Centralization and the dark side of asset tokenization — MEXC exec

Tracy Jin, the chief operating officer at the MEXC crypto exchange, warns that tokenizing real-world assets (RWAs) carries a substantial amount of centralized risks that can lead to censorship, liquidity issues, legal uncertainty, cybersecurity problems, and asset confiscation through state or third-party intermediaries.

In an interview with Cointelegraph, the executive said that as long as tokenized assets remain under the purview of state regulators and centralized intermediaries, then "tokenization will simply be a new version of old financial infrastructure and not a financial revolution." Jin added:

"Most tokenized assets will be issued on permissioned or semi-centralized blockchains. This gives authorities the power to issue restrictions or confiscate assets. The tokenization of assets such as real estate or bonds is still tied to the national legal system."

"If the property or company behind the token is local, in a country with an unstable legal environment or high political volatility, the risk of confiscation increases," the executive continued.

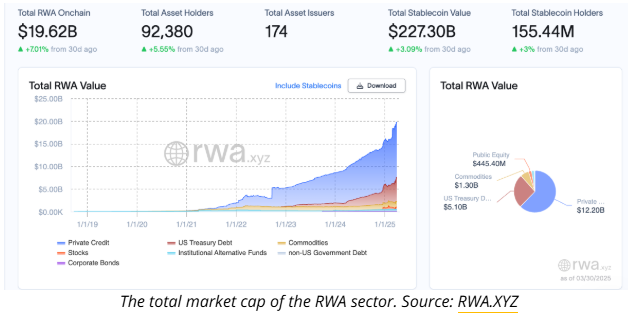

RWA tokenization is projected to become a multi-trillion sector in the next decade as the world's assets come onchain, which will increase the velocity of money and extend the reach of capital markets worldwide.

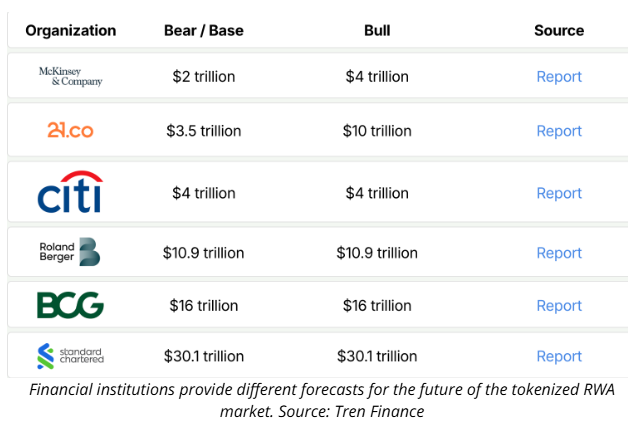

Estimates of the future RWA market differ dramatically

Tokenized real-world assets include stocks, bonds, real estate, intellectual property rights, energy, art, private credit, debt instruments, fiat currency, commodities, and collectibles.

According to RWA.XYZ , there are currently over $19.6 billion in tokenized real-world assets onchain, excluding the stablecoin sector, which surpassed a $200 billion market cap in December 2024.

A research report from Tren Finance polled large financial institutions including Citi, Standard Chartered, and McKinsey & Company; the report found that the participants predicted the RWA market to reach anywhere between $4 trillion to $30 trillion by 2030 .

McKinsey & Company predicted the RWA sector will encompass between $2 trillion to $4 trillion by 2030 — a relatively modest assessment compared to other forecasts.

Meanwhile, institutions like Standard Chartered and executives at the blockchain network Polygon say that the RWA market will reach $30 trillion in the next decade .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!