Two Ethereum whales on MakerDAO are at risk of being liquidated if Ether drops below $1,800. The whales, who borrowed millions in DAI from the DeFi lending protocol and pledged ETH as collateral, are now under pressure due to Ether’s continuous decline.

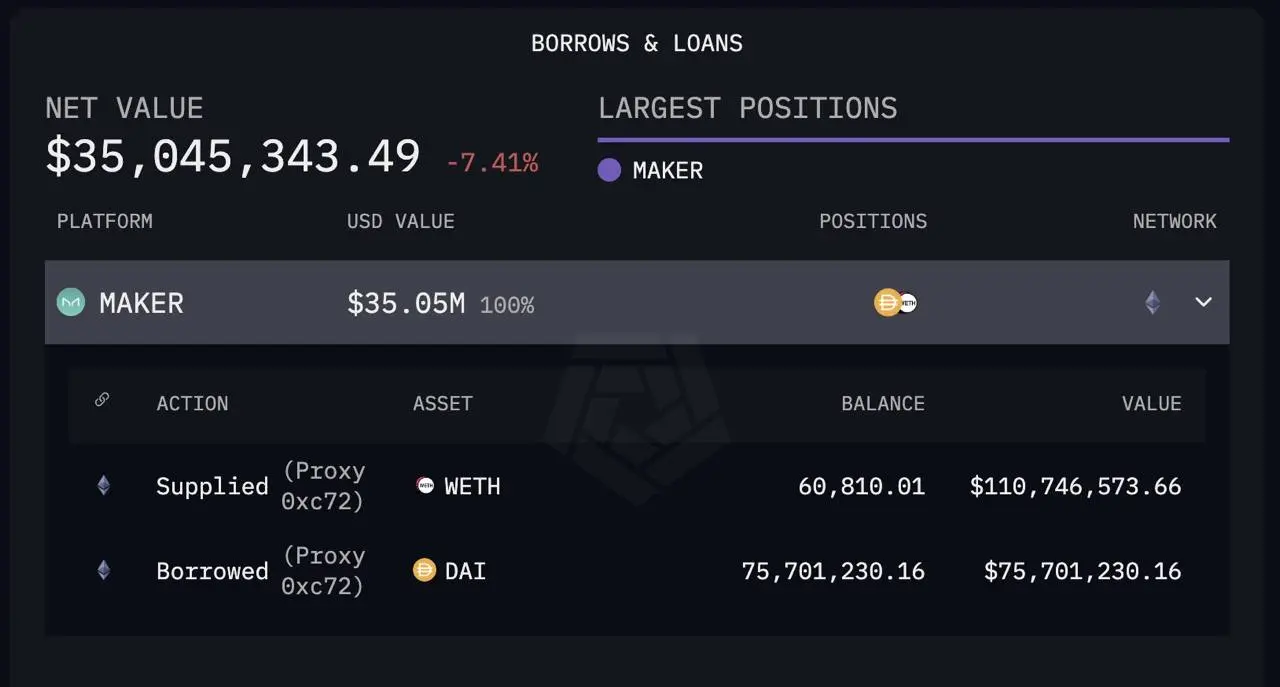

According to Lookonchain and Arkham Intelligence , who both spotlighted the situation, the whales have a combined 125,603 ETH worth $238 million on the line. One borrowed over $75 million worth of DAI from MakerDAO, using 60,810 ETH worth $110 million as collateral.

Ethereum whale facing liquidation on MakerDAO. Source: Arkham Intelligence

Ethereum whale facing liquidation on MakerDAO. Source: Arkham Intelligence

However, the whale has their liquidation threshold set at $1,793, raising concerns that any sharp drop in ETH price could cause liquidation. Arkham Intelligence noted that the whale has been inactive for three weeks, further justifying the concerns.

Meanwhile, the other whale also borrowed over 68 million DAI on the lending platform, putting 64,792.7 ETH worth $122 million as collateral. Their liquidation price is set at $1,787.

Interestingly, this second whale avoided liquidation on March 11 by paying off part of the debt. However, the continuous decline in ETH value means they are now at risk again, and many are observing what will happen next.

Ethereum struggles look set to continue as DeFi feels impact

The struggles of these whales highlight the impact of the ETH price decline on the DeFi sector. With ETH being the major cryptocurrency of transactions for decentralized finance activity, its decline has had a major impact on the sector.

ETH has been struggling since reaching its $4,000 peak in December. Even when other major crypto recorded gains at the start of 2025, the token showed signs of future challenges. However, its struggles have reached new levels in the past few weeks, with value crashing below $2,000. It is now down 45% year-to-date.

With its performance, the TVL of DeFi protocols has also fallen significantly. Per Defillama data, Ethereum DeFi TVL has fallen to $50 billion from over $66 billion at the start of the year.

Out of the top ten protocols on the network, only Aave and Sky (formerly MakerDAO) have seen their TVL increase in the past month. All other protocols, including Lido, EigenLayer, Ethena, Uniswap, and Pendle, have seen TVL declines varying between 5% and 37%.

Meanwhile, ETH’s struggles are not unique. Other cryptos have also struggled due to rising US inflation data and President Trump’s tariffs , worsening the country’s economic outlook. However, the extent of its fall compared to other assets is an outlier, and the long-term expectations are not much better.

Most analysts note that the token could face more problems ahead, with Bloomberg claiming developers are leaving, and smaller competitors are gaining in on it. Crypto venture capitalist Quinn Thompson also described Ethereum’s value proposition as an investment “dead,” noting the decline in transaction activity, fees, and user growth. He noted that the project still has utility as a network but not as an investment.

Castle Island Ventures partner Nic Carter also agreed, noting that the proliferation of tokens and Layer-2 networks killed ETH.

He said:

“The #1 cause of this is greedy eth L2s siphoning value from the L1 and the social consensus that excess token creation was A-OK. Eth was buried in an avalanche of its own tokens. Died by its own hand.”

However, many believe that any focus on Ethereum should not be on the mainnet alone but on the entire ecosystem, including the L2s. Thompson countered that ecosystem growth is not adding value to ETH as other tokens and entities are getting most of this value.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now