Here’s What Bitcoin Needs To Do To Confirm Bullish Breakout, According to Trader Who Nailed 2024 BTC Correction

A crypto analyst known for accurately calling Bitcoin’s pre-halving correction last year believes that BTC needs to reclaim a key technical indicator as support to regain bullish momentum.

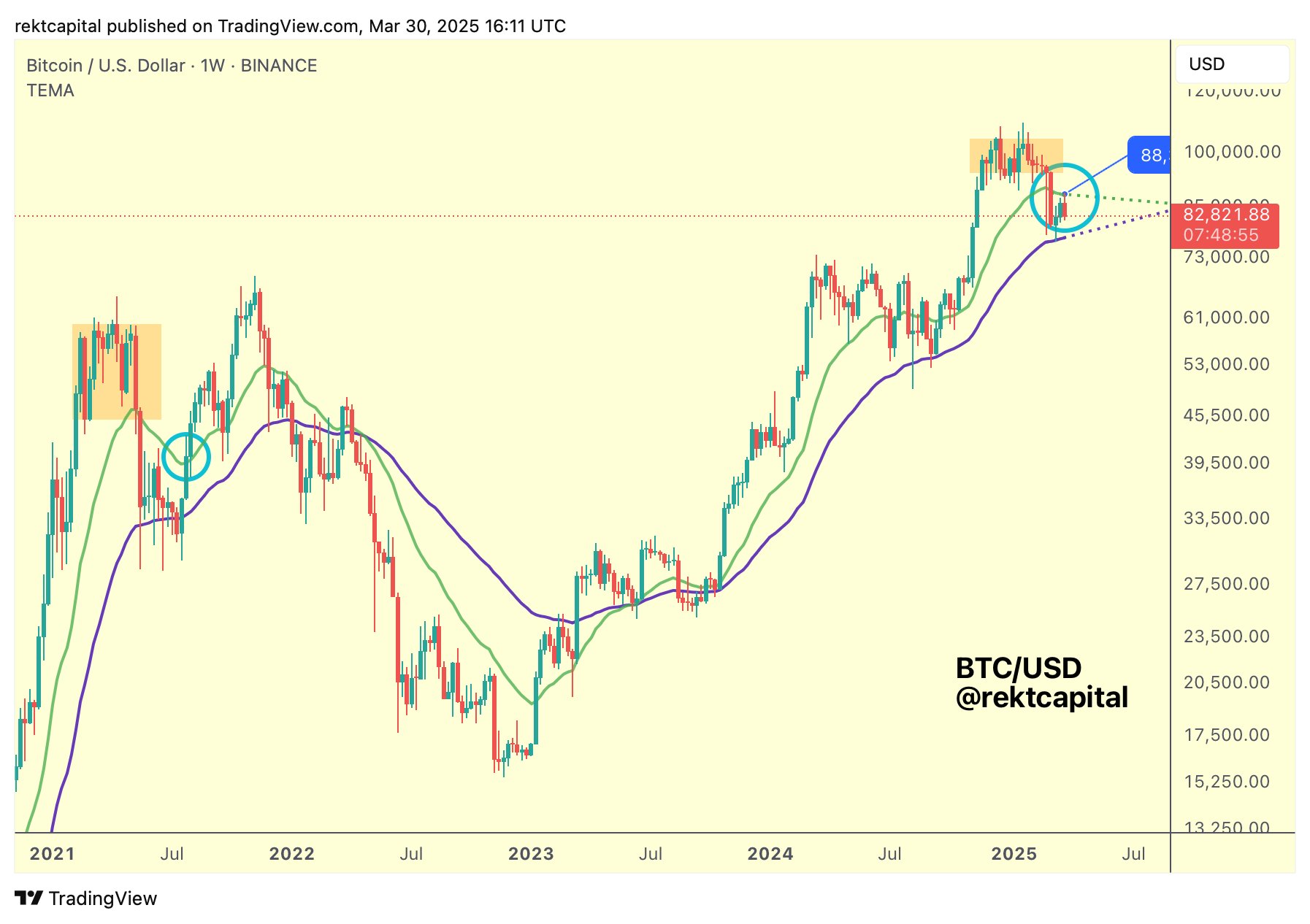

Pseudonymous crypto strategist Rekt Capital tells his 542,600 followers on the social media platform X that BTC appears to be mirroring its price action in 2021 when Bitcoin consolidated between two key exponential moving averages (EMAs) on the weekly chart.

According to Rekt, Bitcoin must convert the 21-week EMA into support to trigger the resumption of bullish price action.

“Earlier this week, Bitcoin rejected from the 21-week EMA resistance (green).

As a result, Bitcoin continues to consolidate between these two Bull Market EMAs, much like it did in mid-2021.

Nonetheless, for the future, the key confirmation signal for a breakout will be a weekly close above the green EMA followed by a post-breakout retest of it into new support (light blue circle).”

Source: Rekt Capital/X

Source: Rekt Capital/X

At time of writing, Bitcoin is trading for $82,536.

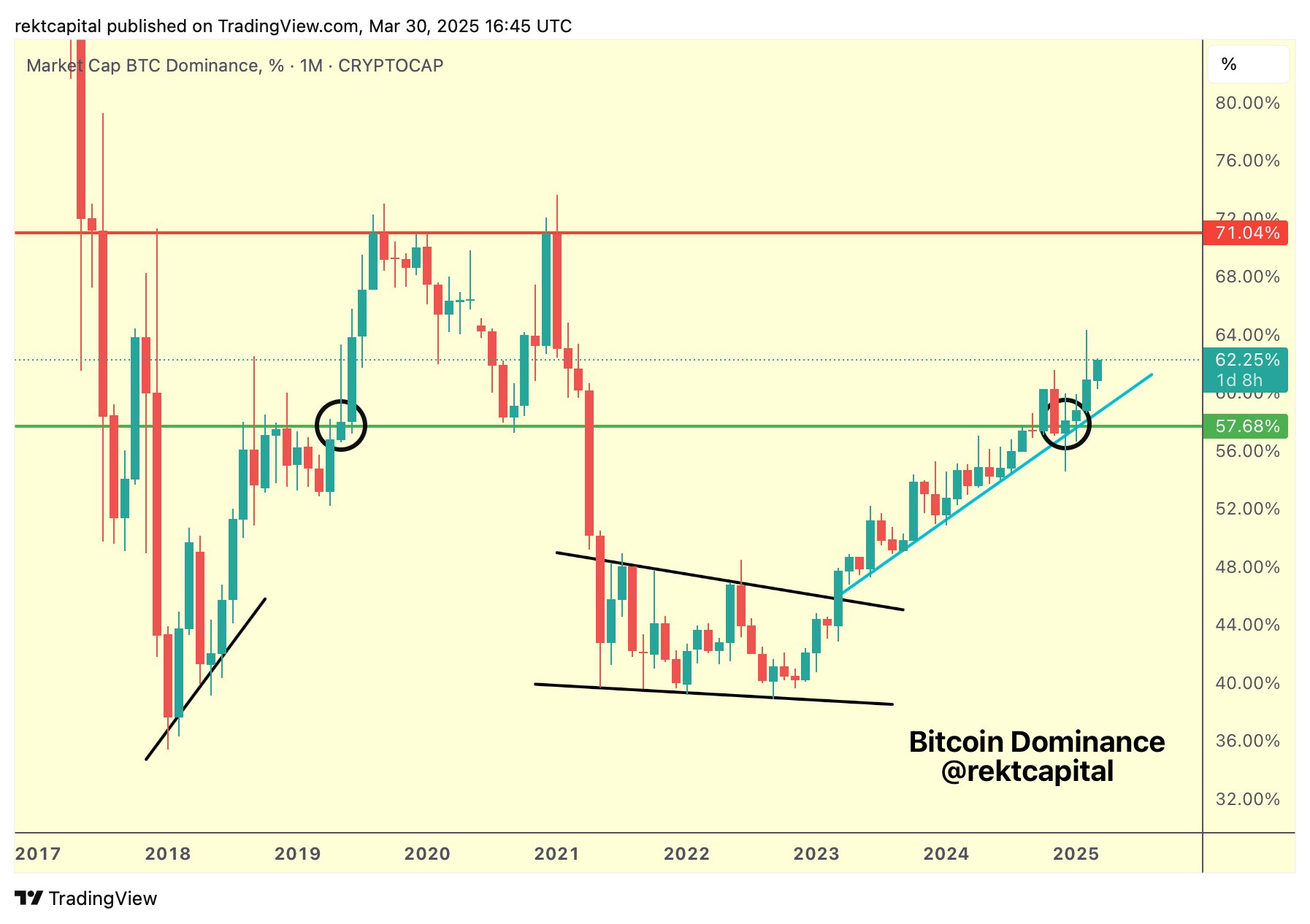

Looking at the altcoin market, the trader says he expects alts to continue underperforming Bitcoin based on the BTC dominance (BTC.D) chart, which tracks how much of the total crypto market cap belongs to the flagship digital asset.

According to Rekt, BTC.D could hit a crucial resistance level that has remained intact since 2017 before losing steam. Once that happens, Rekt predicts that a real altcoin season will come to fruition.

“BTC Dominance.

If history repeats, the real Altseason everybody is waiting for would begin once Bitcoin Dominance rejects from 71% (red).”

Source: Rekt Capital/X

Source: Rekt Capital/X

A bearish BTC.D chart suggests that altcoins are growing in value faster than Bitcoin. At time of writing, BTC.D is hovering at 62.26%.

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

100% rebate for KYB users: Earn fee rebates on EUR bank deposits!

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone

Bitget Trading Club Championship (Phase 21)—Up to 1250 BGB per user, plus a ZETA pool and Mystery Boxes

Bitget Spot Margin Announcement on Suspension of MDT/USDT, RAD/USDT, FIS/USDT, CHESS/USDT, RDNT/USDT Margin Trading Services