Bitcoin price is under selling pressure from tariffs and inflation fears. Will BTC/USD close March green? Explore why prices are down and why the BTC Bull presale is gaining traction.

After Bitcoin posted three consecutive days of losses, market participants expected a reprieve. However, that doesn’t seem to be the case. At press time, the BTC/USD price is approaching $82,000. It remains under immense selling pressure, slowing down and even extinguishing hopes of an altcoin rally.

The losses of the past few days explain why the futures market is flushing out as investors diversify and buy some of the hottest crypto presales in 2025 .

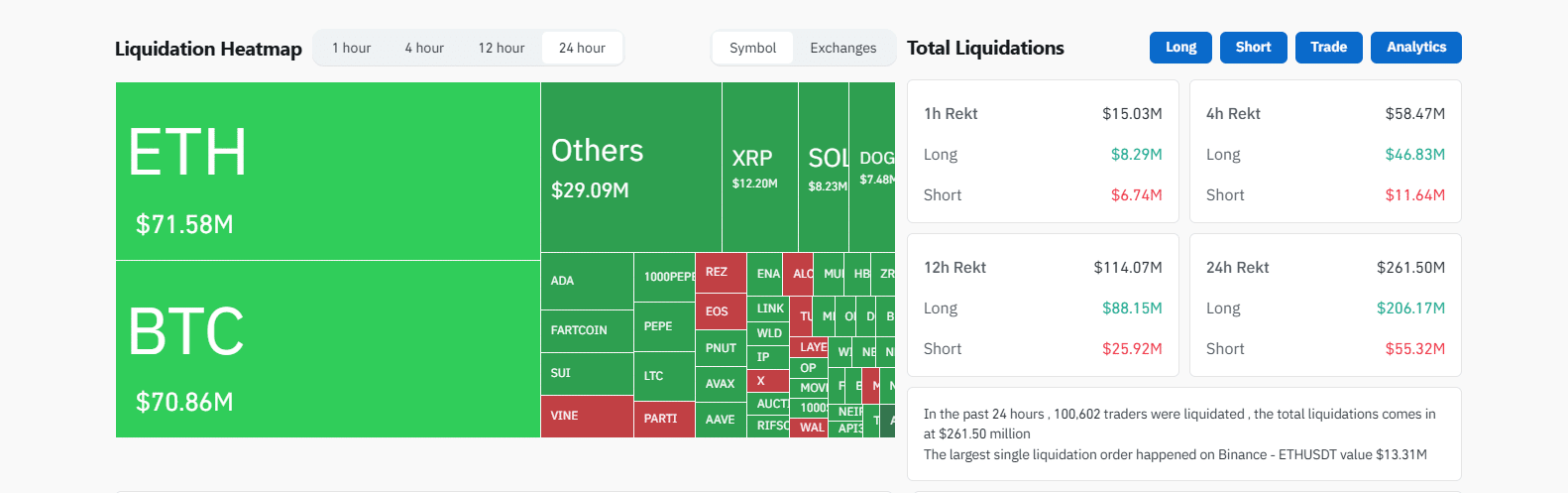

According to Coinglass and crypto liquidation news, over $261 million in long positions were liquidated on Binance, OKX, Bybit, and other exchanges. In comparison, only $55 million in leveraged shorts were closed during this period. Interestingly, more Ethereum longs were liquidated than Bitcoin longs.

( Source )

Why Is the Bitcoin Price Down?

The recent Bitcoin downturn aligns with broader de-risking among traders and investors. Several macroeconomic factors are driving their decisions, including the looming implementation of reciprocal tariffs that President Donald Trump is set to announce. Effective April 2, these tariffs have sparked concerns of escalating trade tensions, dampening investor sentiment, and pushing capital away from “risky” assets like Bitcoin.

The timing couldn’t be worse. Last week, the U.S. Core Personal Consumption Expenditures (PCE) data came in hotter than expected.

Inflation could spike with the risk of additional tariffs on countries that fail to reciprocate and continue charging higher levies on U.S. goods. Goldman Sachs analysts predict inflation will rise with more tariffs, slowing employment and economic growth. They forecast inflation to hit 3.5% this year, well above the 2% benchmark set by the Federal Reserve.

The confluence of harsh tariffs and potential high inflation will likely drive capital to safer assets, such as bonds, further impacting crypto prices. Still, there’s no dismissing the possibility of a Bitcoin recovery.

( BTCUSDT )

Prices remain above the key support zone of $75,000 to $80,000. At the same time, there are hints that whales are rapidly accumulating, which could slow the sell-off and even push the coin toward $85,000 to $90,000—a big win for bulls.

BTC Bull Presale in Focus: Over $4.3 Million Raised

Choppy Bitcoin price action isn’t stopping investors from exploring alternatives.

Attention is now on the BTC Bull presale , which has raised over $4.3 million.

BTC Bull is a meme coin on Ethereum that aims to blend the allure of meme coin culture with Bitcoin’s potential.

At key Bitcoin price milestones, the project will distribute real BTC to BTCBULL holders. Distributions begin when Bitcoin hits $150,000, with airdrops occurring after every $50,000 increase until Bitcoin reaches $250,000.

BTCBULL is also deflationary: once Bitcoin hits $125,000, a portion of the total supply will be burned, with additional burns every $25,000 increase, boosting demand by reducing circulating supply.

The BTCBULL token is currently trading at $0.002435. You can buy now before prices rise in three days.

Afterward, you can stake and earn an attractive 98% yield–one of the many reasons why it is one of the best cryptos to buy . Over 1 billion BTCBULL tokens have been staked, signaling strong investor confidence.

VISIT BTC BULL PRESALE NOW

DISCOVER: 9 High-Risk High-Reward Cryptos for 2025

Bitcoin Price Down As BTC Bull Presale Thrives

- Bitcoin Price Decline: BTC/USD drops to $82,000

- Donald Trump tariffs spark inflation worries, pushing capital from crypto to bonds

- BTC Bull Presale raises $4.3M, offering BTC airdrops