MARA Holdings, the U.S.’s largest Bitcoin miner, is raising up to $2 billion through an at-the-market (ATM) stock offering. The funds will primarily be used to acquire more Bitcoin and support general corporate operations, reinforcing the company’s long-term “hodling” strategy.

Partnership with Financial Firms

According to a March 28 filing with the U.S. Securities and Exchange Commission (SEC), the Bitcoin miner is partnering with leading financial firms, including Barclays, Cantor Fitzgerald, and Guggenheim Securities, to facilitate the stock sales.

Sponsored

“We currently intend to use the net proceeds from this offering for general corporate purposes, including the acquisition of bitcoin and for working capital,” the Bitcoin mining firm stated.

This offering will allow MARA to issue shares periodically, depending on market conditions, with no fixed timeline or volume requirement.

Focus on Bitcoin Reserves

While the funds will be used for general corporate purposes, increasing its Bitcoin reserves remains MARA’s priority.

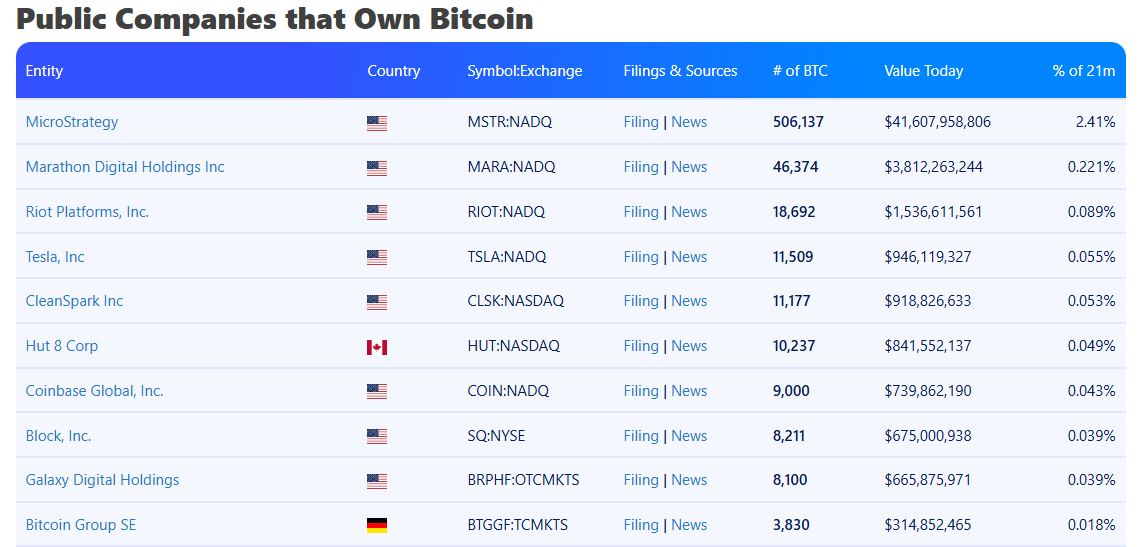

With 46,374 BTC valued at approximately $3.9 billion, MARA is the second-largest public Bitcoin holder, according to Bitbo data.

The list of public companies that hold Bitcoin. Source: Bitbo

The list of public companies that hold Bitcoin. Source: Bitbo

The company aims to strengthen its position as a leading institutional Bitcoin holder, emulating Michael Saylor’s strategy at MicroStrategy, which holds over 506,000 BTC.

MARA Stock Price Action

Despite the announcement, MARA’s stock has experienced notable fluctuations. On March 31, 2025, Marathon Digital Holdings Inc. stock closed at $12.47, marking an 8.58% drop from the previous day.

This decline reflects a broader trend among cryptocurrency stocks, which often mirror Bitcoin’s price movements. On the same day, Bitcoin fell by about 4%, dropping to just over $83,700, which contributed to the decrease in MARA’s stock.

Despite strong financials, including a 37% increase in revenue for Q4 2024, generating $214.4 million, MARA’s stock has dropped by more than 39% since the start of January 2025.

On The Flipside

- The concentration of large Bitcoin holdings in the hands of a few entities, including MARA, raises concerns about the decentralization principle central to cryptocurrencies.

Why This Matters

MARA’s stock offering solidifies its position as a major Bitcoin holder, signaling confidence in Bitcoin’s future as a strategic asset. The company’s aggressive expansion in Bitcoin mining highlights its belief in the long-term value of the cryptocurrency.

Read DailyCoin’s top crypto news:

Crypto Market Plunges: What’s Behind the Drop?

XRP Price: Here’s What’s Needed For Ripple Coin To Flip Bullish