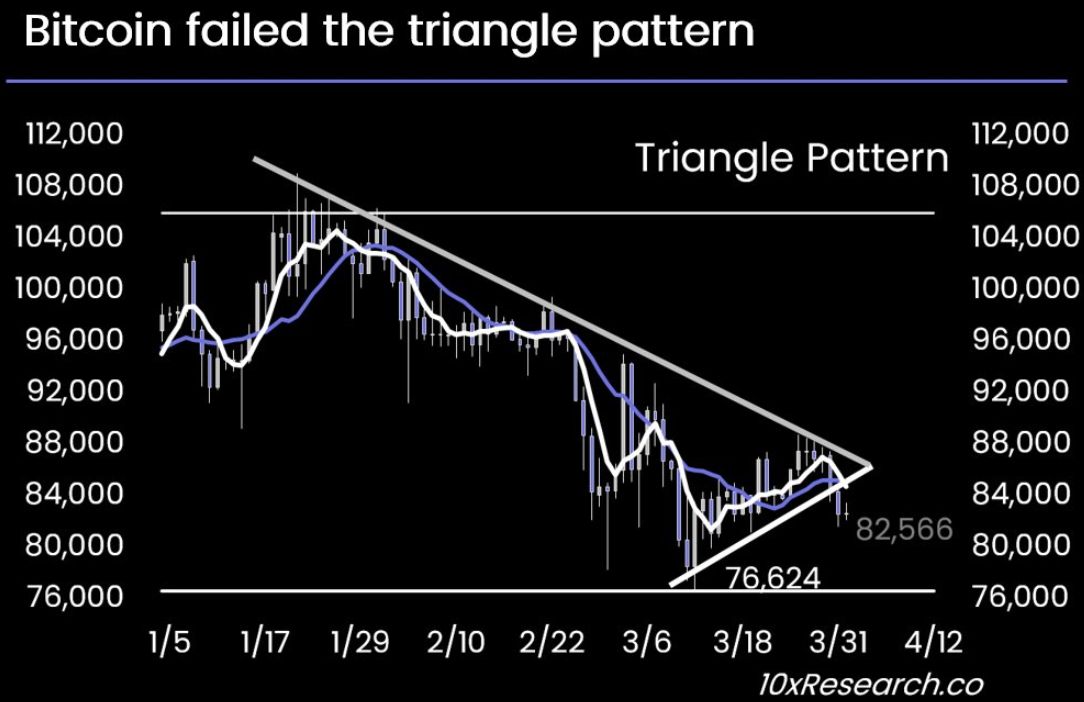

10x Research: BTC may fall below $80,000 this week, multiple hedging factors could put pressure on the stock market and affect the cryptocurrency market

According to a report by PANews on March 31, an analysis by 10x Research suggests that Bitcoin's rebound over the past three weeks has been hampered due to higher than expected core PCE data. The data indicates rising inflation, partly driven by Trump's tariff policy, which has weakened consumer confidence. One-year inflation expectations have risen to 5.0%, leading to poor performance of risk assets and triggering stop-losses in short-term bullish strategies.

10x Research predicts that Bitcoin may fall below $80,000 this week as multiple hedging factors could put pressure on the stock market and spill over into the cryptocurrency market. Trump's tariff policy has shifted from initial mild expectations towards more aggressive ones, with concerns that tariffs might be implemented first while negotiations are postponed. This change significantly increases market uncertainty.

In addition, if ISM manufacturing PMI data is weak it could exacerbate market pressures; whereas if US employment data remains strong it could delay Federal Reserve intervention further pressuring markets. It is worth noting that the VIX index remains low indicating many traders may be underestimating short-term downside risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Starknet launches BTC staking integration upgrade

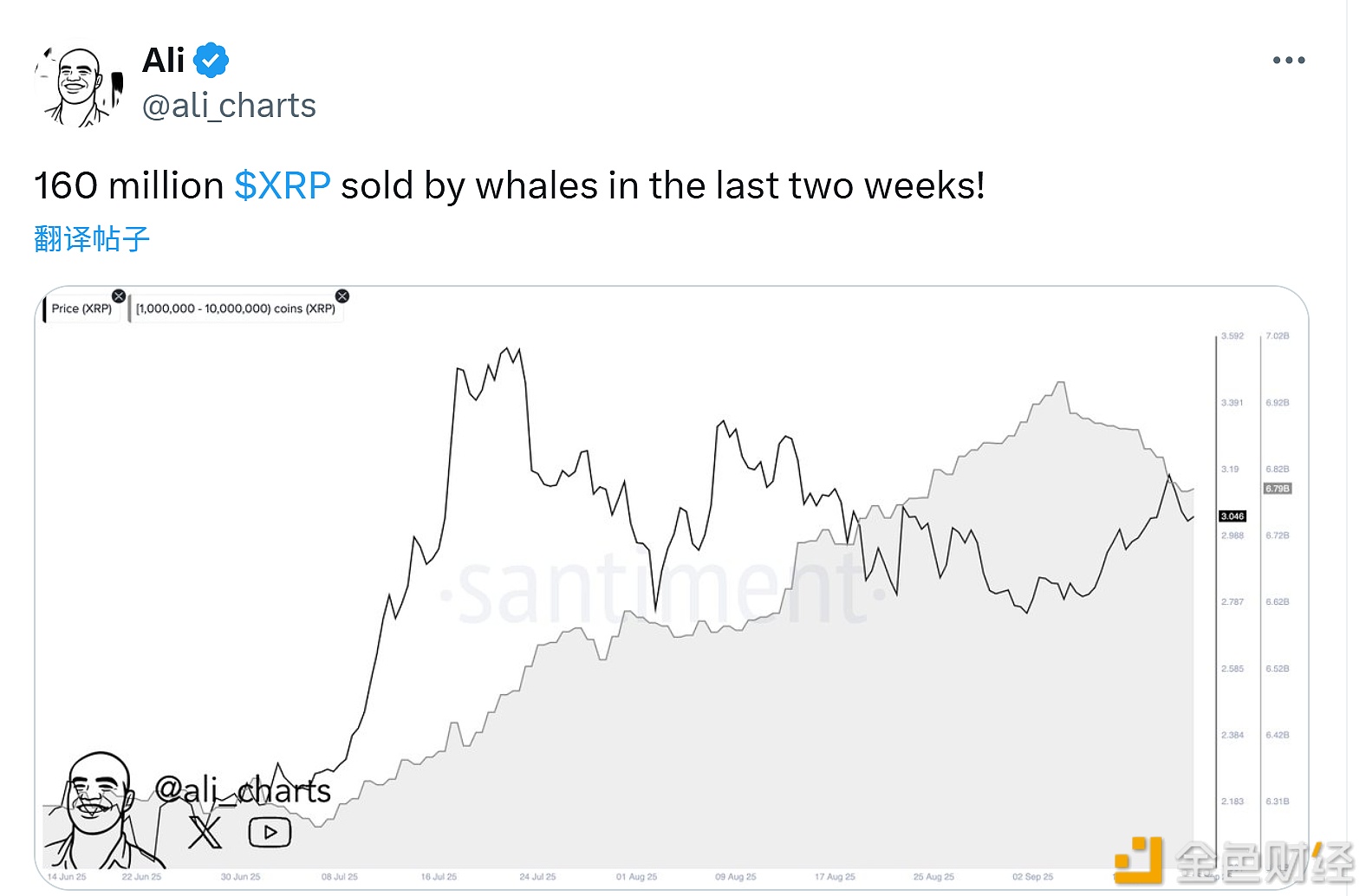

Analyst: Whales have sold 160 million XRP in the past two weeks

Nemo Protocol launches debt token plan to compensate $2.6 million attack victims