red today and extending their 90-day correction phase.

Source: Coinmarketcap

Source: Coinmarketcap

However, despite the bearish sentiment, their technical setups remain intact, and the next move will largely depend on Bitcoin’s dominance in the market.

Double Bottom Formation Still Holding Strong

Even with the recent downturn, ATOM and AVAX have maintained their double bottom formation—a well-known technical pattern that often signals a potential trend reversal. Earlier this week, both tokens managed to bounce off their key support levels, hinting at a possible recovery. However, the broader market correction has dragged them back near these crucial support areas.

A major factor influencing their price action is Bitcoin dominance (BTC.D), which dictates capital flow within the crypto market. Whether ATOM and AVAX hold their support levels or experience another leg down will largely depend on BTC dominance’s movement.

What to Expect Next?

BTC dominance has rebounded from both the 50-day moving average (MA) and the rising wedge support, climbing from 61.34% to 62.12%. As it approaches a key resistance level, there are two possible scenarios:

BTC.D Daily Chart/Coinsprobe (Source: Tradingview)

BTC.D Daily Chart/Coinsprobe (Source: Tradingview)

1. Rejection from Resistance → Bullish for Altcoins

If BTC dominance fails to break its resistance trendline, we could see a rotation of capital back into altcoins, leading to a rebound for ATOM and AVAX. A rejection at this level would indicate a shift in market sentiment, fueling a recovery across the altcoin sector.

2. Breakout Above Resistance → More Selling Pressure

If BTC dominance breaks above resistance, altcoins may face another round of sell-offs. This could push ATOM and AVAX further down, invalidating the double bottom pattern and extending the bearish trend.

The next few days will be critical in determining the direction of the altcoin market. Traders should keep a close eye on BTC dominance for signs of a potential shift in market momentum.

Final Thoughts

Cosmos (ATOM) and Avalanche (AVAX) are holding firm at key support levels, but their fate remains tied to Bitcoin dominance. If BTC.D gets rejected at resistance, altcoins could see a strong bounce. However, a breakout could mean more downside pressure.

Traders should closely monitor BTC dominance and market sentiment to navigate the next phase of the market cycle.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.